Right now in Salem, lawmakers are drafting a statewide transportation funding package that aims to raise over $8 billion. As we reported last week, one small piece of that new revenue — an estimated $2 million a year — would come from a 5 percent tax on the purchase of new bicycles.

The tax would add $35 to the average price of a new bike purchased at a bike shop. It would be an unprecented step for Oregon and the only tax of its kind in America.

Not surprisingly, bike shop owners throughout Oregon are very concerned.

Most of the money raised in the forthcoming bill will be spent on a handful of highway expansion projects that Nigel Jaquiss, a Pulitzer Prize-winning reporter for Willamette Week says, are based on “shaky assumptions about traffic jams”.

“Bikes cannot be the scapegoat here because someone was frustated in their car once.”

— Chris DiStefano, River City Bicycles

While the bike tax will be a relatively tiny portion of the bill; the policy principles and political ramifications go way beyond just a dollar amount (our neighbors in Seattle, for instance, worry it could normalize bike taxes). Perhaps this is why the policy director for The Street Trust, Gerik Kransky, told us he feels the bike tax debate is, “the toughest political challenge” the organization has faced in his seven-year tenure.

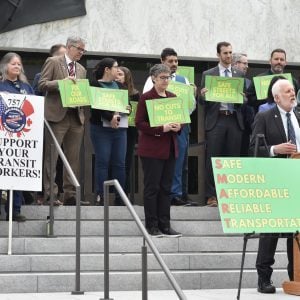

As pressure to fund transportation builds in Salem, The Street Trust is playing a risky game: They support the overall package (along with the Transportation for Oregon’s Future coalition) while at the same time they oppose the bike tax that lawmakers see as a key element of it. The Street Trust has also organized opposition to the bike tax from Oregon bike industry leaders.

20 Oregon-based bike business owners and employees have signed a letter drafted by The Street Trust that will be sent to lawmakers later this week. Here’s an excerpt:

“We write to you as business leaders in Oregon’s bicycle industry and as partners in finding solutions to our state’s transportation and infrastructure needs. As Oregon businesses and taxpayers, we support a balanced transportation funding package that includes significant Safe Routes to School and bicycle investments, both on our roadways and on dedicated bike and pedestrian pathways.

We are happy to see the legislature exploring a variety of funding options. As users of our transportation network, we embrace our role in helping pay for our transportation needs through the gas tax, vehicle registration fees, payroll tax, and other tax dollars, all of which we pay currently. However, we are concerned by discussion of a new bicycle excise tax, as we believe it would negatively affect Oregon’s bicycle industry.”

The letter goes on to cite the $440 million of economic impact and 2,645 jobs generated by Oregon’s bicycle industry. Despite that monetary strength, the letter states that many bike businesses operate on “slim profit margins with a fine line between success and failure” and that, “a bicycle excise tax would have a negative impact both on bicycling and on our businesses.”

This nascent bike industry lobby is pushing for alternatives to the bike excise tax. They include:

- Additional motor vehicle taxes or registration fees;

- An optional checkbox on the state tax return to donate to trails;

- A tire tax for all vehicles (including bicycles) that would correspond with usage like a gas tax; or

- Another revenue mechanism that would be more widely distributed and not target a specific industry.

We wanted to hear directly from local bike shop owners. Last week we emailed about a dozen of them. For good measure we reached out to the president of the National Bicycle Dealer’s Association. Here’s what we heard:

Advertisement

Nathan Roll – Metropolis Cycle Repair

The more I think about it, the angrier it makes me. We already don’t make a ton of money off bike sales, and dealing with the cash flow and inventory issues stocking them creates means a tax might be the final straw that persuades me not to sell them at all, and instead concentrate on service and accessory sales. We all know the ‘cyclists not paying their way’ canard is total horseshit, and much like mandatory helmet laws, this is likely to hurt ridership. Additionally, much like the equally ill-starred bicycle license narrative, how are they planning on enforcing this? Won’t any collection and enforcement mechanism eat up most of the money collected? I’m sure Republican lawmakers will be quick to decry this big government money grab.

Also, I’m certain the legislature will be rigorously enforcing internet sales of bikes shipped to Oregon for tax enforcement, correct?

Leah Benson, Gladys Bikes

– Personally, I think we should be incentivizing bicycling for its public health and environmental benefits rather than taxing it.

– I don’t agree with the underlying argument that cyclists are somehow a group separate from everyone else. People who ride bikes sometimes also drive…or take public transit…or walk…or… Yet, the notion that “cyclists need to pay their fair share” relies on this false assumption.

– A big concern is that this bill leaves more questions than it provides answers. Will the tax be on complete bikes only? Will the tax apply to online sales from out of state companies selling to Oregon buyers? Will people who live out of state that purchase bicycles from Oregon businesses — esp. thinking of frame builders here — be taxed? Why are bikes taxed at 4%, while cars are taxed at 1%? Etc, etc.

– I’m not going to pretend that adding a tax onto the price of bikes would somehow be a boon for business, but in the (hopefully unlikely) event that this does come to fruition I suppose have to be confident that we’ll ultimately adapt and find a way forward. If I’ve learned anything, it’s that constant change is a given in this industry (and life in general, I suppose) and the ability to roll with it is a must.

Chris DiStefano – River City Bicycles

[Note: River City co-hosted (with The Street Trust) a roundtable discussion about the tax with local bike industry leaders on May 2nd.]

At first, I wanted to have a positive approach to this. To participate in a meaningful conversation and not just dig in our heels and say, ‘We’re bikes! We’re different!’. I wanted us to say, ‘We’ll consider it, we’ll be smart and we’ll listen.’ That’s how it works to earn political capital… being open to every possibility and having a smart approach to it.

Then I heard it would be a 5 percent tax and wouldn’t be on bikes under $500. No way. 75 percent of bikes sold nationally are sold at big box stores [where all the bikes are under $500] — they’re not going to get a free pass. Regardless of cost, it’s the same bike on the same roadway.

The way it looks now, it’s a tax paid by bike shops. A bike from a big box retailer like Target or Walmart would be taxed about $6. But a bike shop like ours would see an average tax of $45-50. Do I believe that will impact business? Yes.

I just disagree with the whole, ‘bikes have to pay their fair share’ thing and I’m not going to allow someone to say this is an excise tax when this is a sales tax. Bikes cannot be the scapegoat here because someone was frustated in their car once.

Erik Tonkin – Sellwood Cycle Repair

A 5 percent tax on new bike sales would be significant. A quick look at our numbers suggests that our business would generate a maximum of $50,000 in revenue if all bike purchases — both new and used — were excised at a 5% rate [note: the proposal would only tax new bicycles]. I suppose the legislative intent is to pass this onto the consumer at the point if sale, but I think of protecting my customers first — so I can’t help but look at this from such a perspective, meaning my head and heart immediately make me wonder if I could afford to cover the excise. That much money is roughly what an average full-time employee costs our business. That’s a useful way to look at, in my opinion.

I don’t really think taxing bikes is a good way to raise money for bike-specific infrastructure projects. For one thing, it just doesn’t seem like much revenue. Second, an excise often functions as a “sin tax”. Such taxes seem to work best when levied in order to discourage “use”. The gas tax and cigarette tax are there, in part, to discourage what are considered damaging and unhealthy activities. Driving is not in and of itself a bad thing, but its associated costs are, at least, infrastructure-related. Smoking’s associated costs are health-care related. The one activity has impact on another entity–the tax is there to connect the activity to where it has its impact. It doesn’t seem wise to make bikes sinful when they can actually offset problems caused by driving cars–the sin tax equation doesn’t solve itself here.

It’s hard for me to put bikes in the sin category! That said, if the current climate in Salem — and in D.C. — is that bikes and those who use them have to start paying their way, then so be it. We need to address this reality, look at ways to “put skin in the game”. For me, this issue reminds me that we have an industry-wide identity crisis. Are bikes transportation or recreation? They’re both, in reality. They are not one or the other only when convenient for us.

