In a big new story promoted using its new “watchdog” label, The Oregonian has determined that a wave of new apartments that account for 3 percent of Portland’s housing supply are the best way to start talking about a trend that is rapidly pushing Portland homes out of middle-class reach.

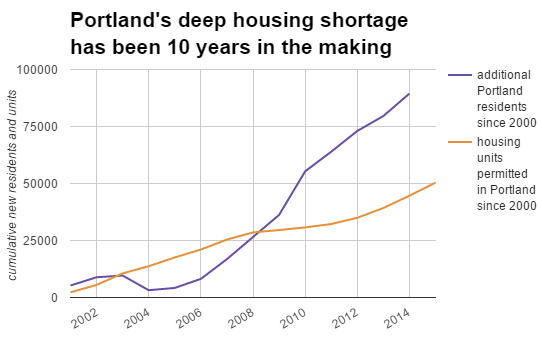

From 2006 to 2014, Census figures show, Multnomah County’s population grew 79 percent faster than its housing supply. The surge of apartments that began to open in 2012 have barely made a dent in the deep shortage that developed during the Great Recession, when housing construction nearly stopped but 10,000 people kept pouring into Multnomah County each year.

In 1,600 well-crafted words about Portland’s housing problems, the newspaper doesn’t find room to mention these facts.

Instead, reporter Jeff Manning and his editors suggest the opposite, writing that the cause of the 41 percent surge in Portland rents is “a real estate gold rush,” exemplified by “hundreds of micro-units” in desirable parts of Portland.

Here’s how an Oregonian editor chose to summarize the accompanying video: “Construction boom transforms Portland, pushes rents to new heights.”

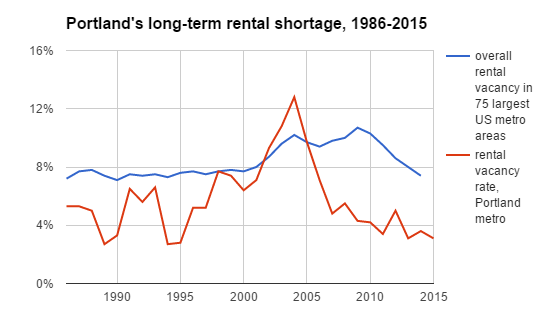

Manning’s piece does mention Portland’s low rental vacancy rates. But again and again, it returns to the implication that Portland’s 10,000 new units can somehow be a cause, rather than an effect, of the rent hikes that have hit nearly all of Multnomah County’s 300,000 housing units over the last few years and are, as the Community Alliance of Tenants warned last week, coinciding with a wave of no-cause evictions.

To his credit, Manning tells the wrenching story of this Portlander’s personal housing crisis:

Colby Gillespie, 63, had every intention of living the rest of his life in his studio in the Sovereign Apartments in downtown Portland. He lived in the building at Southwest Broadway and Madison since 1980 and the $750 monthly rent fit his grocery checker’s budget.

But the new owner of the building had other ideas. In May, Randall Investment Co. informed Gillespie and the residents of the other 43 units that a planned renovation required everyone to be out by the end of the year.

“I have no idea where I’m going to go,” Gillespie said. “I’m really angry. It’s all very cold and corporate.”

Gillespie and his neighbors are suddenly among Portland’s “displaced,” those low- and middle-income locals forced out by the boom. While the big new projects have gotten the headlines, smaller operators have been snapping up dozens of smaller, older apartment buildings.

Advertisement

There’s no question that Gillespie is a victim of Portland’s awful housing problem. As someone who can deal with $750 a month in rent, he’s not seriously poor; he’s simply working class. In a functional housing market, Gillespie might be uncomfortable but wouldn’t be in major trouble.

But the malfunction that made his eviction profitable — a demand for higher-end housing units that exceeds Portland’s existing supply of higher-end units — isn’t explored.

There’s been some great journalism coming out of Portland’s housing crisis. Two weeks ago, Portland-based Lee Van Der Voo of InvestigateWest combined shocking anecdotes and little-known public records to document the practices of American Homes 4 Rent, a Wall Street-run company that has used 85 subsidiaries to buy thousands of single-family homes, including 204 in Portland, and rent them out under contracts laced with hidden fees. It was a terrifying illustration of the ways profit-taking companies are milking the housing shortage for cash without creating new housing.

But despite lower-profile stories like this from last week, in which the Oregonian summarized a panel of experts’ perspective as “people are moving back into cities, but supply can’t catch up,” the paper’s marquee coverage not only chooses to neglect Portland’s supply problem. It also talks about the relatively few new units being created as if they’re the cause of Portland’s housing trouble, and it talks about developers as if they’re the only capitalists feasting off the problem.

In today’s Portland, where a home in a walkable, bikeable, transit-friendly neighborhood is just one of the conveniences of wealth, people who get around by foot, bike and transit because it’s affordable are among the worst-hit by our housing crisis. If tomorrow’s Portland is going to be any different, it’ll require journalism that helps point toward actual solutions.

— The Real Estate Beat is a regular column. You can sign up to get an email of Real Estate Beat posts (and nothing else) here, or read past installments here.

Thanks for reading.

BikePortland has served this community with independent community journalism since 2005. We rely on subscriptions from readers like you to survive. Your financial support is vital in keeping this valuable resource alive and well.

Please subscribe today to strengthen and expand our work.

from the article

“The construction cranes dotting Portland’s skyline mean jobs, tax revenue, and increasing property values. The developers are here because people are moving here, attracted by the vibe, the climate and environment. Portland’s population has jumped by more than 36,000 since 2010.

Under the typical formula used by economists, the city would need 15,700 new units to house that kind of growth. But because so many Portlanders live alone – 35 percent, well beyond the U.S. average – the actual need is significantly higher, city officials say.”

essentially you should put 2 scales on your graph to reflect that more than one person lives in each unit.

Good point! Another option would be to put both growth trends in percentage terms. The chart on this post does that:

http://bikeportland.org/2015/05/21/portlands-housing-supply-still-isnt-keeping-population-falling-behind-slowly-143414

On both of these charts, though the most important thing to pay attention to is really the relative slope of each curve. For Portland, the killer years that caused our current crisis were 2008-2011. Since then we’ve been doing OK keeping up with population, though not great.

I don’t understand your graph. Your y-axis suggests you are adding residents and units, which can’t be right. Perhaps you meant the y-axis is new residents, and omitted scale for the new units? Or are both really on the same scale?

