By the end of this month Oregonians will have their first look at what state lawmakers and interest groups have cooked up for a transportation package.

I’ve followed the progress and have noticed several key themes worthy of your attention. Here’s my best take on what’s going on.

But first, let’s start with an overview of how the package is being developed:

How the sausage is being made

The package is being drafted by the Joint Committee on Transportation Preservation and Modernization — a 14-member body with eight Democrats and six Republicans that represent districts throughout Oregon. They’ve met five times since February 1st. Their meetings are usually less than 30 minutes long because the real work is being done in four work groups. These groups have been assigned to focus on specific topics. Here are the names of the groups and the committee members assigned to each of them:

Congestion Work Group:

– Sen. Brian Boquist (R-Dallas)

– Rep. Barbara Smith Warner (D-Portland)

– Rep. Susan McLain (D-Hillsboro)

– Sen. Betsy Johnson (D-Scappoose)Public Transit/Bike/Ped/Safety Work Group:

– Sen. Lee Beyer (D-Springfield)

– Sen. Rod Monroe (D-Portland)

– Sen. Kathleen Taylor (D-Milwaukie)

Highway Preservation/Seismic Work Group

– Rep. Cliff Bentz (R-Ontario)

– Sen. Fred Girod (R-Stayton)

– Rep. John Lively (D-Springfield)

– Sen. Jackie Winters (R-Salem)Multimodal* Freight Work Group:

*(Note: “Multimodal” has nothing to do with bicycling in this context. It refers to freight that uses ships,railroads, and trucks.)

– Rep. Caddy McKeown (D-Coos Bay)

– Rep. Andy Olson (R-Albany)

– Rep. Greg Smith (R-Heppner)

Because these are technically “work groups” and not official committees, their meetings are not recorded for the public. They meet twice-weekly (give or take) in Capitol meeting rooms that are open to the public. Sources have told me that the discussions are very candid and interactive between the lawmakers and the various lobbyists in the room. The work groups report back each week to the larger Joint Committee and their final recommendations are due March 15th.

Based on video recordings of the Joint Committee’s meetings thus far, here’s what I think are the most interesting takeaways…

Get Ready for a bike excise tax

Seriously. Word has it that the package will include a provision to tax the purchase of bicycles. In the committee’s meeting on February 27th, Sen. Lee Beyer offered this in a report-back from his work group: “We heard about potential revenue sources for transportation… And we talked some about if there’s an opportunity — or what opportunity there might be — to do something with bicycles.” And at an event last night, The Street Trust (formerly the Bicycle Transportation Alliance) Policy Director Gerik Kranksy said, “There are a lot of people down there [in Salem] would would love to pass a bicycle excise tax. And I’m not kidding.”

“We are inclined to oppose bike taxes yet willing to consider a complete transportation funding package before we make our decision.”

— Gerik Kransky, The Street Trust

According to documents released by the committee a 1% bicycle tax would yield $450,000 per year ($5 on a $500 bike). Compare that a 1-cent increase in the gas tax — a funding source sure to be in the package — which would yield $28.4 million per year.

How large would the bike tax be? We haven’t seen a detailed proposal, but an influential report released in May 2016 by the Governor’s Transportation Vision Panel, included this passage (PDF):

Implement a bicycle excise tax. To ensure that bicyclists are contributing to the infrastructure they use, the Legislature should consider creating a new tax on the sale of bicycles. Relative to bicycle registration or licensing which would have high administrative costs relative to potential revenue, a bicycle excise tax of 5-10% could raise substantial funding for bicycle infrastructure, and create opportunities to leverage additional federal dollars that require a local match.

For what it’s worth, a bicycle excise tax hasn’t been dismissed outright in the past. Not even by Oregon’s largest bike advocacy organization or by Metro, our regionally-elected government.

A 2013 transportation funding research report by the City Club of Portland recommended such a tax. At the time, The Street Trust’s Kranksy (currently Oregon’s only full-time bike lobbyist in Salem), said he would be “open to the conversation.” The Street Trust also supported a bike excise tax in 2008 — because of its potential to quell pushback and fund bike programs — when it was proposed as part of the 2009 Jobs & Transportation Act. Metro has supported it too, based on the idea that it would, “address concern, however mistaken, that cyclists don’t carry their weight.”

Reached today for his current opinion on a bike excise tax, Krasky said, “My board… will review any final bill language before our organization takes a position. We are inclined to oppose bike taxes yet willing to consider a complete transportation funding package before we make our decision.”