In Oregon there’s a basic fishing license. Then, there’s an additional salmon and steelhead “tag” — and that revenue is earmarked, I believe, for that specific fishery, its habitat, etc. This is an imperfect and incomplete thought, but such an additional “bike tag” could be paid for in addition to vehicle registration at the DMV. Of course, there’s always the idea of a “bike license”, too. I suppose these go hand-in-hand.

The tax I’m most fascinated by now is Portland’s art tax. It seems so imperfect and flawed at the surface-level, but it also seems to be working. I wonder if something like that but writ statewide — and possibly graduated — could work for bikes and pedestrians. I’d likely pay such a “bike-‘n-ped” tax each year to get this ball rolling. Bikes are a huge part of our state’s identity — as are beer, coffee, etc.

Joe Doebele – Joe Bike LLC

— The tax panders to a false assumption that a lot of people have: that cyclists don’t pay for the roads they ride on. Most cyclists have cars and pay all the taxes everybody else pays, yet the wear and tear they put on infrastructure when is much lighter. They’re also part of the solution to traffic congestion, especially when there’s separated infrastructure. In lending credence to a public misperception, they’re only going to ingrain the idea that cyclists should shoulder more and more of the burden. It fosters an us vs them mentality and may make drivers feel entitled to insist that cyclists “go ride somewhere else”. Instead, we should better educate the public about who pays taxes, who creates congestion, who damages the roads and bridges.

— The funds are earmarked specifically for bikes-only infrastructure such as trails and paths. That’s got an element of fairness to it. But, by analogy, do we then tax wheelchair sales so that people with handicaps can cross the street without falling off a curb? Do we stop funding any cycling infrastructure if the tax on bikes doesn’t proceed?

— The state proposes to lump bike sales into the category of vice taxes: alcohol, tobacco, weed, gambling…and bicycles. Which one of these things does not belong with the others? This is the inverse of the principle that you tax activities you want to discourage, not ones that are good for society.

— The tax will generate less revenue than expected as people turn to used bikes. Of course, bike shops can also turn to selling used bikes, which may be what we’d do. I’ve got nothing against giving new life to old bikes and putting them back into top shape.

— If the tax applies to out-of-state customers, it will kill our burgeoning out-of-state business. I don’t know how the state would tax new bikes sales on Amazon or directly from bike manufacturers, but if they’re not taxes, obviously online sales will just keep on making it harder to stay in business with new bikes.

— Bike shops are being hit hard from several directions. Rising rents in Portland make it harder to afford retail space and raise the cost of living for our employees. So far we’ve been able to keep pace by raising wages, but there’s a ceiling and we’re getting closer to it all the time.

— Incidentally, a few years ago, City Club of Portland recommended a 4% tax on new bike sales. If the state passes this, does that pave the way for the city to follow suit? Are we then going to see 9% taxes on new bike sales?

Lou Doctor – Velotech (parent company of Western Bikeworks)

I don’t believe the proposed bike tax is the right way to raise funds for bike-related infrastructure. It won’t raise much money and is likely to lead to even more people shopping online instead of locally. I’ve suggested that the state add an optional $15 bike infrastructure fee to the state tax return which taxpayers could opt out of if they chose to. The fee could be thought of as a way to ‘crowdfund’ the necessary projects.

Todd Grant – President, National Bicycle Dealers Association:

Would a 5% tax have an impact? Yes. If the average bike sale through a specialty retailer is close to $700 than a tax of $35 on top of whatever else you pay in taxes will certainly cause sticker shock. The impact on retailers in high tax areas has been shown in Massachusetts and New Hampshire where people in Massachusetts that live anywhere near the border of New Hampshire go across the state line to save on the taxes.

In addition to the above, such a tax on a kid’s bike [the proposal would only tax bicycles with 26-inch wheels and larger] might drive that consumer into a big-box store that already has lower starting price points.

Bicyclists already pay their way to use the roads and trails through various licensing, taxes and fees. If the government wants to raise money they should add the tax to the vehicles that have the most expensive infrastructure to build and maintain – cars.

Is there still time to kill the bike tax? Or to swap it out for something that will be more favorable to the bike industry?

The Joint Transportation Preservation and Modernization Committee continues their debate on the funding package today at 5:30 pm. Stay tuned.

— Jonathan Maus: (503) 706-8804, @jonathan_maus on Twitter and jonathan@bikeportland.org

BikePortland is supported by the community (that means you!). Please become a subscriber or make a donation today.

Thanks for reading.

BikePortland has served this community with independent community journalism since 2005. We rely on subscriptions from readers like you to survive. Your financial support is vital in keeping this valuable resource alive and well.

Please subscribe today to strengthen and expand our work.

In my shop, most of the bikes would get a much higher tax than $35. Not only would this be bad for business, which is already down because of the weather, but it’s ridiculously unfair. If you’re going to tax bikes to build bike trails, why not shoes for hiking trails? This just feels punitive, spiteful, and stupid.

What do you speculate will happen with this tax? Enthusiasts will forgoe purchasing a new bike? I could see consumers dropping their price range, i.e., instead of 2k on a bike, I’ll spend 1.5k.

> instead of 2k on a bike, I’ll spend 1.5k.

Wouldn’t it be instead of 2k you’ll spend 1.9k?

If the state and transportation lobby insists on a 5% tax for bicycles then I would insist on a 5% tax on motorized vehicles (electric, diesel, and hybrid) I would also insist on 5% for farm equipment ( Farm equipment are exempt from the clean air requirement ) on an annual basis. If they do not have insurance then they need to pay the insurance fee +5%.

T,

The infrastructure for automobiles is already paid for. The tax will provide more bike infrastructure. We need that because global warming is coming some day – this mini ice-age we’re in now will go away eventually.

“We need that because global warming is coming some day”

good to see you come around so quickly.

Glad I won’t be around for it!

“The infrastructure for automobiles is already paid for”

Haha, good one. Thanks.

maybe comment of the week?

yeah, I nearly did a spit-take on my screen.

I want to laugh but others here have done that for me.

An optional checkbox on the state tax return to donate to [bike/ped infrastructure] is the way to go. It could be called the “pay more than your fair share option, like you already do.”

The collection mechanism is already in place. It will generate more revenue than an excise tax. It won’t unfairly target specific businesses. It is not regressive. And, it allows for enlightened car-only motorists who realize getting people out of cars is good for everyone to contribute.

As long as it does not take away from biking infrastructure funding that is already in place, it would be a big positive.

People who commute by bike have already demonstrated a desire to be civically and socially responsible. I am sure that this would be extended to direct tax donations.

“Bikes cannot be the scapegoat here because someone was frustated in their car once.”

This.

Why do other countries have no trouble raising the gas tax again and again, and then raising it again, until they raise so much money they don’t know what to do with it?

This bike tax business is just nonsense. Have those debating it in Salem not heard of how other countries do this, and if they have why can’t they explain why we’re special, can’t learn from their successes?

We are in agreement here, if you can believe it. Though you never answered my question on what your favorite dessert was.

But I think the crux of your observation is a moral issue. That we (as individuals) all do our part, and all others are takers who do not do their part.

I’m delighted we agree. Though I’m unclear about the dessert bit.

“But I think the crux of your observation is a moral issue. That we (as individuals) all do our part, and all others are takers who do not do their part.”

I guess I’m not sure where you’re headed with that. In the comment above to which you’re responding I was talking about other countries where they have no problem (logically, politically, economically, morally?) sticking it to those in cars to pay for and marginally discourage the mode which everyone recognizes exacts all sorts of costs on society besides requiring fairly expensive infrastructure to operate. I can’t think of anything wrong with that model, and as others continue to point out the one being discussed in Salem has lots and lots of flaws besides not raising the money we all recognize we could well use.

We were arguing about something and you asked me if I liked pie. I stated I didn’t as I’m not much of a dessert guy. But I do love cookies in the morning. Totally lose my sweet tooth after 2pm.