You’re right, we’re not adding residents and units together – just charting both lines on the same y-axis. “Cumulative” refers to the fact that each of those totals is cumulative of all changes to each figure since 2000.

It’s basically just a standard growth chart that lets us compare two different growth trends by setting 2000 as the baseline.

I like that graph better, I would encourage you to use it in the future

I was going to post this exact passage.

Lambasting the O for something that seems to actually be in the article seems a little weird.

You:

“The surge of apartments that began to open in 2012 have barely made a dent in the deep shortage that developed during the Great Recession, when housing construction nearly stopped but 10,000 people kept pouring into Multnomah County each year.

In 1,600 well-crafted words about Portland’s housing problems, the newspaper doesn’t find room to mention these facts.”

The O:

“Portland’s population has jumped by more than 36,000 since 2010.

Under the typical formula used by economists, the city would need 15,700 new units to house that kind of growth. But because so many Portlanders live alone – 35 percent, well beyond the U.S. average – the actual need is significantly higher, city officials say.”

I think they basically said what you are accusing them of not saying. Maybe we’re just interpreting that passage differently?

You’re right – that is the most useful passage in the piece for describing what’s going on. What it fails to convey is that it’s not merely the population growth that caused the imbalance, but specifically the nearly total lack of housing production during the recession.

This is important, because it illustrates why we very badly need this housing “boom” (such as it is) to continue. Instead, The Oregonian explicitly claims that this new housing is responsible for “pushing rents to new heights.”

The building stopped because the population growth stalled (even declined for a year). Doesn’t the building lag the growth by a year or two?

Strange piece. Fixated on the physical result of the boom (new buildings) and those who develop them, as if they are the cause of rising rents and not the effect. Also curious that the lead anecdote is of a “hipster” living in a “hovel,” but we don’t hear directly from him if he likes it, or if he’s glad to live in a unit that is ~20% cheaper than the city average. He seems happy in the photo.

I’m curious why bikeportland’s Michael Andersen would use the catchy ‘hipster hovel’ phrase from the Oregonian story in his story’s title, but not quote the the O stories’ opening paragraph to help explain the type of housing it appears the O is referring to with that phrase:

“…Enrique Rios, a 26-year-old Los Angeles transplant, lives with his fiancée and small dog in a 250-square-foot “micro-unit” apartment in Northwest Portland. It is the size of a college dorm room with space for a bed, a toilet and not much else. He cooks meals in a communal kitchen shared with other tenants.

Rios pays $995 a month. …” oregonian

Whoa…! Get the lovely ‘tiny house living’ experience in northwest Portland for just a $995 a month. New building, pictures show a nice little place, so use of ‘hovel’ is a bit of fun artistic license, but still…250′ does seem small, and small is part of what a hovel is. And $995 a month doesn’t seem low priced, though the magical ‘market rate’ and ‘affordable housing’ formulas work at least try to present housing prices favorably… .

The last section of the O story, ‘Terminated at the Sovereign’ is poignant example of just how dispensable consideration by business for people’s home can be. A central point raised in it being ‘no-cause termination’. Nice, classic old building, the Sovereign, right on Broadway near the performing arts center, the Schnitz.

Not reported how many square feet he had, but good chance more than 250. Colby Gillespie had a good deal for $750. Wonder what kind of deal the new owner may have had available to him had he decided to stay once the building was renovated, if that’s the plan. At any rate, him and his fellow tenants apparently were just given the boot, whether they wanted to and were prepared to pay the rent to continue living in the building, or not.

By definition it is not a hovel, it is not squalid and unpleasant, nor it it simply constructed.

hov·el

noun

noun: hovel; plural noun: hovels

1. a small, squalid, unpleasant, or simply constructed dwelling.

archaic an open shed or outbuilding, used for sheltering cattle or storing grain or tools.

synonyms: shack, slum, chantey, hut; More

informal dump, hole, dive, pigsty

“people there are living in the most dismal hovels”

2.

historical

a conical building enclosing a kiln.

Origin

i suspect some view all small apartments as hovels.

Bingo.

A small apartment is a luxury compared to what I consider hovels, the ADUs and sheds people are trying to rent out for $1000+ a month.

I believe the Oregonian writer intended the phrase as used, to be read ‘tongue in cheek ‘. Still, 250 for two people seem kind of small to me.

It seems like the Oregonian is trying to alienate what little audience it might have left. Let me know how that business strategy works out for you O.

How so? By printing something that the author here or you don’t agree with? I don’t think that qualifies as alienating whatever audience it does have.

you think HIpsters read the Oregonian?

no, but hovel-dwellers do, and they’re mad as all get out!

This “O” article has nearly a thousand comments! Certainly struck a nerve and the editors are strolling to the bank with pr dough and advertisers! I am sure we will see more. However the o reminds of the housing crisi in its poor coverage of local stories, people and issues. The Trib is salivating to market its conservatism clothed in seemingly folksy local coverage.

What do you expect from the conservative Oregonian? They’re pandering to their “those darn young people” attitude of their reader base.

“Conservative”??? LOL! Wow…

Yes, the Oregonian is a conservative newspaper.

Conservatives consider it a liberal one

By what standard or set of criteria is the Oregonian “conservative”? Juat curious. Is it their favor for what has been traditonal cultural norms? Their favor for limited government? Originalist judicial philosophies? Really?

Sorry if that doesn’t fit with the supposed neocon frame that all media liberal.

Remember when they said climate change isn’t newsworthy? http://www.oregonlive.com/opinion/index.ssf/2014/12/why_climate_change_will_not_be.html

This is their parent company https://en.wikipedia.org/wiki/Advance_Publications

No, I don’t and the article you linked to does not support your contention.

Here’s the actual reasoning provided by the Oregonian to explain the omission of climate change from it’s editorial agenda for 2015:

“We seldom discuss climate change, rather, because we focus almost exclusively on state and local matters.”

Hmmm, does that look like the OEB expressing that climate change is not newsworthy? Of course not. So you have to wonder why a commenter here felt compelled to so radically misrepresent the OEB’s very clear reasoning.

Does the omission of a single issue from it’s editorial agenda render the OEB either conservative or liberal? Hardly and QED.

Climate change IS a local matter.

Portland imports cars, exports dryland farmed wheat, sensitive to drought, and sits awfully close to sea level (Sauvie Island will be the first to flood) and as a state we have many harbors that would be affected.

Not a local concern at all.

“Has been” cultural norms are key words here. The O is dying. No, being choked.

