(Photo: J. Maus/BikePortland)

The Oregon Legislature is considering dozens of changes to the major transportation bill they passed last year. Among them are two substantive changes to the $15 bike tax.

The Oregon Department of Revenue (DOR) thinks the existing tax is too complicated and they want to make sure it captures as many bicycles as possible.

In a nutshell, if House Bill 4059 is signed by Governor Brown, the tax will apply to more bicycles than before. The proposal has caught the ire of national bike industry leaders who have written a letter to lawmakers opposing the idea.

As currently written, “taxable bicycle” is defined as a bicycle with a wheel diameter of 26-inches or larger (so as not to tax children’s bikes) and a retail price of $200 or more. DOR’s proposal would drop the wheel-size stipulation from the definition and the tax would then apply to all bikes over $200.

“There are a whole bunch of adult and kids bikes you can buy for under $200.”

— Senator Lee Beyer, committee co-chair

DOR has also requested that the definition of “bicycle” explicitly includes electric assisted bicycles (by striking the phrase “propelled exclusively by human power”) so that e-bikes can be charged the tax as well. The change to the e-bike definition would also fix the confusion with the vehicle privilege tax. (Because of a quirk in the existing bike tax law, buyers of electric-assist bikes must pay the “vehicle privilege tax” of 0.5 percent of the purchase price. However the law only applies to e-bikes sold at certified automobile dealers — and since most e-bikes are sold at bike shops, they are currently exempt.)

The Joint Committee on Transportation is debating these changes in House Bill 4059. Committee Administrator Patrick Brennan addressed the confusion over the bicycle wheel sizes at a public hearing on February 12th.

“The tax was designed to exclude children’s bicycles,” he said. “However, bicycles come in all sorts of shapes and sizes… Some bicycles have one big wheel and one small wheel and the existing law says ‘two wheels’ of a certain size.” To clear this up, Brennan explained to committee members that the “simplest solution” would be to just remove all references to wheel size entirely. “Just say the excise tax applies to all bicycles over $200. Period. Regardless of wheel size.”

Advertisement

Senator Betsy Johnson then asked the committee what kids bikes cost these days. “About $100 bucks” committee Co-Chair Lee Beyer replied. “There are a whole bunch of adult and kids bikes you can buy for under $200,” he added. “That seems to be a benchmark.”

Xann Culver with the Department of Revenue testified that, “Limiting it to just the dollar amount would be much more clear to the bicycle retailers as to which bicycles would be subject to the tax.”

The bike industry supports the change in how e-bikes are handled; but they oppose the expansion of the bike tax to all wheel sizes.

In a letter dated February 21st, the Director of State and Local Policy for the PeopleForBikes Coalition Alex Logemann, National Bicycle Dealers Association Board Chair Brandee Lepak, and Bicycle Product Suppliers Association President Adam Micklin urged Committee members to maintain the 26-inch wheel diameter requirement.

“Our objection to altering the minimum wheel size requirement is premised on two issues,” they wrote, “1) the new bicycles that will be subject to taxation will primarily be children’s bikes; and 2) it will place an additional burden on bicycle shops that have already invested resources to comply with the tax.”

These bicycle industry experts say the existing tax leaves out only some children’s bikes, folding bikes, BMX bikes, and some recumbents. In total, these, “make up an exceedingly small portion of the bicycle market” and have a much larger impact on bikes ridden by children and teens. “Eliminating the minimum wheel diameter requirement will subject very few bicycles used by adults to taxation, and many more bicycles used by children to taxation,” they wrote.

Here’s a longer excerpt from their letter:

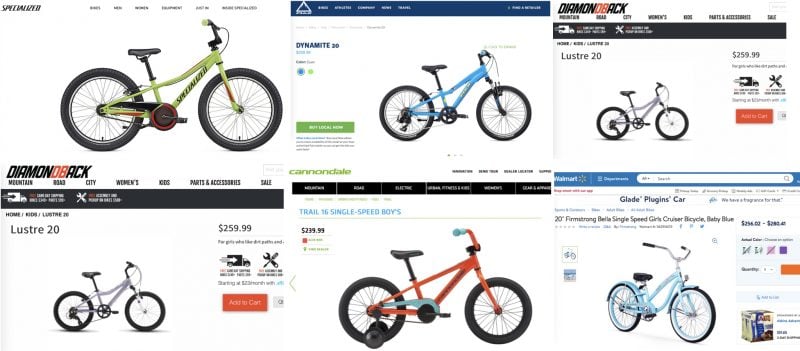

The elimination of the 26 inch wheel diameter requirement in the existing statute will undermine the Committee’s objective of ensuring that bicycles ridden by kids are not subject to the bicycle excise tax. Discussion at the February 11th hearing indicated that many members believe that children’s bicycles rarely meet or exceed a $200 retail price. This is simply not true. We have included examples of children’s bicycles that retail for more than $200 from some of the most popular brands on the market to demonstrate that children’s bicycles are commonly priced between $200 and $350. These bicycles all have wheel diameters between 12 inches and 24 inches, and they only avoid being subject to the bicycle excise tax due to the minimum wheel diameter requirement in existing law. If the statute is amended to remove the minimum wheel diameter requirement, the primary effect will be to tax more of these children’s bicycles.

Beyond the issue of which bicycles would be subject to the tax if the minimum wheel size requirement were to be eliminated, we question amending the tax after bicycle retailers have diligently worked to align their inventory and point of sale systems to the requirements of the bicycle tax. Relying on the statute, retailers have made substantial investments in efforts to comply with requirements of tax. Mandating that these businesses go back and make changes to these procedures, only two months after the tax has been implemented, will be a burden.

The bike tax is expected to raise about $1.2 million per year with funds going into the Connect Oregon grant program where they’ll be spent on “off-highway” paths.

The Joint Committee has not taken a formal vote on the amendments and no further public meetings have been scheduled. A work session has been scheduled for Wednesday February 28th at 5:30 pm in Hearing Room D. You can find contact information for committee members here.

UPDATE, 2/28: We’ve heard back from Tim Goodall, managing director at Islabikes, a children’s bike maker based in Portland:

“At a time when childhood obesity is at an all-time high in the US, a trend that’s showing no signs of reversing, it’s extremely disappointing that children’s cycling is being specifically targeted through taxation. We’d much rather see higher corporate taxes than punitive taxation of children’s bicycles.

Of course, this tax will impact Islabikes as now every bike we sell to Oregon residents will be taxed. This will increase our administrative costs when there are already multiple ways to generate state income via business taxes.

More importantly, we’re penalizing an activity we should be incentivizing for the benefit of our children’s health.”

— Jonathan Maus: (503) 706-8804, @jonathan_maus on Twitter and jonathan@bikeportland.org

Never miss a story. Sign-up for the daily BP Headlines email.

BikePortland needs your support.

Thanks for reading.

BikePortland has served this community with independent community journalism since 2005. We rely on subscriptions from readers like you to survive. Your financial support is vital in keeping this valuable resource alive and well.

Please subscribe today to strengthen and expand our work.

People keep voting for the same leaders.

But will they tax guns?

Does this comment have anything to do with the bicycle tax?

Care to clarify why you’d make that statement?

The article was on the misguided bicycle tax, nothing about guns as far as I could tell!

I wish they would. If public health is important they should.

Will shoes, skateboards, wheelchairs, and crutches get taxed? Oregon has some pathetic leadership.

LOL Oregon

” Senator Betsy Johnson then asked the committee what kids bikes cost these days. “About $100 bucks” committee Co-Chair Lee Beyer replied. “There are a whole bunch of adult and kids bikes you can buy for under $200,” he added. ”

Pretty sure Beyer’s research into the issue (assuming he actually researched) consisted of browsing WalMart’s and Target’s websites, and not looking at an actual bike shop at all.

Beyer probably bought crap bikes for his kids and a Mercedes for himself.

smh

This pretty much sums up the state of the country today. Reduce taxes on multinational corporations and the rich and add new taxes for children.

Don’t forget to disarm the 18 yo unless its goin overseas to duty on their kids though

Nobody is having their guns taken away and that doesn’t relate to this topic at all.

Let’s tax bike helmets too.

or instead

But why would we tax something we want to encoura—oops.

Let’s pass a 100% sales tax on mass transit passes!

No kidding. Freeloaders! Transit riders need more skin in the game; those buses don’t maintain themselves, you know.

Also children on school buses. They don’t even have the “I’m also a driver who pays gas taxes myself” argument.

Tax based on wheel size rather than cost of the bike, is a much more stable means by which to avoid taxing the purchase of kid’s bikes. Wheel sizes used for kid’s bikes don’t change that much, but dollar amounts, with inflation, can.

I find the entire nickel and dime premise of the bike tax to be kind of naive, but I suppose having this tax money delivered into state coffers to be spent on public off-highway bike paths is worth it if it helps some people feel better about biking.