My point about it being a moral issue is a comment on our societal values, mostly.

I was trying to state that it is probably much easier to pass laws that affect entire communities in Europe than it is here, because people there are (IMO) more attuned to the greater good of their nation than as to their own needs as individuals.

We have a very diverse country and have been taught from birth about being rugged individualists. I think Europeans tend to view themselves first as citizens of their country and second as individual citizens (as we do here). When one thinks of the group or tribe first, it changes the dynamic of how policies are made and enacted.

Everyone likes to think they pay enough in taxes to cover what they get back, but also see others they don’t like as “freeloaders” of the 47% who are “takers” and not paying their fair share. “Fair share” is a moral item. When people see what they consider to be moral failures in others, the level of outrage tends to be much greater – look at the disproportionate reaction to LGBTQs (or to cyclists for that matter)…since some consider it a “sin” to be gay, their level of outrage and anger is amped up even more than if it was a mere municipal infraction.

Your argument only works when you understand that most European countries also have hefty VATs, that is, an effective 21% sales tax on manufactured goods that’s paid before goods get to market, but that’s ultimately passed directly onto consumers. Since bicycle users are already paying a such a huge tax on their bikes and related stuff, European governments are more willing to keep raising their gas taxes, as you say. The problem here is that Oregon and a few other states don’t pay sales taxes, so bicyclists get less sympathy from car drivers, who are paying a kind of sales tax on every gallon of gas they buy.

That VAT business is interesting but I don’t see it as somehow explaining their gas tax attitude. I am not at all sure that people in those countries are so niggling when it comes to these issues, argue about whether ‘he paid his fair share.’

They do when it comes to trains and their high subsidies, especially for first class accommodation. Bicycle infrastructure varies quite a lot in Europe, from superb in the Netherlands, Germany, & Denmark, to terrible in parts of Italy. Sidewalks are terrible almost universally in Europe – those 2-foot wide flagstone sidewalks in most cities are simply not compatible for either strollers nor disabled mobility devices. Europe is very un-ADA. My point is that although they have very high gas taxes, and some places do fund more bike infrastructure, a majority of their gas taxes are still going towards roads, and most of the remainder towards trains, rather than bikes, and certainly little towards widening sidewalks. In addition, most European countries, like most US states and cities, and unlike Oregon, pool their gas tax funds with other tax revenue, including VAT, to pay for social services, police, and the like.

Your point was to keep raising gas taxes “like they do in Europe”. My point is that it’s a package deal – you can raise gas taxes, which I agree with, but you also need to have a sales tax (I hate them) and/or VAT (I like them) and the ability to pool your resources, both of which are missing in Oregon.

“Europe is very un-ADA.”

Uh, no kidding. 😉

“My point is that it’s a package deal – you can raise gas taxes, which I agree with, but you also need to have a sales tax (I hate them) and/or VAT (I like them) and the ability to pool your resources, both of which are missing in Oregon.”

You keep saying this but I am unclear why you feel this way. Germany’s car related taxes and fees raise 3x (Three times!) the amount of money they need to do all the infrastructure maintenance. The other two-thirds of that sizable pot of money ~53 billion Euro is left over for other things: free post secondary education, health care, I don’t know what all. This is the exact opposite situation from what we have here, where we’re constantly borrowing from other places to throw a bit of asphalt at the rapidly deteriorating infrastructure we have but can’t seem to afford to maintain. First world, ha!

I agree, and European are more willing to pay higher taxes and a greater diversity in kinds of taxes than we do, but seem to be more satisfied that they get good benefits from paying such taxes. In contrast, look at the reaction of BP readers to any kind of tax on bikes – “no, never, not in my lifetime”. Shoes wear down pavement very slowly (such as the worn steps of 900-year-old cathedrals) and bikes have nearly no impact on road pavement, but they are nevertheless taxed in both Europe and much of the US. True, the money raised is negligible, but it’s the symbolism of “everyone paying their fair share” that makes egalitarian societies like Germany and the Netherlands so egalitarian – everyone is seen as paying, everyone benefits.

Cyclists pay the same tax on every gallon of gasoline they buy.

Very true, but they are not perceived that way by state legislators. Perception is everything in this case, alas, and logic means little with politicians writing budgets.

Do you feel it’s necessary to repackage and repeat the illogical beliefs of politicians? I don’t know what purpose that serves.

In short, yes, it is.

When I was involved with EPAP for 7 years, I often worked with state legislators – East Portland has 10 state legislators representing parts of the 160,000-person district. All of them are very smart people, but they are all part-time legislators who are bombarded by mixed messages from “special interests”, including the bike and car lobbies. All care very deeply about “doing the right thing”, but as they say, the road to hell is paved with good intentions. Some legislators are very transportation savvy, and most of those tend to be pro-bike and pro-walk, but most legislators are ambivalent about transportation and focus instead on other topics – security, housing, homelessness, etc.

Most Portlanders, about 70%, still drive alone to work (alas), and for those legislators who are ambivalent about transportation, most are vaguely pro-car, especially those who have to drive from quite far away to Salem. I have found that if you advocate/lobby those legislators about the benefits of supporting bicycling and walking, keeping the message as simple as possible, you’ll make more progress. But the message needs to be really simple, so that even a distracted teenager can understand it. For example, “more bicycle users mean more space for car, less traffic congestion”, and avoid talk of induced demand and such, even if it is real (and it is.)

By the way, if you want to lobby a legislator, you need not go all the way to Salem. Many have “town hall” meetings around Portland and other towns – much more intimate and easy to talk with them. They are all very nice people.

I think the average motorist believes that roads are paid for, in full, by gas taxes and other vehicle fees. hence their fury at someone who is not driving, and therefore not paying taxes in their immediate use of the resource. And therein lies the misperception – that if you are not using something now that you paid for in one way or another…that you have not paid for it at all.

“Why do other countries have no trouble raising the gas tax again and again, and then raising it again, until they raise so much money they don’t know what to do with it? …” watts

What “…other countries…”? Do you mean Germany, which you referred to a few days ago as similar in area size to Oregon, in a comment to an earlier story on the proposed new bike tax? Germany with, according to wikipedia, “…Population. 82,175,700 (2015 estimate)…” compared to Oregon’s “…The United States Census Bureau estimates that the population of Oregon was 4,093,465 on July 1, 2016,…” wikipedia?

Germany’s much larger population, and a thriving economy, confined within an area the size of Oregon, may have something to do with the amount of money the country is able to raise for bike specific infrastructure. And a greater public awareness of the need for and support of bike specific infrastructure with that many people jammed into the amount of land area Germany has.

density hardly explains the difference, wspob. Maybe try again.

Usually culture and people’s relationship and trust with government are the main factors. Most Canadian provinces are far less dense than Oregon, but have far higher taxes overall. Ditto with Sweden.

“Usually culture and people’s relationship and trust with government are the main factors. Most Canadian provinces are far less dense than Oregon, but have far higher taxes overall. Ditto with Sweden.” hampsten

Without some study, I wouldn’t know how the taxes in those countries differ from that in the U.S. But I do know that Canada, and probably Sweden too, has some socialized medical care, making in in my mind, a lot further ahead than the U.S. in caring for their people.

Whether the U.S. not having those amenities is related to people’s trust in their government, I don’t know for sure, but probably not. Culture, maybe. The U.S. has always been strong on capitalism with a lot of people always wishing to believe…’the market’ success will one day be able to take care of everything. Which it does, except for poor people, and increasingly, not so poor people.

I doubt the U.S. public though, is anytime soon going to support a lot higher taxes than they pay now, so there can be the kind of bikeway systems that some countries have where biking is a much percentage of road users. I think most people here in the U.S. simply do not yet see the need or the justification for that kind of public investment.

So we continually hear the argument from drivers and non-cyclists that “cyclists need to pay their fare share”. We also hear from cyclists that “we pay our fair share”.

Can someone please provide an actual, tangible number for what “fair share” is?