It’s a mistake to label the Oregonian with a single label. Many of the editorials are very conservative. But the reporting is a huge mix. Much of it is middle of the road, some of it is liberal, some of it is conservative.

Too many people judge the paper by the editorials.

Contrast that with Fox News, which uses both the “news” and the editorial arms to portray a world that doesn’t exist, with specific conservative goals.

A hit piece on hipsters, renters, and micro-apartments from the conservative billionaire-owned Oregonian?

Shocking!

So, let’s see…

The graph shows roughly 85,000 new residents, 35% of whom live alone, (assuming everyone else lives with a single other person, which is the worst case) means demand for 85000 * .35 + 85000 * (1 – /.35) / 2 new units = 57375 new units. We’ve permitted 50,000 units, so we’re really not that far behind in terms of raw numbers.

I suspect what’s really at play here is that the newcomers have more money (either because they have it, or because they came for a good paying job), which is driving up demand for higher end units, which is causing less expensive places to upgrade chasing higher rents.

And that is what’s causing the displacement of lower-income renters that we see.

I really doubt a shortage of 7000 units across the city would, in itself, drive rents nearly as high as they’ve gone.

You are forgetting that some of the permitted units are replacing existing units that are being torn down.

You are right, I did not account for demolition. Most demolitions I see are single houses, not large blocks of units, so I’d be surprised if they added up to a significant number. (Ok, that’s speculation based on personal anecdote.)

Nonetheless, given that most new units are at the upper end of the price range, that does suggest that a big part of the problem is that people are willing/able to pay more than than they used to, and that builders are catering (almost exclusively) to that market.

If we continue building mostly high-end units, it suggests that we will need to end up with a significant glut in units before rents start to fall meaningfully. And before we get to that point, we’ll probably see condo conversion reduce the stock of apartments, which will slow the fall.

In the short run (i.e. before developers have time to build more homes) I guess that depends mostly on how inelastic the demand curve is – i.e. how uniquely desirable Portland life is.

I agree, though, Portland is probably disproportionately attractive to rich folks in the last few years – or at least to folks able to spend windfalls from California’s even more screwed-up real estate market.

The problem with the Oregonian piece isn’t that it fails to imply “supply is the answer.” The InvestigateWest piece linked above didn’t focus on supply; the recent Mercury piece didn’t focus on supply. They were good pieces that raised other parts of the problem! The problem with the Oregonian piece is that it implies “supply is the problem.”

I’m guessing that they don’t understand remedial economics in their newsrooms.

Then please tell us why supply is not part of the problem? Simply asserting that it’s not a problem or a minor contributing favtor is to argue via naked assertion.

“Then please tell us why supply is not part of the problem?”

Are you really arguing that increasing supply in the midst of a shortage causes prices to increase?

I would argue that yes, increasing the supply of units at the upper end of the market will raise average rents.

Your prior theory about Class B multifamily renovating and chasing Class A rents is interesting.

At the end of the day, though, the root cause is still demand-driven, not supply-driven. A counterfactual: what if the same amount of folks came here without any developers building Class A multifamily? My guess is that you would see the same, if not higher increases in our current Class B and C multifamily housing stock.

This might be somewhat disturbing, but one way to ensure that Class B and C properties don’t chase Class A rents is to vastly overproduce Class A so that it totally doesn’t pencil out to renovate.

In any case, the more I think about the problem, the more that it seems like a solution that relies on supply itself to provide housing affordability (while trying to keep the character of neighborhoods intact in some way) seems relatively futile.

I think of San Francisco, which has tried to divert supply in ways to provide for housing affordability (inclusionary zoning, rent control; they haven’t really markedly tried to increase density though, but there is still the persistent political problem that increasing Class A multifamily seems to provoke ire), but they seem to have all failed.

The simplest, but most politically difficult way to solve housing affordability is some sort of demand-side intervention.

first of all, characterizing apartments that rent at ~$500 per month per tenant as “high end” (as in the oregonian article) is very debateable. secondly, people who rent these “high end” apartments free up demand for “low end” apartments.

let me provide a personal example: i can afford to pay more for rent and if i move the “high end” apartment that i currently rent ($500/month in shared rent) will become available. in other words my choice to move up to an even “higher end” apartment would increase supply (and all things being equal decrease prices for comparable rentals).

And yet… you haven’t moved to a more expensive unit. So it is true that if you did move, a cheaper unit would become available, but obviously (as your example illustrates) there is some friction in the system that keeps people from moving up, even if they can afford to do so.

The people who keep making apologies are almost invariably people who own their homes and/or happen to be profiting from the current state of affairs.

You can use basic economics can explain the issue, but they’d be just that: basic. There is more than a little nuance to these points of equilibrium or pretty curves of supply and demand. That’s the problem with new construction in Portland: these luxe new homes bend the curve.

I know what you get for $1500/mo. in Portland. They’re not especially big, but they have community spaces for neighbors you hate, pet wash stations for a dog you don’t own, car parking spaces you have no use for, and a bike storage room with all the security of a cable lock. Take a step down to $1300/mo. and suddenly most aren’t worth a grand, relatively speaking. Then again, what choice do you have?

” suddenly most aren’t worth a grand”

If they aren’t worth $1k then why can they get more than $1k for them?

Supply and demand. The free market.

The same free market that was demanded for Uber and AirBnB.

Uber doesn’t have to abide by the same rules as taxis, it’s a free market.

AirBnB isn’t really a BnB so they don’t have to abide by local bylaws.

So odd that those who talked a mean game about free markets, and are seeing the free market in action with rentals, all of a sudden want government to interfere in the free market with rent controls.

I think the “relatively speaking” made that pretty clear. In matters of supply and demand, none of the supply is going toward people with minimum qualifying household incomes of less than $60k/yr. Below that threshold, rent does not reflect quality.

You know how Comcast tries to push the $99/mo. “Triple Play” full of services you don’t want or need? Somehow when you cut back to the essentials it doesn’t cost much less. Same deal.

Relative to the market

The market is paying over $1k for those properties, so they are worth over $1k, you may not think so, but others certainly do.

That is the definition of supply and demand price setting.

In a free market we would not have incredibly restrictive single family residence only zoning. In a free market we would not provide enormous state and federal tax subsidies to home/loan owners at the expense of tax-paying renters.

If we had a free market central portland would have a lot more apartment buildings. And, imo, this would be a very good thing.

In a free market, we would not have any zoning at all, or a UGB, or renter protection laws, or other tools we’ve developed to help keep the city livable.