Ughhh. If expanding it is on the table, then removing it should be on the table too. This is embarrassing.

Let’s make it a $15/year tax for car ownership, and a $15/year credit for bike ownership.

Do I get $15 for each bike? Just kidding. I really like the idea of formally noting that car use has many costs to us that are not paid for by motorists’ fees and taxes but are instead spread among the entire population while other means of transportation either externalize fewer costs or actually save society money. I wonder if there are any legislators informed enough and brave enough to bring such a notion up in session.

“Do I get $15 for each bike? Just kidding.”

Well, right now you get taxed $15 for each bike…

The Bend Bulletin is trying to inject some common sense:

http://www.bendbulletin.com/opinion/6045109-151/editorial-legislature-should-scrap-the-bike-tax

There’s really not much to add to that nice editorial. As it recommended, scrap the bicycle tax.

Reminder: while committee members can be contacted, legislators mainly care about their own constituents.

So if this upsets you, contact *your* legislators. As a second step, feel free to contact the committee members.

Beyer’s not mine, but he is local and is very friendly with my legislators. In fact, my representative had him as a guest at her end of session gathering with constituents. It disappointed me that both her and her staff were surprised that people who consider themselves progressive environmentalists were very upset with the transportation package. She’s looking for a way to appease us, maybe killing the bike tax would be a start.

Done and done (Committee Chairs at least). FYI, the legislators offices told me to contact committee members.

And people continue to fall for it!

Maybe they should ask one of those “cyclists” that now have “skin in the game” and “a seat at the table” what to do.

In other news, legislators enacted a car death/maim tax of 100$ per vehicle, per year.

Wow, these people are gonna make me move back just so I can help vote them out.

Why the Walmart and Target handout again?

Call your legislators. I just called mine and asked for a full roll-back of this absurd tax. It doesn’t make sense for either party. It’s taxing green transportation and putting a burden on local business to report and administrate this stupid tax.

Took me 4 minutes to leave messages for both of them. Go do it.

https://www.oregonlegislature.gov/findyourlegislator/leg-districts.html

Why why why are we not seriously incentivizing people to get out of their cars and use bikes, mass transit? Why tax breaks for SUVs and light trucks and not for cyclists and folks who go carless? This is insane. We’re deep into climate change, heading for disaster, and we’re doing the exact opposite of what we should be doing. Our lawmakers are craven fools.

I’ve linked to this article so many times but it bears repeating and repeating and repeating. Cyclists ALREADY have ‘skin in the game’, as most are drivers, and drivers don’t even come close to paying for the huge cost of roads and driving.

https://www.theatlantic.com/business/archive/2015/10/driving-true-costs/412237/

But here in California we’ve just permitted unmanned cars to take to the roads… that should help! 😉

Well, the goal does seem to be “Make America Dependent on Obsolete Industries Again”. I’m waiting for the tax break on buggy whips and the campaign to restore Beta(tm).

They’re actually fast-tracking those ideas right now. Or maybe 8-tracking them.

Just as a quick check on kids’ bike prices–REI’s website lists 56 “kids’ bikes”, with 16 under $200. Most–if not all (I’m no expert)–of the 16 look like they’re for very small/young kids. None were close to $100. That doesn’t mean other places don’t have more sub-$200 kids’ bikes, but it does show it’s silly to assert that few kids’ bikes will be taxed with a $200 threshold.

The lawmakers either don’t understand how much the new $200 threshold is going to turn this into a “family bike tax”.

Most adults who ride may get a new bike once every several years. That’s not possible with kids, because they grow. Even a kid who at any point has only one bike will go through several by the time he or she stops growing. Sometimes kids’ bikes can be handed down among children, but not always (due to wear and tear, kids being too close in size or age…).

So in the several-year period an adult might buy zero to two new bikes, a family with two kids might easily buy six or more (for the kids only) without being extravagant, with all but the first two being over $200.

I’m not saying every family has to buy that many bikes over $200, or that the total tax is going to break the budgets of those who do. But it does show how a high percentage of this tax is going to be paid by families buying kids’ bikes, and are kids riding $250 bikes really the group whose “skin needs to be in the game”?

And every one of those bikes will be purchased new, with the old bikes going to a landfill? Such a shame that there’s no way for parents to get together with other parents to trade / swap / sell used children’s bicycles, and that there’s no natural gathering place like a school where you might be able to meet parents of kids older / younger than your own.