I suspect for the driver, no amount will ever be enough and that “cyclists need to pay their fair share” is simply the most available and simple reason they can come up with to voice their displeasure of cyclists. I guarantee that even if cyclists paid an additional $500/yr, it would either not be enough or there would be another reason why cyclists are the worst people on the planet.

I suspect for the cyclist, if they pay anything at all into the system that somehow it all goes for their preferred form of infrastructure, when in fact their tax contributions may only result in pennies per year towards it.

I wish we could determine (as individuals) how much we actually contribute towards local road funding and cycling infrastructure as a subset of that. We only tend to look at aggregates and not individual contributions.

Obviously, a more wealthy cyclist will contribute more than a poor one and a wealthy driver might also be contributing more as well even if they do not use the cycling infrastructure.

The danger of the approach of the “fair share” is the assumption that we all have to pay equally for a public good such as a road. Obviously, we do not – the government provides it because it is a good thing from a societal standpoint to do. They idea that we have to pay equally for it is not part of the equation.

So the real question is why do people (especially drivers) look at a public resource as a private one? That someone else using it is somehow taking away from them?

I’m particularly interested in Kyle Bannerjee’s view. I think he approaches things in a very objective and pragmatic way and would like to hear (if he is willing) his viewpoint.

I am not categorically opposed to the concept of targeted fees and think they can be a good thing. However, coming up with a practical mechanism that generates a reasonable amount of money is tricky.

I think the most likely outcome of the proposed tax will be to raise a relatively small amount of revenue for projects in very select areas that have the potential to serve only a tiny percentage of cyclists that actually pay the tax while hurting local retailers.

I don’t know what would be best. My first reaction is that the model for the invasive species permit required for small watercraft — i.e. you buy a tag for $5/yr (multiyear tags would also be available) which you carry and which people are told to buy when they get a new bike — would be a simpler and more effective mechanism.

Even if you know a lot of people wouldn’t buy the tag and there’s no credible enforcement mechanism, I would expect decent buy in since the cost won’t be a hardship and the people will generally support the objectives.

With a lot more people buying these things, the low costs are spread across a much larger base creating less incentive to dodge the fees while generating more revenue. By not requiring registration, a lot of administrative costs are avoided and the optics are good.

Here in Greensboro, bicycle registration is required by city ordinance. The one-time fee is $5. Raised revenue goes towards bicycle improvements, by law. For your $5, you get a sticker that goes on your bike and your bike number goes into a city data base.

Due to very high administrative costs and a total lack of compliance (who wants to put a gray sticker on their $3,500 Massi?), the city dropped enforcement of the law over 10 years ago. I actually asked the police to issue me one – they refused.

Stickers are a bad idea as is registration because so many people refuse either for multiple reasons. A one time fee is an even worse idea because you don’t have a consistent source of revenue.

A tag/card that you can buy everywhere and carry with you that goes to fund good stuff has a more organic feel to it, costs a fraction of the amount to administrate, lends itself to something that a significant number of people will reasonably comply with, and will raise way more money. In addition to the invasive species permit, there are a bunch of passes people buy to use sno-parks, county, state, and national parks as well as various wilderness areas. I know people often don’t buy these permits, but compliance is decent and people tend to support rather than resist the premise of them.

The energy behind the proposed legislation strikes me as more punitive than practical. But the question of how to fund bike projects is a legit and complex one and frankly if cyclists can carry some bright colored card to flash when idiоts blаther about how cyclists don’t contribute, maybe we can get discussions going in a more productive direction rather than waste so much energy on impractical sideshow distractions like forced bike registration and poorly conceived taxes that only a few will pay.

I know many riders who ride without their wallets, crazy but true. No wallets, no tags with them.

I’m certain that’s true, but enforcement is impractical on so many levels that I hope no one would try.

Even though such a fee would be easy to dodge, my guess is that a huge percentage of people would pay it (maybe even happily). I’m certain it would raise more money with fewer undesirable side effects than this nutty tax.

I’m sure the police here would completely agree with you, and so do I.

This ignores the fact that some types of road users’ vehicles damage the roads continuously while others do not.

The weather and vegetation damages the roads as well. Even if the roads were completely unused, we would still need to pay to maintain them at some point.

At some point your line of reasoning would I think be called special pleading. You are working so hard to find a way to show that, no, people cycling really don’t pony up enough for maintenance. But the fact is people cycle the world over (Africa?) without roads. I grew up cycling through the woods – no roads. The idea that everything in a post-auto world would grind to a halt because road maintenance wasn’t paid for is absurd. When that time comes, we’ll have far more difficulty refining and transporting asphalt without trucks.

It takes extreme examples to argue with extreme opinions.

It’s extreme to say that bicycles don’t damage blacktop?

Do we need a tax on weather and vegetation?

True, but these are public goods. We don’t generally measure how much of the resource one uses…just that it is available for all to use.

“…So the real question is why do people (especially drivers) look at a public resource as a private one? That someone else using it is somehow taking away from them? …” road guy

I think it’s the part of the road people driving or traveling by motor vehicle, can’t use…the bike lanes, elaborate bike infrastructure in downtown, that they feel people biking should pay towards the provision of, somehow similar to the way people driving pay a tax on fuel.

People biking, except for some freeways, literally are entitled to use every public road there is with their bikes. People driving are prohibited from driving in the bike lane.

“So the real question is why do people (especially drivers) look at a public resource as a private one?”

That…. is an interesting question. I seem to have missed it the first time around.

My hunch is that (a) because in this society we have grown accustomed to thinking of taxes as a burden, focus on the paying part rather than the what-we-get-fort-them part, and so having to pay a paltry gas tax rankles (some). (b) we have a special problem here in the US that those who bike are treated as the other, as different from us, as weird, as elitist, or freeloaders, or any of a number of other categories. The evident freedom of the guy on a bike passing me stuck in my stuffy hot car on Division contradicts the advertiser’s pitch that helped me decide to plunk down $40,000 for this car-that-promised-freedom, but only predictably causes me to constantly be stuck in bumper-to-bumper traffic while this good-for-nothing punk on a bike gets to sail past me!!!!

Oregonions insist on paying more for gas per gallon since it is sold as full service. However, the thought of asking for a higher gas tax where funds go to fix roads makes motorists furious…what gives?!

Ashland has a 5% sales tax on prepared food….why doesn’t PDX do the same and the 100+ million dollars it generates per year go towards livability, etc…?!

Tonkin has such a level-headed, rational take on this.

“We need to address this reality, look at ways to “put skin in the game”. For me, this issue reminds me that we have an industry-wide identity crisis. Are bikes transportation or recreation? They’re both, in reality. They are not one or the other only when convenient for us.”

They are both, but what really matters is that, whether ridden for transportation or recreation, bikes don’t wear down the roads.

This is n true. Do bikes wear down road slower than cars? Yes. Would we still need to maintain roads if they were only used by bikes? Yes.

(Go watch one of those life after people shows if you don’t believe that nature itself can simply damage roads over time)

Close enough for practical purposes. The amount of road wear caused by a humans on bikes is so minuscule as to be completely undetectable. Weather damage is far, far worse. Trying to say that bike cause road wear just like cars and trucks cause road wear is a battle of semantics, nothing more.

“Would we still need to maintain roads if they were only used by bikes? Yes.”

This is like saying people who whistle need to pay for the extra air they inhale. Unless you can come up with a sound argument for deterioration of roads from bike tires I suggest giving this a rest. You’re sounding ridiculous.

Actually, this analogy is what sounds ridiculous. No one pays for air because there is plenty for all and it costs nothing to provide.

Roads would still need maintenance even if there were only bikes so as road users, they consume a service that costs somebody something to provide. Even if someone in this state goes their entire life without ever getting in a vehicle, they benefit immensely from the roads — it would be impossible to provide other things they depend on without them.

And they still are paying taxes to cover ~half of the costs of those roads, and are doing zero damage to them.