I agree we don’t have a “free market” in property, and I think that’s a good thing.

I still don’t see what the big deal is with rising rents. TFor every new million dollar home and luxury apartment building that gets built here the city gets a new source of tax revenue. The more rent gets collected here the more taxable income the state gets. That money can (and should!) be used to build awesome new bike infrastructure. We can’t have world-class bike infrastructure if the tax base is too poor to pay for it.

But if we have a housing shortage, shouldn’t the money generated by the property taxes go to more housing first, before anything else?

It should go to the backlog of road projects.

There will be those who push for that. Unfortunately as the price of land rises that gets very expensive. And has a limited impact on improving affordability.

http://www.oregonmetro.gov/news/housing-woes-what-portland-can-learn-bay-area

>One affordable apartment building in San Francisco cost nearly $900,000 per unit to build, because of the $18.5 million cost of the land under the building. A proposed $300 million bond would help pay for 500 units of affordable housing.

>And those efforts, in turn, only help lower-income residents in a city increasingly dominated by high-income residents, squeezing out the middle class.

Bringing down the cost of land per unit or per square foot of housing is possible by allowing more construction, but that changes the character of neighborhoods. Portland tries to avoid that by limiting where that higher density can go. A low rise apartment building per square foot costs the same to construct as a house. A high rise tower is much more expensive. There’s a growing segment of the population that can’t afford the cost of high rise construction on free land, and can’t afford the land under a cheap structure within 3-5 miles of downtown. Subsidized housing units aren’t the way to help them.

What about the fact that we require new buildings to have space for cars but not low income (over even regular income) folks? We need lots of new buildings and we need tools to regulate rents for people like we do car spaces.

We just need to make it affordable to move with your tiny house into one of those parking spaces.

An 8’x19′ parking spot gives you 152 square feet. Ikea could furnish that nicely. Maybe a tuck-under loft bed to give you more space.

There are at least 4 vacant homes 2 of which are completely unrecoverable within 2 blocks of my house. The city needs to start foreclosing on abandoned homes and selling them to developers so they can be torn down and replaced. There is a huge hidden inventory of homes that banks are sitting on because they don’t want to acknowledge the losses on their balance sheets.

If the banks are paying the taxes and they own the property, then there is no foreclosure that can be done by the city. The minimum would be bylaw infractions for not taking care of the property, but foreclosure is not an option.

The property next door to mine has liens owed to the city approaching 6 figures from dozens of cleanups etc that have had to take place over the past few years due to squatters and illegal dumping. The city always gets paid first when a property finally sells so they have a policy to never ever initiate a foreclosure even when they are in a position to do so. Often these properties are also several years behind on taxes because the state generally will not initiate foreclosure until a property is at least 3 years behind on taxes.

Abandoned is a very different situation than a bank owned property that has not been sold.

Maybe legally, but a lot of bank owned properties have sat without anyone in them for years. They send someone to mow the weeds each year when they get their yearly city ticket.

Couldn’t even sell it at auction.

But I would bet they are still paying the property taxes, including the annual increase.

Again the bank has done nothing to take care of this property, all mowing, garbage removal etc has been performed by the city because neighbors complain for months when the rats start to get particularly bad. It would take a long time for unpaid taxes to the city to add up to much money, but the existing lien provides more than enough money to move forward with foreclosing on the property. Many abandoned properties also have liens of tens of thousands of dollars and the city should start moving forward with foreclosure and redevelopment.

So, some observations:

“In 1,600 well-crafted words about Portland’s housing problems, the newspaper doesn’t find room to mention these facts.”

Okay, so the Oregonian author failed to mention these facts…so what? Do these facts fundamentally contradict the story?

You would expect the author here to now turn to explaining why these facts contradict the Oregonian story…but he doesn’t.

Instead, relying merely on the power of assertion, the author here simply says, “Again and again, Manning’s piece returns to the implication that Portland’s 10,000 new units can somehow be a cause, rather than an effect…”. Again, you’re left with the impression that the author here will now tell us why Manning is wrong.

But, he doesn’t, again…instead, the author here chooses another assertion, this time via an appeal to authority:

“as the Community Alliance of Tenants warned last week, coinciding with a wave of no-cause evictions.”

Well, if this “Alliance” warns us, it must be true…

Further, the author here writes, “There’s been some great journalism coming out of Portland’s housing crisis. Two weeks ago, Portland-based Lee Van Der Voo of InvestigateWest combined shocking anecdotes and little-known public records”

Wow, the always reliable and always representative “anecdote”.

Notice, too, that the author here claims that these properties that are subject of the InvestigateWest analysis are rented out on agreements with “hidden fees”. I notice that the article the author here links to does not include the word “hidden” at all. We see new fees being charged, but the InvestigateWest analysis does not characterize these as “hidden”. I want to give the author here the benefit of the doubt and believe that he is not intentionally characterizing InvestigateWest’s work, but, when viewed in the anti-landlord context of this article here, I have to conclude that the author here is intentionally and irresponsibly misrepresenting what InvestigateWest has found.

The relevant section from InvestigateWest:

“Longer-term tenants, however, noted a distinct change when American Homes 4 Rent took over: some rents went up dramatically. Lawn maintenance ceased. Several observed a steady creeping of fees. The company expected them to pay for plumbing problems and other maintenance. And American Homes 4 Rent does not provide pest control. Some residents said they struggle with rat infestations.”

Hmmm, no conclusion that there are hidden fees. In fact, there’s not even the implication of such hidden fees.

The author here may disagree with AH4Rs management model, but there’s no need to misrepresent what InvestigateWest has found.

And is the drama really necessary?

“It was a terrifying illustration of the ways profit-taking companies are milking the housing shortage for cash without creating new housing.”

“Terrifying”?

No. Terrifying is what ISIS is doing to Christians in Iraq. Terrifying is Assad lobbing primitive chemical munitions against rebels and civilians alike. Terrifying is not having your rent increase and having to take on more maintenance responsibility for the home you rent.

You see, this is the problem with language and a direct result of what we saw during the Bush years with the evil of Hitler being minimized so people could condemn Bush as the new Hitler and the evil of real torture (amputation, for example) being minimized so people could condemn stress positions as torture.

The author here really doesn’t have much to get on with in his anti-landlord screed so he resorts to anecdotes, appeals to authority, and dramatic language.

Wow…this is bad…so the author here not only misrepresent’s InvestigateWest’s analysis by falsely claiming “hidden fees”, he also mischaracterizes the Oregonian article he cites later in his article:

“But despite lower-profile stories like this from last week, in which the Oregonian summarized a panel of experts’ perspective as “people are moving back into cities, but supply can’t catch up,”

Huh?