Seems like anyone buying a new bike a year for their kids is not going to worry about a $15 tax; everyone else will buy / barter for a hand me down.

No, no and no. That’s why I said, “I’m not saying every family has to buy that many bikes over $200.” I didn’t think to tell people I didn’t mean that everyone would throw the new bikes in a landfill, or that nobody would swap bikes, etc. because I never thought anyone would twist what I said that direction. And I never said, “A bike a year” either.

I also said the total tax isn’t going to break the budgets of families who buy multiple new bikes. And affordability for parents isn’t the point either. The point is that placing a large share of the burden of paying for bike facilities on parents isn’t fair or right. And the solution isn’t telling parents as you did that they can “buy/barter for a hand me down”, it’s to address the tax itself.

The bike tax will cost more to collect than it brings in. It’s stupid, except as a symbol. That symbol is that Oregon is stupid for penalizing rather than subsidizing green, healthy, efficient transportation.

UPDATE, 2/28: We’ve heard back from Tim Goodall, managing director at children’s bike maker Islabikes:

To be fair, if childhood obesity (without a tax on childrens’ bikes) is increasing it’s unlikely that a tax on bikes is going to change that trend – there are so many other factors involved and more enticing forms of entertainment (gaming, social media) for kids than getting on a bike.

The tax, however small, sends a message straight to the pocketbook of every parent in the state: Don’t buy your kid a bike because we made that cost more money. It’s a small push but it’s pushing Every Person in the state in the same direction. That direction? Away from bikes.

Onion Newspaper Quits, State of Oregon Provides Last Straw

What message are we sending when we have a tax on a kid’s bike, but no tax one one of these monstrosities?

https://www.youtube.com/watch?v=EZITfrIdWrU

Of course not. These battery cars for kids do too good a job of socializing driving=normal. Plus I don’t think the wheels on those are bigger than—oh, wait; never mind.

But it is remarkable that many of these kinds of toys (“powered ride-on toys”) are also under $200, and also sold at Wal-mart/Target (Wal-get?), who are apparently largely exempted from the bike tax due to the poor quality (and therefore low price) of the bikes they sell.

Yep, another layer of stupid. In the next five years this tax will cost me at most $15.00. That’s a cup of coffee per year. I’d write the State of Oregon a check for $100.00 right now if they were doing something that made sense.

Wow if this legislative crew had been around in the 1970’s when Tom McCall was governor instead of the bottle bill and public access to beaches we would have had privately owned beaches with tolls and throw away pop bottles and drinking fountains with pay meters on them.

I called my Representative and my Senator ask for repeal of the bike tax. Senator Frederick’s office has a live person answering the phone!

I emailed my state Rep. You can too!

Taxing bikes is so lame! Kids’ bikes too? when 20% plus are obese! We should be offering publicly funded discounts for bikes…transit passes and walking shoes too.

The state’s willingness to put millions…etc.

I do not favor the bicycle excise tax and think it should be removed. That said, however, a contrary view has occurred to me. Jonathan writes in the article:

“Off-highway” paths are just the sort of places one might like to have more of for kids to ride on. Perhaps kids’ bikes should be the target of this tax, and commuter/city bikes (that is bikes intended for transportation) get an exemption. I would be much less distressed by this tax if its proceeds went to improvements that related to using bicycles as transportation. In the law’s current form, its meager proceeds are just bolstering the misguided notion that bicycles are recreational devices that don’t belong on the roads. We will not see substantive changes in our state-wide transportation policies and projects until lawmakers start viewing bicycles primarily as a transportation mode.

Stph

You have more confidence in this state than I do.

I think a half cent increase in the fuel tax would create more revenue than a bike-specific tax.

And ZERO administrative costs.

I certainly wasn’t trying to express confidence. When I wrote to my representative about this last year expressing my dismay over the whole thing, I got responses that suggested to me that the prevailing view was bicycles are toys or sports equipment (i.e. for recreational uses). The idea that someone might consider a bicycle as a primary or even secondary mode of transportation was not in the forefront of their thinking in Salem.

If that’s the thinking–that bikes are used for recreation and sport, not transportation–(and I don’t doubt that that IS the thinking among those behind the tax) then wouldn’t that mean that people riding bikes ALREADY have “skin in the game” since they’d be driving for transportation purposes just like everyone else, thus also paying gas taxes like everyone else? I know that that actually IS true–that most people who ride bikes also drive–but it would be even more true if bikes are mainly recreational toys.

Oops, I forgot that the group they’re targeting now are children, who don’t drive yet.