Dan, they are not paying half the costs. They are paying taxes, a portion of which go to roads. You don’t get to choose where your taxes go. In reality, you are probably only paying a few bucks a year towards cycling infrastructure. You are paying just as much towards cycling infrastructure as a driver is (assuming similar incomes and taxes).

“In reality, you are probably only paying a few bucks a year towards cycling infrastructure.”

Do you disagree that cycling infrastructure is derivative, only makes sense as a defensive response to the ubiquity (and threat) of the auto, and as such doesn’t make sense to stick cyclists with the costs for it?

“Gas taxes and other fees paid by drivers now cover less than half of road construction and maintenance costs nationally – down from more than 70 percent in the 1960s – with the balance coming chiefly from income, sales and property taxes and other levies on general taxpayers.”

http://www.uspirg.org/reports/usp/who-pays-roads

Half. Or more.

“No one pays for air because there is plenty for all and it costs nothing to provide.”

Perhaps before Charles Dickens? These days clean air is hardly free or ubiquitous.

In that case, if I breath faster we have a Tragedy of the Commons situation.

Posting comments on here is fine, but

it is NOT a substitute for letting your state representatives and state senators know of your opposition.

Send messages where they may actually have an impact!

We should probably just agree to license bicycles.

Hardly anyone will do it, it is basically unenforcible and will cost more to implement than it brings in.

Apparently we need to throw them a bone… so throw them one we will not even have to pay.

Yeah, it would be very difficult to post a single officer on each bridge periodically …

I am sure they would do that….

Of course they will. They periodically undertake enforcement actions at Ladd’s Addition because it has proven to be an area with lots of fatalities. NOT.

Sounds like it would create more scofflaws.

Then pay some stupid tax.

I was just giving an alternative to just saying no, which even the bike orgs are not doing.

If you have a better idea, feel free,

If just saying hell no, that is easy and I agree…

There are other funding ideas I agree with on these threads, and I have said as much.

A state tax refund check off option for Trail construction and maintenance would make sense. I don’t drive, so this idea is something worth considering.

We have to face the fact that our road and highway funding source (primarily gas taxes) will be in structural decline in the future, at the same time the need for funds to fix and replace 60 year old ( or more) transportation infrastructure increases rapidly. The reasons are many; from improved fuel efficiency, declining use of autos among urban young, growth of electrical vehicles, future climate change mitigation and the declining net energy availible from the petroleum complex due to peak oil. This is a huge structural economic problem that will not be solved with minor policy tweaks like bike taxes, in fact such a tax is counterproductive because bikes are one of the few ways to provide short to medium distance transportation in the face of declining infrastructure quality. The road to ruin is paved with small stupid choices.

One thing I would add is an increasingly large and unsustainable pension burden with state and local governmental agencies. Take a look at Illinois – over 100B in shortfalls alone.

https://www.illinoispolicy.org/reports/pensions-101-understanding-illinois-massive-government-worker-pension-crisis/

Maybe Oregon Incorporated ought to declare bankruptcy and merge with Washington State. I hear they have nice roads…

Maybe Washington has nicer roads because the state gas tax is 49.4 cents per gallon; Oregon’s is 31.12.

Source: https://en.wikipedia.org/wiki/Fuel_taxes_in_the_United_States

Yes. It’s amazing to me how many people here in Portland don’t realize that. Anytime you question the costs of having gas station employees pump your gas, you’re inevitably met with “Well it costs the same as in Washington”. Unfortunately we’re paying extra for the gas station employee, and Washington is getting that extra money in gas taxes.

Tax metal-studded car tires ! Preserving Oregon Roads needs it !

Yes – its probably time for Oregon to get creative (and fair) about facility user fees…may as well include a shoe/ boot / rain jacket fee (pedestrians) plus a tax on electricity used to power EV vehicles…

Additionally, a part of any thorough and successful discussion about a retail bike sales tax would be to calculate how many Oregon motorized vehicle owners (or their parents if they are a kid) already pay into the roadway fees (license tabs, fuel tax, property taxes, car rental/ car sharing taxes, etc.)…there are already few truly “car free” cyclists in Portland…

I was discussing this with a coworker a few years ago (using all the bike cliches about road funding) and he pointed out that while cars do more damage or pay more infrastructure, they also pay car-specific taxes through registration and gas taxes (and I think we’ll all agree it isn’t “enough”, but at least it’s something). There is no bike specific fees or taxes. So while we all pay a baseline of taxes (property, income, etc.), bikes don’t pay anything additional (as cars do). I really didn’t have a good answer for him. To me the “bikes do less damage” line isn’t good enough, even though clearly the vast majority of transpo funding is spent on cars. We really aren’t paying anything specifically because we ride bikes. If I was a pedestrian only (or transit only rider) I also might be a little miffed at bikes getting off without paying anything extra.

‘90% of cyclists surveyed in Oregon and southwest Washington also own and drive cars.’

http://blog.oregonlive.com/commuting/2009/10/survey_90_percent_of_oregon_bi.html

I’m one of those cyclists, but that doesn’t change the fact that I would pay the exact same if I only drove or I took the bus, etc.

Even if a cyclists also owns a car and pays those fees/taxes, they are for their car, not for their bike. Sure there is plenty of overlap.

I am honestly fine with cyclists not paying anything extra (I also don’t have expectations that cycling is going to get to >10% mode share). I just don’t think you’re going to win the perception war by arguing that we all pay other taxes. I’ve made those arguments as well in the past, and they just don’t really gain much traction.

The point that has been made clearly here is that drivers are currently under taxed for the externalities of driving. It’s not my responsibility to pay extra to make up for the perception gap. It IS the responsibility of our leaders to find out the facts and speak the truth, not just reiterate the bogus chants of the unwashed masses. Other countries have figured this out.

I would agree if we had better public transportation options. This is the catch-22. The state needs the money for transit but nobody wants to pony up the cash. The majority of Portland citizens own cars and I imagine most would drive on gravel roads before increasing taxes to pay for transit infra.

Really? Let’s raise the gas tax and find out.

But yes, I agree that our current public transportation is really lacking.

Yes. This. 100x. Thank you, Dan A.

Somewhere here in the comments I linked the other day to a Monday Roundup story from a few years back which described the city in Norway(?) which paid people who rode bikes and walked in recognition of the money their mode choice actually *saved* the municipality. You seem bound and determined to stick it to those who bike, but in other places they take a different view of this situation.

PS. Did the State’s calculations on income include the planned purchases of future bike share bikes?

My deepest desire is for my customers, my family and myself to be able to ride around without the very real threat of injury and death.

The only way that is going to happen is if we can muster enough political strength to accomplish (infra)structural change.

5% tax is nothing to me if I sell 400% more ebikes because PDX streets are so safe that my 82 YO mom feels safe enough to ride.

Do I trust that the changes will happen if the tax goes through? That remains to be seen. But if it passes, my voice will be heard with amplification if the changes are not made.

5% is really just a drop in the bucket when you look at the total cost. However, if the tax doesn’t go through and one of my customers, family members or even I am injured because the VisionZero did not materialize, then I will kick myself for what could have been.

On the other hand, if nothing is achieved and no revenue is raised, the roadways may “go to pot” and everyone will have to slow down to dodge the potholes, broken bridges, and rough pavement. Soon Oregon will start to resemble West Virginia.

All of what you say could be accomplished without enacting a sin tax on bikes.

“5% tax is nothing to me if I sell 400% more ebikes because PDX streets are so safe that my 82 YO mom feels safe enough to ride.”

I fully agree. Even if it were a 50% tax and it forced you out of business, I would support it if it made PDX streets safe for ages 8-80.

It’s nice to hope, but it’s better to support good policy.

1. A bike tax will not increase the appreciation or bargaining power of “cyclists.”

2. Law makers who thrive on anti-Portland sentiment will not give up their anti-Portland rhetoric or pass on another opportunity to lampoon “portlandia cyclists.”

3. The tax as described will not make a noticeable difference.

4. Compromise is great when it is a genuine compromise benefitting both parties. Acquiescing to political theatre while hoping for miracles is not compromise.