If you actually read the article he links to, we see the author there summarizes out four major points:

“People are moving back into cities, but supply can’t catch up”

“The panel’s consensus: rent control and inclusionary zoning don’t work”

“The ‘elephant in the room,’ according to one panelist? Parking requirements’

“What about NIMBYs?”

Why doesn’t the author here acknowledge these other three? Because at least one, the parking issue, and perhaps another, rent control and inclusionary zoning are two important themes to BikePortland commenters. It’s clear that BikePortland commenters prefer rent control and affordable housing inclusion rules. The article the author here links to contains information asserting that these are failed concepts. Maybe I am being unfair to the author here, but it sure appears he’s pandering, at best, and, at worst, dishonest.

To me at least, the most shocking part of the InvestigateWest article was the part where they charged one of their tenants $442 for reporting an unexplained, deafening alarm that was unable to be turned off. Plumbing and maintenance problems are traditionally the responsibility of the landlord. All of those fees are essentially hidden to someone looking for a place to rent.

I didn’t mention the other three issues that were in the O’s article about last week’s panel because this post isn’t about those issues; it’s about the O’s implication, in its latest article, that supply is a problem.

I think people who’ve been reading the Real Estate Beat for a while will verify that BP is rarely accused of being soft on minimum parking requirements or NIMBYs. I’ll cop to being soft on rent control and IZ when it comes to their supply impact. Seems to me that the tradeoffs with those are a good bit murkier.

I’m sorry michael, but I don’t at all read “too much supply is the problem” in this article.

If anything this article seems to be lambasting large financial corporations for buying newer buildings and jacking up rents. (something I would assume you would be against)

A direct quote:

“Construction boom transforms Portland, pushes rents to new heights”

and it also says:

“Under the typical formula used by economists, the city would need 15,700 new units to house that kind of growth. But because so many Portlanders live alone – 35 percent, well beyond the U.S. average – the actual need is significantly higher, city officials say.”

To me that is also presenting the argument that there is not enough housing.

And when a lot of the new construction we have seen is catering to high rents I don’t see how the statement your quote isn’t true.

I really don’t view this piece as taking much of a stand either way (other than the cheap shot at “hipster hovels”. Just seems like they’re telling peoples personal stories and spewing facts.

Anecdotes can be shocking, in fact, theyre often shocking because thats the nature of anecdotes. Anecdotes tend to be used to describe extreme conditions. But anecdotes are typically highly specific and rarely representative of current conditions. So to derive from this very specific circumstance a representative model is not a fair reading. You have double-doened on your previous assertion re: hidden fees without, again, referring to specifics. Tenants have lease agreements. We can complain that we dont like the new mtc fees, but that doesnt mean such fees are “hidden”. Theyre new, perhaps unprecedented, but not “hidden”. To characterize as such is to unfairly malign the property mgmt firm in this case.

it’s amusing and frustrating that disingenuous supply-demand arguments are being used to argue against rent control but that supply-demand arguments are ignored when it comes to portland’s housing shortage. talk about having your cake and eating it too.

“Gillespie and his neighbors are suddenly among Portland’s ‘displaced,’ those low- and middle-income locals forced out by the boom.”

We who can’t bring ourselves to ever say ‘enough,’ acquiesce to this kind of displacement of (relatively poorer) folks who’ve been living here all along by (relatively wealthier) folks still to come. Why is this o.k.? Why can’t we bring ourselves to pick up the conversation that Alternatives to Growth Oregon started 17 years ago? http://www.agoregon.org/page34.htm

because it’s failed argument.

http://www.citylab.com/housing/2015/07/whats-the-matter-with-san-francisco/399506/

San Francisco has adopted a we will accommodate those who live here first before inviting any newcomers here policy? A let’s problematize growth of all kinds policy? First I’ve heard of it. Do tell.

The problem with a “we will accommodate those who live here first before inviting any newcomers here policy” is that it is unconstitutional. Americans have the constitutional right to move anywhere in the country, no matter their place of origin.

“it is unconstitutional.”

Of courses it is. But so were racial equality and the consumption of alcohol at one time. You act like this is an Act of God. If our strategies we keep pursuing just make the hole we’re in deeper we need to stop digging. I don’t think the problem is solvable by looking at structures, development, expanding the Urban Growth Boundary. Some places attend to those (Sao Paolo); other places (San Francisco) do not. But the problem of too many people overwhelming everything dogs both.

Besides there are many tactics we could employ that fall along the spectrum between what we have now here, which amounts to a tacit Iron Law of Accommodation, and outright restriction on people’s movements. Our imagination can surely help us solve this if we stop treating the whole subject as taboo, as something we can’t bear to look straight in the face.

I don’t actually think that’s written anywhere in the U.S. Constitution, sorry.

It depends what a “we will accommodate those who live here first before inviting any newcomers here policy” would entail. Courts have struck down requirements that a person reside in the state for one year before permitting them to vote, collect welfare, or receive subsidized medical care. There’s a constitutional right to travel and those policies infringed on it.

https://en.wikipedia.org/wiki/Freedom_of_movement_under_United_States_law#Constitutional_freedom

The failed policy is refusing to ever address the exponential increase in human beings, and the pressures this exerts on our infrastructure, on our planet, on those displaced.

Infinite Ingress

By Lee Green For the LA Times

http://www.latimes.com/local/la-tm-growth04jan25-story.html

Reproduction is a human right.

But birth rates are falling everywhere around the world, including right here in Oregon. I believe Oregon already has fewer births among native-born people than the 2.1 per woman needed to maintain the current population (immigration and migration from other States is the reason we are not facing demographic decline like Japan and much of Europe)

Even if the birth rate were cut in half tomorrow, we would still have another 20 years of this “problem”: people want to move to Portland, and employers want to add more jobs in our city! It has very little to do with the local or even international birth rate.

So you agree that population growth is a key variable in bringing us to this point; but you say there is nothing to be done. That doesn’t strike me as very inspired. We’re (ostensibly) the richest country in the world, and this is the best we can do?

Hardly. More impactful conditions exist that contribute to this problem… you just choose to ignore them. For example, thr urban growth boundary ehich limited developable space; federal policies that encourage bad home loans via freddie and frannie; the Feds easy money policies priming the pump with cheap interest rates; state and local zoning requirements that limit development and make developing properties less likely and more expensive. All of these have far contributory impact than populatiin growth.