The law isn’t rational. Sadly. Given that the proceeds go to recreational type facilities simple highlight the inconsistency. This tax doesn’t give cyclist any more stake in the transportation game than we ever had, at least by rational standards.

“The Oregon Department of Revenue (DOR) thinks the existing tax is too complicated ”

It would be nice to hear from a few bike shops to get their opinion if the current tax it too complicated.

I wonder how many years of collecting this tax it will take to cover the costs we have already sunk implementing it. If you factor in the cost to businesses, I suspect we never cover it.

The idea that changing the law again only makes things more difficult and costly for businesses.

As money grabs by our government go, this is a particularly foolish one.

The most direct form of action would be to stage a consumer moratorium on new bike purchases throughout the state, for a set period of time (figure at least 3-6 months to make a real statement). Then let the business owners scream at the legislature. Business owners generally get more notice than private citizens, especially those of us who’ve already eschewed car ownership.

Failing that, just buy all your stuff used. Portland’s used bike market is positively saturated with all manner of things people donate to thrift stores, put in curbside free boxes or simple throw away; and all of it is available at a fraction of the cost of new.

(BTW, I already scavenge or barter for most of what I need, and haven’t bought anything shiny-new in quite awhile — not even a patch kit, because I make my own patches from old inner tubes. Yes, I’m cheap. No, I don’t care.)

If enough folks did this and sustained it for a few months, I think some minds would change and this stupid tax could be repealed.

(Of course, an awful lot of Oregonians keep voting for the same legislators instead of trying to bring in new people and fresh ideas. So maybe not.)

Now if we could only find a way to repeal the Arts Tax that was unilaterally passed without voter approval a few years back…

..::sigh::..

This is an indirect form of action that relies on damaging the livelihoods of innocent victims until they suffer so much that lawmakers reconsider the policy.

I think such a path is likely to be ineffective and harm rather than help cycling overall. Unless the goal is to wipe out small operators so that big box stores and online retailers peddling cheap junk can take over, I think there are better approaches.

What you need is a two-wheeled “fulfillment center” whereby bikes are parceled out into distinct under-$200 segments a-la-cart: you buy a frameset for $199, make a transaction, get a receipt; they buy your wheels for under $200, do another transaction, etc. After you get your mix of components on a series of under $200 receipts, the shop would charge less than $200 to assemble your bike, on another receipt, as a fulfillment center like what Raleigh and Diamondback are pushing. Of course this would exclude framesets that cost more than $200 like Surly, but most folks wouldn’t care.

Essentially the illegal chop-shops are already doing this, so I’m wondering, what would prevent a legitimate business from doing this?

Dan, Islabikes is hosting a kids bike swap in 2 weeks: https://www.facebook.com/events/157431308378287/.

Islabikes also has a buy-back program, though they only offer up to 1/3rd of the original price, and you can do a lot better selling it yourself on craigslist.

There are several things about this issue that are not being mentioned:

CONNECT OREGON: This program isn’t about bicycles. It’s about multimodal transportation. Bicycle infrastructure didn’t even get funded by Connect Oregon until very recently. The little funding bicycles received irked rural legislators who panicked that their rail terminal and airport funding may be sucked dry by liberal Portland and its pet bicycle projects. This is the primary reason behind the sudden revival in a bicycle tax. Unless someone shows me something I’m not aware of, there’s nothing stopping bicycle tax revenue from being used for funding rail terminals.

SKIN IN THE GAME: This awful phrase has been thrown around as the raison d’etre for the tax. It’s certainly fine that everyone should pay their fair share. The problem with this is that there are other modes of transportation that DON’T PAY THEIR FAIR SHARE already! Let’s ignore the huge externalities, an economist term for costs not accounted for, which make bicycling a positive influence on society and the environment and driving a huge negative one. How do studded tire users pay their fair share? How do pedestrians? Finally, this ignores the entire calculus and reasoning behind Oregon’s Bicycle Bill. The bill sets aside 1% of the states transportation budget for bicycles specifically because this saves the state money in excess of that 1% spending year after year after year. A bicycle tax essentially reverses this which will result in higher state transportation spending later.

I don’t know what $1.2 million will buy in off road facilities, but for perspective, a recent rebuild of a four-lane intersection near me cost $800.000. I am going hazard a guess you might be able to build 5-10 miles of good bike path for $1.2 million.

IF it even raises that much.

Sorry, none of these clowns are from Portland excepting Rod Monroe, who is far east Portland/Clackistan.