If any contribution by bicyclists is blocked, legislators from rural Oregon are likely to demand that investments in bicycle infrastructure be minimized. Personally, I’d be happy to pay for accelerated infrastructure development.

That decrease in investment will also bring decreased bike tourism.

Good call. There are a number of rural towns who see bike tourism as something good they can cash in on.

There are other ways to contribute to a cause besides non-sin taxes. Share The Road plates are popular, and people voluntarily pay an extra $5 a year to have them.

Come on cyclists. We’ve got to put our money where our mouths are; and support cycling infrastructure.

Where was this resistance to taxing people when O crammed his mandate penalty tax of several hundred to several thousand dollars per year down our throats if we could not afford his health care plan?

All together now: “Yes, please Mr. Legislature, tax the bejesus out of us cyclists so we can make our infrastructure great again.”

🙂

Oh… you’re still here.

well, that impacted everyone that did not have employer based insurance.

A bike tax would target a much smaller subset of the population.

I’d like to see Portland offer an option – Arts Tax or Bike Tax. You only have to pay one.

I burn the art tax envelope every year. When my child’s school in North Portland remains without heat I will continue to do so. No heat at my child’s school for 7 years now. No heat at the three other K-8s within our region. Art tax, ha.

I can’t imagine your envelope provided much heat.

Or:

Come on drivers. We’ve got to put our money where our mouths are, and support cycling infrastructure. We can’t logically complain about bikes getting in our way on our roads, while at the same time not be willing to chip in to provide them with alternatives to riding in auto traffic.

This needs to be seen for what it is, a nuisance tax, this is a disguised beatdown from a sector that places no value on the good bikes do all the way around, decreased traffic, pollution, freed up parking, etc. total BS, we do plenty to pay our fair share by supporting local business that support us and in turn pay lots of taxes, operating expenses, transportation costs, etc. As we all know if all the bikes at rush hour on say Williams, around Lloyd center and every other busy bike route were cars instead the gridlock would be much more crippling and the car sector would be targeting something else and likely with far less traction. Because we are so visible and numerous we become an easy target that many love to hate. Also, I own 3 cars, drive plenty and pay plenty, but commute mainly by bike.

“…rush hour on say Williams, around Lloyd center and every other busy bike route were cars instead…” vans

For comparatively high road use with bikes, I suspect the locations you mention are the rare exception in Portland, other cities in Oregon, and the state as a whole.

If the people riding their bikes, weren’t riding, would they be driving single occupancy vehicles? Some would, some would be taking public transportation, some would be carpooling. I’m not so sure that at the current percent of people riding, that there would be a major increase in motor vehicle related traffic congestion.

A big draw in terms of public support for more and better biking infrastructure, and public dismissal of tax proposals like the tax on new bikes, would be to somehow motivate people to vastly increase from the apparently 8-15 at best, percentage it is now, of road users that are riding bikes.

Bike tax, schmike tax. Oregon needs a sales tax. Five percent on everything across the board (okay, food excepted if you want). Let’s go!

Of course, lets tax poor people exactly the same as the 1%.

What good idea…

This happens in other states and the difference is made up in the income tax rates.

But we could also argue that wealthy people will spend more on food in general and dine out more, so they will in essence be buying more expensive food, and therefore paying more in taxes.

Some states differentiate between restaurants (sit down especially) and grocery food. It’s not difficult.

There are plenty of ways to offset the sales tax for lower income people. For example, the state could collect a 5 percent sales tax on everything (including food) and offset that tax by sending everyone a check of $100 every three months. That would compensate for the 5 percent sales tax they paid on their purchase of $8000 of “necessities” annually.

Exempting things like food gets really complicated. In Iowa, for example, every October the state reminder grocery stores that pumpkins purchased for food are tax exempt, but those purchased for decorations (jack-o-lanterns) are subject to sales tax. In Ohio, food purchased at a restaurant for consumption on site are subject to sales tax, but for carryout it’s untaxed. Customers at fast food restaurants regularly ask for carryout, but unwrap it and eat in the establishment. Oh, well.

MQ,

I’m all for it. Let’s have a sales tax, and get rid of the income tax. Think of the savings in paperwork the citizens, AND the dept of revenue will have. I’d vote for that. Same system as Washington state. But, no way will I vote to ADD a sales tax on top of our income tax. We’ve rejected it multiple times at the ballot box. Fuhghedaboutit!

Can someone explain how this will hurt local retailers? The tax is 5% and applies to bikes over $500. Doesnt this mean that the tax will be applied to a certain type of bicycle that can only be found at a local retailer? For example, no one going to buy their carbon road bike at Walmart. So isn’t this just a tax passed on to the consumer? If the bike is $1000, the consumer will pay additional $50. I doubt the bike shop is going to drop the price of the bike to make up for the tax.

And cyclist can’t go to Vancouver to purchase, there’s sales tax. So the consumer has to buy from local regardless of price. And if the tax is uniform, the consumer will pay regardless of the bike shop.

Again? There are three posts on the subject already with hundreds of comments.

From what I’ve read, shop owners talk about thin profit margins and I understand that, but I speculate people that want to buy a high quality bike will regardless of this tax. I could see people not wanting to buy accessories on the spot. If you think about it though, people buy high quality bikes, what, a couple every ten years. I can’t imagine this tax will have that great of an impact on consumer choices. A 5% tax on a $2000 mountain bike isn’t going to turn me away, there’s no other options for me to purchase elsewhere. Maybe online, but I would never do that.

Bottom line: you don’t put a sin tax on things you want to encourage. It doesn’t matter what size the tax is or what demographic you think it will affect the most. You may as well tax shopping locally, or organic vegetables, or volunteer work, or voting, or recycling.

Sin taxes are applied to cigarettes and such, I wouldn’t put this type of tax in the same category. What do you think about the Portland art tax? I imagine the bike tax is a precursor for additional taxes to emerge on a variety of goods. Soda pop is next in line.

Aren’t soda taxes are sin taxes?

So we should tax the purchase of cigarettes, alcohol, and bicycles. Which of these doesn’t belong?

The exercise benefit from cycling extends your life, therefore you’ll be using services such as libraries and parks for more years. The other two shorten your life, freeing up public resources for others when you die early. So the bike tax is the one that makes sense.

ha ha 🙂

Do you support a sin tax on earning money?

Taking a percentage of earnings that were made possible by our government is not the same thing as tacking on an additional expense to a purchase that is of benefit to the greater good.

And, when you tax gas while simultaneously desiring that gas consumption decreases, you don’t tax people who are successfully decreasing their gas consumption, decreasing road space use, and road wear and tear.

When people quit smoking, do we tax them because we have to account for lost revenue from decreased cigarette sales?

We tax carrots.

I don’t consider this a sin tax. A sin tax is designed to be punitive enough to put a dent in the behavior. Ages ago when I was in grad school for public policy, we learned that a good tax was one that raised revenue for the particular behavior the tax was on. In this case, a small tax on cycling that goes towards cycling projects would not be a “bad” tax. Now we just tax behaviors that are considered sinful and use those funds elsewhere.

Can you imagine the tax shortfall if there was no tobacco or gambling? These behaviors will never go away because there is too much tax revenue tied up in them. There are actuaries who try to figure out what the optimal rates are to maximize revenue but not kill the behaviors.

Dan A,

Or working.

I agree. I think it’s a dumb tax on principle, but honestly don’t think there will be any “sticker shock” when a buyer gets a tab for $735 instead of $700. And especially not then it’s a $2k bike. I can’t imagine many folks are in the market for a new bike >500 bucks who can’t afford 5% more. All that said, I still oppose it for being bad policy.

Yeah, but what about when you’re buying a $6,000 carbon dual-suspension MTB and the tax is $300? At that point you might look for other options.

I suppose wealthy people even need a break from time to time.

Also, who would ever ride that $6,000 MTB on the road?