San Francisco also protected EVERY parking space in the city. It is illegal to take your 120 year old Victorian, and convert the basement garage into an apartment. They also protected every historic building, so there have been very few high density developments in large swaths of the city. If they would have protected people over automobiles, then rents would be significantly lower, but only the very rich would have cars. Their rent control system failed because they looked at it in isolation, while you need a more holistic approach.

Relax everybody. The Big One will solve all these problems, probably for decades.

LOL..and don’t worry we’ll be happily riding our bikes around on cracked and cratered streets that look like they were bombed. Sure.

“Colby Gillespie, 63, had every intention of living the rest of his life in his studio in the Sovereign Apartments in downtown Portland.”

Assuming you can spend the rest of your life in a rental unit and assuming the rent won’t change is the very definition of a poor life choice.

I disagree. We’ve just become inured to the fact that ‘rents always go up’. But why do we think that? Is this the case everywhere? What would we need to do as a society to take better care of people in Colby’s position? Why beat people with the Social Darwinism club?

My family inherited a tiny condo in a city in Southern Germany from my great-aunt when she died in 1984. It came with a tenant, a little old lady. We never met her, but kept paying the dues and depositing the tiny rent check she paid every month. In 1996 my father died so my mother and I inherited the responsibility, but since EFTs had come into being by then we really didn’t need to do much, except pay when the roof needed to be fixed. At some point (~2006 if I remember correctly) I started asking questions about the rent, about whether anyone had ever raised it in all these years? We did some inquiring and learned—to my lasting astonishment—that, no, the rent she was still paying a quarter century after my great-aunt had died (and perhaps starting even earlier?) was still within the parameters for rental rates/sq meter the government sets. A year later she died, in her mid-nineties, and we sold the condo.

Absent other factors, I would expect inflation alone to push rents higher. Inflation is low at the moment, but that, like this housing crisis, is a right now thing, not a forever thing.

I think our current political-economic system practically guarantees lowflation.

Is that an endorsement?

an endorsement of negative interest rates, QE for the people, and trillions of fiscal jobs, infrastructure, and education stimulus.

If you want to loan me some money, I’ll happily pay a negative interest rate!

While I’m waiting for that deal, I’ll enjoy this period of low inflation while it lasts.

Except that QE has failed as monetary policy and the so-called “stimulus” spending failed, by every objective measure, to do what it intended to do.

I absolutely agree that conventional QE has not been effective. And that’s not what I argued for.

On the woefully inadequate Obama administration stimulus:

One year after the stimulus, several independent macroeconomic firms, including Moody’s and IHS Global Insight, estimated that the stimulus saved or created 1.6 to 1.8 million jobs and forecast a total impact of 2.5 million jobs saved by the time the stimulus is completed.[79] The Congressional Budget Office considered these estimates conservative.[79] The CBO estimated according to its model 2.1 million jobs saved in the last quarter of 2009, boosting the economy by up to 3.5 percent and lowering the unemployment rate by up to 2.1 percent.[80].

Just imagine how much better off we would be if Obama had not halved the stimulus recommended by his economic advisers and also not resorted to voodoo-economics tax cuts.

OK, I’m waving a checkered flag on the monetary policy conversation in this venue. Feel free to exchange Facebook profiles and continue it there. 🙂

You are correct, inflation can go up. Although inflation is low now, it compounds each year. A dollar has lost about 97% of it’s purchasing power since 1913.

http://www.infoplease.com/ipa/A0001519.html

So for a while you were a rich land owner?

No I wasn’t. Did you read the story to which you are responding?

You seem to bicker with nearly every person who posts here. Do you spend all day debating people on Bike Portland? Have you won yet?

Well I try to engage the substance of the person’s comment I’m disagreeing with.

9watts debates. He’s civil, isn’t belittling, and his points are well thought out. I don’t always agree but respect his point of view. If only every O-Live commenter were so civil! As far as how he spends his days, that’s really none of our business or problem unless he’s doing something illegal 🙂

Nice try, 9watts

What is that supposed to mean, nested as it is below Carlsson’s comment?

They’re implying that you are both posters.

huh?

I wonder if 9watts is even real. Is it really Maus’ alter-ego?

wsbob’s my alter ego.

I think there’s only like 3 real people here…

…except I know you and wsbob disagree on taillight legislation. 😉

I think Lester and I are using different definitions of alter ego. I was more on the Jekyll and Hyde end of the spectrum of the term when invoking wsbob – hahaha.

Easiest way to find out is show up and buy him a drink:

http://bikeportland.org/2015/09/10/bikeportland-is-10-years-old-lets-have-a-party-158668

🙂

I really understand where the checker above is coming from – I was a journeyman checker for 13+ years and know exactly what income level that is.

My GF and I lived in downtown from about 1992 to the end of 2012. In 2000 or thereabouts we got a nice place at the Portland Towers (up on 21st). We were extremely fortunate – there was a glut at the time (everyone was buying houses) we got in cheap, we got a month free when we signed a year lease – the works. Over the next 3 or so years the rent barely moved – and we got great deals to take 1-year leases. Then the bubble burst, vacancies plummeted and our rent started an inexorable climb.

3 years ago we looked at how much of our money was going to rent and projected the cost going out the next couple of years (I estimated that it would be $1300+ for 650′ by the beginning of this year) and decided to look (for the first time in our 23 years together at that point) outside of downtown for a place.

I’ve never been happier – My bike commute is a wonderful workout now (I haven’t seen the inside of a gym in almost 3 years and I’m stronger now at 48 than I was then) through beautiful scenery, our 401(k) withholdings are way up, our liquid savings are way up, and I have a *garage* to work on my trike!

What shocked me was that we only saw a rent increase after 2.5 years at the new place and it was very modest (around 2%). I guess I’d gotten so used to the steady climb at the old place that I thought it was just the way things were.

That is a great story, 9watts. My father in-law handles his rental properties (purchased in the 60s) about the same.

How would your family have handled this differently if there was a mortgage to pay? Higher maintenance tenant, property? Would they expect a return on the 25% down payment?

“How would your family have handled this differently if there was a mortgage to pay?”

That’s a really good question. I am not sure. In this particular case (my experience with the German rental market is pretty thin otherwise) I think the crux of the matter was that in Rosenheim—as opposed to Munich or Berlin or some other highly desirable location—rental properties were/are not a good bet financially. We sold it for what seemed like a pittance. I think it is entirely plausible that—in contrast to what we here have come to expect—people in a country, or particular non-growing cities within that country—may not make money on this kind of investment. Or perhaps we’re just terrible capitalists.

“Higher maintenance tenant, property? Would they expect a return on the 25% down payment?”

The property—the building itself not the unit we owned—did have some significant maintenance costs associated with it. Certainly on an ongoing basis we were barely breaking even with the rent and the costs we saw.

In a cooler market like Rosenheim investors would expect steady cash flow in lieu of higher appreciation. It is a pretty different dynamic from Portland, today.

A few weeks ago a mortgage broker told me most of her investor clients were putting down 25% and ‘feeding’ their investment properties hundreds of dollars a month. Negative cash flow at market rents in exchange for appreciation. They are speculating, of course but how far in the red can we realistically think they will go on a month to month basis?

Housing bubble fueled by easy money policy established by the Fed. Note, again, government intervention causing a crisis.

That is half the story. They are also betting the relative shortage of housing will go unaddressed long enough to drive rents much higher. Are they wrong?

My Grandparents owned an Urban duplex and rented out the bottom flat for decades to the same couple. They got reliable tenants that took care of the place and the yard, the renters got reasonable rent. When my grandmother was living alone, we kept her in the house for as long as we could……many years after we could have if she was truly living alone. In Miwaukee Wisconsin, there are wast swaths of the city made up of two-flats like this.

Then when we needed to move her out, the downstairs neighbors bought the house……sound like a solid life model to me. A little different than in a large building, but many societies rents are deigned for long term habitation…on the scale of decades. The United States is fairly unique in allowing a free market on pricing, yet restricting where apartments can be built. Sounds like the rules were written by the wealthy…..

The new owner of the Sovereign, reportedly told all the tenants they had to leave. Not just a raise in rent. No arrangement offered for housing while the building is being renovated. Just : Get Out.

What’s missing in the O piece and in the above discussion is stagnant incomes here and throughout the USA since the Great Recession. Part of that is due to the continued attacks on both private and public unions. Organized labor played a large role in rise of wages in the 30’s/40’s and 50’s. It was great to see that the new apartments being built at the east end of the Burnside Bridge by Andersen Construction employing union workers! Speaking of that lovely bridge…When will it get a “road diet,” and we get big wide bike/ped promenades on both sides?!?

Meanwhile we just got to keep replacing vacant lots, parking lots, etc. with more housing for all income levels. And get ready for Cully, Gateway and Lents to be the next “Big (and affordable) Things!” Enjoy the ride, we could be Detroit.

Public and private attacks on unions have caused wages to stagnate? Where is the research into this?

Isn’t the real news here that someone actually still reads The Oregonian? I didn’t know that thing still existed.

But seriously, the tone of all of this reporting seems to be that everyone is entitled to a really nice close-in apartment in a desirable location at an affordable price. That isn’t a concept that exists anywhere. There are lots of places I would love to live that I just can’t afford. That is called “life.” You live in the best place your circumstances allow, which may not be in inner North East Portland.

“…But seriously, the tone of all of this reporting seems to be that everyone is entitled to a really nice close-in apartment in a desirable location at an affordable price. …” JF

What is ‘affordable price’ is the catch. Affordable to whom? Whatever the market will bear. Is this the “…”life”…” we as members of society today, believe is reasonable to subject people to?

Landlords being at liberty to terminate their tenants residency for little or no cause, or raise their rent prohibitively, has been one of the reasons for urban flight, in addition to other problems cities find themselves having to deal with.

Average rent for a 2 bedroom in August 2015 for some west coast cities:

Seattle: $2481

Portland: $2270

San Francisco: $4812

San Jose: $3163

Los Angeles: $3527

San Diego: $2466

Could be worse I suppose.

anyone who is paying that in rent should really reconsider their housing options and ability to save. My mortgage in the FoPo neighborhood is $1850/mo (including taxes) for 2000sq. feet. small down payment. there are alternatives.

We may be in a housing shortage, but nothing raises the rent except landlord/owner’s decision to. That decision may be motivated by things mostly out of their control, like rising taxes or utility or maintenance costs, but again and again we hear that rent-hikes are a matter of “what the market will bear”. Rent increases are clearly are decision to extract more wealth out of the population. That landlords/owners take advantage of the market is the elephant in the room for most coverage. The rent is how much a landlord charges, not in most cases how much it costs. While there may be other reasons to build more multi-family dwellings, supply-side “solutions” to rent in particular argue for “trickle down” economics in terms of housing. The idea is that by growing the housing market in the area we make increase the competition among landlords who then have to lower their rents to get renters. We are basically told by those who would like to be seen as advocating renters interests that we have to “beat them their own game”. This line of thinking is also what leads many to saying “if you don’t like being a renter [i.e. exploited and regarded as a second class-citizen] then you should buy”. It’s a pernicious kind of victim blaming and cheerleading for an unequal society where the power to determine who gets housed is held by a certain class of folks, and the only way to escape abuse and exploitation is to seek refuge in property itself.

“…That decision may be motivated by things mostly out of their control, like rising taxes or utility or maintenance costs, but again and again we hear that rent-hikes are a matter of “what the market will bear”. …” Joe Clement

The heart and soul of the U.S’s fabulously successful economic system is in no small part due to people being able to ask for what they have offer, “what the market will bear”.

And there’s definitely some merit to that operational means of setting prices, and not just for people of the wealthy classes. Question is, how much profit should a business be able to draw by way of what it’s offering, and at how much burden to people in need of what they’re offering?

It’s part of the ‘American Way’, it seems, to be prepared to put up with possibly a lot of hardship from an economic system in which people can hope to be very successful in their own right by way of that system. There is to consider though, the callous indifference with which some aspects of business is able to regard the human collateral damage resulting from standard business operating procedure, ‘what the market will bear’.

The state of emergency will allow the city to:

● Waive zoning codes.

Yes!

http://blogtown.portlandmercury.com/BlogtownPDX/archives/2015/09/23/mayor-charlie-hales-has-declared-a-housing-state-of-emergency-in-portland

http://www.oregonlive.com/portland/index.ssf/2015/09/portland_to_declare_housing_em.html

>Portland Mayor Charlie Hales on Wednesday said he wants to declare a housing emergency next month with the hope of providing shelter for all homeless women by year’s end.

>Hales’ announcement, which comes on the heels of similar efforts in Los Angeles and a mayoral challenge from State Treasurer Ted Wheeler, would allow the city to bypass its zoning code when siting shelters for the homeless.