‘Cause you can, this is ‘Merica!

By showing your Oregon driver’s license, you can get Washington sales tax waived for items you don’t consume in Washington. I’ve done that plenty of times.

Hmm, interesting. I wonder how many bike shops are in Vancouver?

Some places do it (usually places dealing with big ticket items). A lot of places in Washington won’t go through the hassle of the paperwork on smaller ticket items.

I’ve never been refused the waiver, and use it in Seattle on anything over a few dollars.

I’d guess it’s illegal to refuse to grant the waiver, but I’ve never even had a need to say that.

Businesses in Washington do have the legal option of refusing to do the waiver, but I’ve only been refused once when I lived in Oregon doing business in Washington. Businesses like making sales and their loss in time on filling out the forms is usually made up on the long run by having a reputation of waiving the sales tax. The waiver in Washington is available to any resident from other states without sales tax, plus Alberta, and also for Colorado residents as they have a very low sales tax. Washington is the only state currently offering the waiver (apparently Georgia used to.)

How about a tax on UPS, USPS, and all other delivery services? Today many people buy all kinds of things via on-line services like Amazon. Local businesses pay licensing fees, payroll taxes, and many other taxes and fees that support the infrastructure that allows companies like Amazon and UPS to send trucks all over our neighborhoods. How about having the on-line sellers helping to pay? Adding a $.50 per home delivery fee would raise all the money we need to rebuild the infrastructure to support all the deliveries and would barely cost any more. Best of all it would most likely target people who can afford to pay.

So I looked it up. Oregon’s Weight Mileage fee (17% of ODOT budget) applies to trucks over 13 tons – this applies to semi trucks.

The average loaded weight of a UPS truck is 10 tons, so they do not pay additional fees.

But the real question is are those delivery companies already assessed additional fees we don’t know about? I believe sometimes they pay for road improvements around their facilities.

Wow, now that’s a fascinating idea. Heck, how about a $5000 permit to allow them to pull over into bike lanes and park while they deliver a package. I mean the fact that it’s illegal doesn’t stop them, might as well make some money. We get nicer bike infra in return for putting ourselves in harm’s way to get around the UPS truck in our lane. (I’m only sort of kidding)

In my humble opinion … I appears the Oregon government discouraging folks to purchase a bicycle. One of the best means of eco-friendly transportation.

Here’s a thought … put a sales tax on the purchase of vehicles; all vehicles. We can also afford to put a slight increase, how does 5% sound, on vehicle registration. Not that would discourage many folks to purchase or drive their cars but it just seams more practical. The systems are already in place. These are what I would like Salem to consider.

Better yet, have the cost of registration be a fixed percentage of the value of the vehicle. A number of states do that, and it raises serious revenue.

All vehicle taxes hurt those with low incomes the most.

It’s too hard to determine objective value of a vehicle, especially older ones. I would rather have the registration cost be tied to the vehicle weight – much easier to determine, and also more directly related to wear and tear of our roadways.

I’m not sure what those other states do, but they have something that works for them. I think they just go off estimated BB. My bro lives in one of those states and he drives an old junker. So I suppose a gearhead could fix up an old car and get a break, but that’s hardly a major issue. People who drive lux SUV’s pay a lot.

Though if you buy a 6000lb SUV and use it for your business 51% of the time (even just driving to work), you can deduct up to $25,000, plus annual depreciation costs. I have a friend who does this, and she would get by in a regular car, but the large SUV deduction saved her a ton of money.

There are certainly lots of tax scams.

I personally am not a fan of taxes that aim to raise huge amounts of money from a relatively small number of transactions because people have an incentive to dodge the tax and game the system.

Much better to have small taxes everywhere that are impractical to dodge. On the regressive issue, economic assistance is a separate issue. The whole reason people with means can dodge paying things is because the tax system is riddled with loopholes. Better to get everyone paying in and then to provide assistance to those who need it.

At the end of the day, the license, registration, and Multnomah County registration fee that I pay on the two motor vehicles that I own, not to mention the property and payroll taxes I pay more than cover my share of the roadway.

Particularly when those taxes are being paid while the cars sit in the garage all week and I’m riding my bicycle to work, and my wife is taking the light rail.

Indeed. I really think we should focus on the property, payroll, and income tax aspects of it. While you’re right about the vehicle fees, too, I think it’s easy for the “Bikes don’t pay their share crowd” to discount that, as they say our bike use as an overage, beyond what they are paying for their vehicle. I think driving home “roads are only about 50% funded by use taxes; I pay a huge amount of income tax to roads–even for those that don’t have a car!!–a tiny portion of which pays for bike infra” is much more to the point.

Not in Oregon. The state legislature and Oregon cities are pretty strict about separating income tax revenue from car-related revenue. Car-related revenue, at least in Oregon, can only be used for transportation projects, maintenance, personnel, etc, due to past legislation – it’s part of the reason that Oregon is in the fix it’s in. Income tax revenue in Oregon can be used for transportation, and some of it is used for transit, but in practice almost none of it is used for road construction and maintenance, either by the state or by the cities and counties.

Most other states mix the revenue, but Oregon doesn’t.

In Oregon, property tax revenue generally goes to schools and cities/counties, and also is rarely used for transportation projects.

How can a state legally square a sales tax on only one product?

There is nothing to prevent the legislature (or the citizenry via the initiative process) from passing dumb laws. Just check out the Oregon Constitution — it’s a pathetic joke.

And despite the repeated mantra that there are no sales taxes, there are some. They are simply called something else.

I hope this tax increase goes to the ballot. I will vote NO.

I would vote YES if it included the decommissioning of eastside I-5 and the Marquam Bridge and the conversion of I-405 to I-5. The latter could require an added lane, but should include at least six blocks of capping as per Mayor Katz’s study from the 90’s.

We learned in ’97 from the Interstate Bridge closure that a full court press of incentives for SOV commuters to team up with friends, neighbors and colleagues releases a ton of freeway capacity in the peaks when its needed.

As Joe Cortright has clearly pointed out, so called “Freight” needs become daily less relevant to our economic well being.

I’m so tired of the taxes conversation in Oregon. Most people acknowledge that the state and local governments are chronically and structurally underfunded, but no one wants to support any proposals to increase revenue.

Is this a perfect solution, NO. But I will offer two observations:

1) This is a progressive tax. Not taxing bikes under $500 may advantage big box retailers, but it also means that those who can pay more, DO.

2) Can we talk about old-fashioned political compromise? You don’t like the tax, fine. But I’m sure you recognize the need for the revenue. How about we bring the conversation around to using the 5% tax to leverage additional matching funds or key infrastructure projects?

It is not at all clear that MOST people in Oregon acknowledge the state is under funded. We’ve had the opportunity to pass bills for more revenue and they fail every time. It is true that the bills have been exceptionally poorly thought out – like taxing companies on their gross sales instead of profits – anyone who knows anything about business understands that is not reasonable.

I think the state has a spending problem, not a funding problem. Many others would agree with me.

And yet we’re about to get a kicker back…

Actually, I’m more offended by the proposed increases in title and registration fees. They pose the potential to take a bigger bite out of bicyclists’ pockets. These fees were intended to cover the costs of administration while the gas tax and weight-mile tax was supposed to cover the cost of use of the vehicles. I haven’t purchased a new bike in years, but the cost of registering my motor vehicles, which I drive sparingly, keeps going up with much of those increases going to pork barrel highway projects.

I like the tire tax compromise that the Street Trust proposed. The tax could be based on tire width and materials to account- in part- for the relative vehicle impact on the roads. This proposal probably makes too much sense for politics involved and would expose the driver lobby’s disproportional impact on the transportation system. It is truly frustrating to witness the myopia of this transportation package. It seems bent on expanding miles of asphalt (and all its financial, health and environmental impacts) rather than giving people more transportation choices and thereby stemming the growth in cars. BTW, where are we going park all the new cars that quickly fill up these new roads and simply move the bottlenecks around?