Great, and this will help some people if the policy doesn’t get rolled back. Doesn’t solve the problem in a comprehensive manner though.

That article is gone, where did it go??

They changed the title from “Hales has declared” to “Hales wants to declare” and that changed the URL. It’s still linked from their homepage:

http://blogtown.portlandmercury.com/BlogtownPDX/archives/2015/09/23/mayor-charlie-hales-wants-to-declare-a-housing-state-of-emergency

In my copy of the O was a one page pullout flyer ad for a retirement complex in Happy Valley, advertising “independent retirement living,” including everything but your phone, for $1,895/month. Happy Valley is being urbanized so fast by developers that there are streets there that didn’t exist 5 years ago. In Sellwood, I’m paying $750/month. Right down Milwaukie Av., a garage was removed this summer and new housing is going up in its place. Now that MAX has a station at Bybee Blvd., one wonders about even more rent increases and evictions taking place here.

hear, hear.

The graph is misleading and not an accurate representation, it just goes for a bit of “WOW” factor. By showing just resident increases and permits issued you are not factoring in the vacancy rate in 2002. To get a true picture of the severity you would need to know # of units in 2002, vacancy % of those units, then factor in new units vs. population.

Sorry, but I feel that graph trying to pander to the general sentiment that we have massive growth in population with little growth in new units.

That simply isn’t true. I just see this as you trying to manipulate 2 sets of data to have a chart that looks extreme.

Even better would be to reduce “population” to “households”, which is a much more useful metric.

That’s what I see too. There is a dip in the early 2000s in people coming to the city (which most likely led to an increased vacancy rate), thus developers stopped building as there wasn’t a market. Then the influx in people starts up and they have started building again.

It looks on that graph like the lag was due to the decrease (or stagnant) population of the early 2000s.

here you go:

http://bikeportland.org/2014/09/23/2000-missing-homes-prices-soar-bikeable-areas-portlands-rental-shortage-deepens-111270

The criticism of this graph is reasonable. I actually used it for the first time in the previous Real Estate Beat post two weeks ago, but it was accompanied by another chart showing vacancy rates over time. Hopefully that helps tell the story. I’ve added the vacancy chart to this post.

If you count households only you miss what might be called the underhoused, those who take on roommates only because of the economic pressures of rising rents.

Isn’t this why most people have roommates?

Yes probably. But if the number of people living with roommates increases you miss that by only counting the number of households.

(all of this is for the city of Portland) –

2014 ACS gives 257k households. 49k households have one or more non relatives. 2005 ACS gives 228k households. 35k households have one or more non relatives.

ACS also gives an estimate for the number of housing units. 271k in 2014. 245k in 2005.

So over ten years a 13% growth in households, but a 40% growth in non relative households. Housing stock grew less than 11%. My point is if it grew a bit faster at 13% that still wouldn’t be enough, because that ignores all the people who have been moving in with roommates.

Clearly I’m missing something. If there are 257k households, and 271k housing units (ACS 2014 numbers), that suggests there is not a shortage of housing at all, and that rents are being driven higher by other factors.

So vacancy citywide is 5% down from 7% a decade ago. An empty unit in a rough part of East Portland doesn’t do all that much to bring down rents in inner NE/SE. I don’t know how feasible 100% occupancy is. This whole piece is worth reading, but here are two paragraphs.

https://pedestrianobservations.wordpress.com/2014/08/17/zoning-and-market-pricing-of-housing/

“Briefly: it’s understood in both Keynesian and neo-classical macroeconomics that an economy with zero employment will have high and rising inflation, because to get new workers, employers have to hire them away from existing jobs by offering higher wages. There is a minimum rate of unemployment consistent with stable inflation, below which even stable unemployment will trigger accelerating inflation. In the US, this is to my understanding about 4%; whether the recession caused structural changes that raised it is of course a critical question for macroeconomic policy. A similar concept can be borrowed into the more microeconomic concept of the housing market.

There’s also the issue of friction, again borrowed from unemployment. There’s a minimum frictional vacancy, in which all vacant apartments are briefly between tenants, and if people move between apartments more, it rises. For what it’s worth, the breakdown of 2011 New York vacancies on pages 3-4 by borough and type of apartment suggests friction is at play. First, the lowest vacancy by borough is 2.61%, in Brooklyn, not far below city average. Second, the only type of apartment with much lower vacancy than the city average is the public housing sector, with 1.4% vacancy, where presumably people stay for decades so that friction is very low; rent-stabilized units have lower vacancy than market-rate units, 2.6% vs. 4.4%, which accords with what I would guess about how often people move.”

Vacancy rate in portland is not 5% it is around 3% (2.7% and 3.4% in the last two census ACS updates).

I was using vacancy rate to refer to share of housing units the census defines as unoccupied. That includes homes that are for sale, for rent, rented but not occupied, sold but not occupied, for seasonal/recreational/occasional use, for migrant workers, or ‘other’ vacant.

If you define vacancy as

(units for rent + units rented but not occupied) /

(renter occupied housing units + units for rent + units rented but not occupied)

Then you’re right, the vacancy rate drops to ~3%.

thanks for clarifying.

No–the city needs to start siezing those foreclosed homes and deeding them over to Habitat for Humanity.

The big problem isn’t so much that there isn’t housing, but that there isn’t AFFORDABLE housing, particularly affordable housing that isn’t undesirable.

While I haven’t any figures to back this claim up, I suspect that the supply of affordable housing is going down, not up.

Builders, generally, won’t build it unless a) the land is dirt-cheap (which means either greenfield housing on the suburban fringe, or places that are undesirable) or b) they are required or bribed to do so.

And one indicator of the hotness of the housing market is that CONVERSION projects are housing–i.e. good housing is being torn down and replaced. Usually when this occurs, one or both of the following happens: a) the new housing has more dwelling units than the old; b) the new dwelling units are more expensive to rent/buy than the old. And the places where conversions occur are not undesirable or greenfield, ergo the housing won’t be cheap.

(And low-income housing generally gets opposed by the neighbor).

And in the current economic climate, cheap housing in Rockwood or Aloha or Sherwood or Gresham is less desirable than (formerly) cheap housing in St. Johns or Montavilla or Cully or Ladd’s Addition, if nothing else due to the far more auto-dependent nature of the ‘burbs.

Complaining about developers ISN’T off the mark–many projects are making the problem worse, not better, even if they do increase the overall supply. But the alternative proposed by various local NIMBYs–stop construction–also drives up prices due to a constrained supply.