Tire tax is a rotten idea — I suspect trucking companies might not buy their tires in OR. Also, with half of the population of the state in Multnomah County and even more relatively close to the border, don’t you think a few people might just drive a couple miles to avoid the tax? This can only push internet sales of bike tires even higher as it would be unenforceable and make local shops seem less competitive.

Thank you for lettimg us know about this ill concieved bill. Clearly contacting legislators is needed but where is their contact info? Perhaps I missed it. If all we are doing by posting this is generating internet traffic and burying comments here, where lawmakers won’t see them, i think we are wasting an opportunity!

If you were to suggest a 5% tax on new semi trucks, which cause the most damage to our roads, you would get backlash because that tax would affect the cost of hauling goods and eventually be passed down to everyone. But if you put a 5% tax on new bikes, hey what a great idea, new bikes are just luxury toys for white boys in spandex.

It would have no impact whatsoever on the cost of hauling. For the kind of money you’d save, why would anyone buy a semi in OR? Such a tax ignores that new truck sales are already weak due to a strong inventory of used reliable trucks.

If taxes are needed to fund projects, something other than a political stunt consisting of an administratively cumbersome mechanism directed at a tiny population which raises completely insufficient funds is needed.

Just like new bike sales are weak because of craigslist. I agree with you.

Among other things this proposed tax comes down hard those buying fully assembled electric assist cargo bikes instead of cars. Logically, bikes used for bike delivery or other business purposes also would pay big surcharges.

The good news for those with decent mechanical skills is that they don’t need to pay any tax since they don’t have to buy whole bikes. Seems like most people with high end race stuff do this already…

Ssshhhh, don’t talk about this too much. I imagine the bill will be rewritten to cover high quality one off frames. Salem deffinetly wants to to capture this potential revenue. What constitutes a bike? Frame, headset, fork, BB. Maybe? When it cost 3k, surely it counts…

It would be interesting to hear from a custom bike builder, since this would certainly affect how they do business. You can get the top-end Speedvagen built up in the neighborhood of $14K. Tax would be $700. Or you could get a Kia Rio for the same price and pay a tax of $140. My guess is people would stop getting their bikes built up from the maker and have it built up separately, but I don’t what effect it would have on the custom builders’ bottom lines. Probably very bad.

Kind of like saying an individual buying a Ferrari can’t afford the insurance…

Actually it would be more like saying that an individual buying a Kia Rio couldn’t afford the insurance. And actually Kia Rios cost more than the bike.

And it’s not really like that anyway.

Kind of like saying an individual buying a 14k bicycle can’t afford $700 in taxes.

2017 Kia Rio MSRP: $14165. You can get a Speedvagen built up that costs more than that.

But again, it’s not the point. The issues (at least as I’m seeing it–don’t want to put words in Dan A’s or others’ mouths) are whether they’ll pay it when they don’t have to, and whether it’s fair that someone buying a $600 bike would pay more taxes than someone buying a much more more expensive bike that isn’t fully assembled.

And again, that issue of someone buying a bike paying more taxes than someone buying a car of the same or even greater value.

My replies are to Matt S, just to be clear. I agree with Dan A 100%.

But the person buying the Kia will pay taxes during the life of the car. I’m sure it eclipses $700.

Yes, the Kia owner will pay ongoing taxes that the bike owner won’t, but the Kia is also creating needs for infrastructure and maintenance that far oustrip what the bike is creating.

Hmm, maybe you look at the cost of buying a luxurious bike that will last you 20 years, supports local industry, and creates little to no pollution over its lifespan and compare it to the cost of buying a cheap car that is going to be a sinkhole for money over its lifespan and will have considerably more external costs imposed on the surrounding community. Why would the first item be taxed at 5x the rate of the second one? If a person can afford a $14,000 car, they can afford a $14,000 bike. It’s certainly not the same thing as a $250,000 Ferrari.

The only person I know who rides a 14k bike (or around there) could also afford a Ferrari.

I guess I’m an optimist. I hope that our tax policies are decided by logic, and not anecdotal evidence.

“The only person I know who rides a 14k bike (or around there) could also afford a Ferrari.”

You’re saying that someone who can afford a 14k bike is the same as someone who can afford a 14k bike plus a 250k Ferrari. The math doesn’t add up.

The point that I’m making is that Item A costs the same as Item B. Item A supports a local industry, doesn’t pollute, and requires far less road infrastructure/maintenance/parking space than Item B. Item B supports Korea and pollutes. Why would we tax the purchase of Item A at 5 TIMES the rate of Item B?

If your answer is ‘because it’s a bicycle’, I think that reveals a bias in your thinking.

Wealthy people ride 14k bicycles, working class mothers drive Kias and ride sub $500 GIJOES’ bikes.

Who should be taxed on their purchase?

Sounds to me like you either have it in for bikes, or for rich people. You’re saying that people should be fine with buying a cheaper bike to make it easier to pay the tax, so maybe you have it in for bikes (and their retailers). But if you want to tax rich people, there are much more effective ways already in place.

And it sounds like to me Dan A, and I do say this politely, your a little out of touch with reality.

Deffinetly.

Yes. One of the most frustrating things for anyone watching City Council or any other government body is seeing them get backlash about a proposed fee or regulation, then make a series of exemptions or changes to appease the strongest opponents, until the proposal only affects a group small or weak enough that they can’t fight back, and all the earlier opponents can now support it because they’re off the hook.

Sometimes, all the whittling away makes whatever’s left almost worthless, but then they’ll pass it anyway to show they’re “at least doing something”.

In this 5% sales tax case, they started right up front by not applying it to any road users (trucks or autos) that have strong representation and lots of members, so it only hit bikes. Then they protected the poor ($500 min.) and the children (min. tire size) to show they care about those groups and how it’s not unfair to them.

So it won’t raise much, but “at least they’re doing something” and then later on they can admit that, or make it 15%, and add 10 pages of regulations addressing internet sales, component sales, out-of-state sales, etc.

Why not just raise the price of a driver’s license? Have the Oregon ID card (non driver’s license) still be a reasonable cost. But if you want to have the option to drive instead of bike, skateboard, walk, or public transport, then increase the cost associated with obtaining that privilege.

DMV’s own website indicates it issues 200,000 new and 350,000 renew driver’s licenses every year. Add a $50 fee to a new driver’s license renew and $35 fee to renew driver’s license then poof! 22.25 million dollars annually! And if you primarily ride your bike/walk/etc and have a driver’s license to drive, great! if you don’t need a driver’s license and utilize other forms of transportation, just get a regular Oregon ID.

dwk, I support this proposal. Cost-wise it would affect me the same as buying a $700 bike once every eight years, but it would actually raise a useful amount of money.

I’m curious about something.

Is there a correlation between how densely populated parts of Portland are, and how traffic volume has increased, and the fact that two of my relatives now have commutes that virtually REQUIRE them to have an automobile?

One drives from Parkrose to Tigard, for a job she cannot afford to leave because it pays her a livable salary and benefits that, at her age, she’d be hard-pressed to find elsewhere.

Another (her daughter) was forced to move to Keizer because she and her husband couldn’t afford to live in Portland anymore. She also commutes to Tigard (a different job), for a salary that can get them a nice rental house in the Salem area, but cannot get them a one-bedroom apartment in inner-eastside Portland or even Milwaukie at this point.

Maybe I’m asking the wrong question, or I don’t know how to ask what I want to.

But the only reason my wife and I can still live in inner-eastside Portland is that we bought a crummy, very little house 14 years ago that we could never afford today.

And we’re the lucky ones; we both freelance and don’t have to drive to work. We barely pay our bills by cobbling together multiple jobs and gigs, but so far we get by.

But if we had to rent our house today it would cost three times our mortgage and we, too, would leave Portland.

So who is all this hand-wringing supposed to be for, exactly? What neighborhoods do they live in? What developments are in store for their part of town? And how is this stupid bike tax supposed to address ANY of that?

This is worse than a band-aid. it’s a cotton ball without tape.