An excise tax on bicycles has a very small yield, would require a new collection mechanism, and is likely to be somewhat controversial. The reason it’s under considerations has everything to do with politics. For many years some lawmakers and agency staffers have chafed under pressure from constituents who say “Bicyclists don’t pay” and “Bicyclists need to pay their fair share.” Regardless of the facts and principles of the issue, a tax on bicycle users is seen as a way to quiet those critics. And while it might annoy you, consider this: This red meat is probably seen as necessary only because the bill will include significant funding for bicycle projects (see below).

Advertisement

Bikeways and Safe Routes funding will get a significant bump

The most promising development with the state package thus far is that it’s very likely the bill will include significant funding for Safe Routes to School programs statewide. The amount of funding for Safe Routes currently being tossed around is $20 million. Just today at the urging of The Street Trust, Rep. John Lively and Sen. Kathleen Taylor introduced House Bill 3230 that would allocate $20 million to Safe Routes from the State Highway Fund. The money would be earmarked for projects that are within one quarter-mile of schools. Projects at Title 1 schools, that have a majority of students who receive free and reduced lunch, would be prioritized. This bill could get incorporated into the larger package as-is, or with amendments depending on what the committee agrees to.

In addition to projects that improve safety for cycling and walking around schools, the legislature is likely to include some funding for bike path and trail projects. One proposal says an additional $5 million per year is possible.

To raise additional funding for projects that improve bicycling, the state is considering raising the “1 percent for bicycles” funding set-aside (a.k.a. the “Bike Bill”). If it were raised to 2 percent, the state would have an additional $20 million in funding (based on $500 in total new revenue into the highway fund).

Freeway widening is a sure thing (of course)

As we’ve reported, highway expansion projects are a sure-bet in this package. The Big Three projects in the Portland region will get some money. The only question is how much (keep in mind they’ve already been given millions in funding for project development and planning). The package can’t fund these three projects entirely because it would push the overall price-tag way too high.

How much will lawmakers devote to “fix congestion” in the Portland region? Our guess is about $30-40 million per project. For comparison, the last major transportation bill passed by the Legislature included nearly $900 million for 37 highway projects. The Newberg-Dundee Bypass alone got $192 million and overall the projects averaged about $23 million each.

To raise the money for these big-ticket items, the Legislature will ask Oregonians to pay more for their gasoline and for various automobile-related fees like licenses and registration. A committee document shows that a 10-cent gas tax increase would raise $284 million a year; a new DMV title fee of $100 per vehicle would raise $36 million a year; a $29 increase to the vehicle registration fee would raise $171 million a year; and a $15 increase to the cost of a driver’s license would raise $9 million a year.

Bikes could lose Lottery funding

2013 was an important year for bicycle infrastructure funding in Oregon: That was the year, thanks to a concerted push by The Street Trust, that bicycle, walking, and transit projects were allowed to compete in the coveted State Lottery-funded Connect Oregon program. Since its inception in 2005, the program — which was created to fund “off-highway” projects that can’t utilize gas tax revenue — was formerly open only to airport, rail, and marine projects. Almost immediately active transportation projects flooded the grant application pool. Currently biking and walking projects earn about 5 percent of the $40 million or so available each cycle. (One recent project was the new carfree bridge over NW Flanders).

Also almost immediately, major players in the port and business lobby were not happy about sharing the pie with newcomers.

Now it appears those voices have the ear of key members of the Joint Committee. Sen. Johnson and Rep. McKeown have made veiled comments during committee meetings that a change is afoot.

At the Joint Committee meeting on February 20th, Rep. McKeown said,

“The Connect Oregon methodology has been a common topic among shippers and the ports to date. Part of it has to do with… how the current process may have wandered away from the original intent of Connect Oregon as it was devised a number of years ago. One of the conversations that has come up is the difference between moving people and moving freight. I know Sen. Beyer is working on bike/ped/transit issues and is there a way that we could begin to decouple revenue sources of how we move freight and people? That’s a conversation we’re going to wrestle with in our work group.”

And on February 13th, Sen. Johnson said, “We want to take a look at Connect Oregon and how it’s functioning. There was a lot of discussion at our first meeting about what the original intent of the legislation was.”

Kransky, with The Street Trust, has been at these work group meetings every week. I asked him about Connect Oregon and he confirmed that there’s talk of re-structuring the program. Instead of taking active transportation projects completely out of the mix, he said he’s working to create a “firewall” between the them and port/rail projects. If there’s more money coming into the program overall, and clearer boundaries about what types of projects can receive it, Kransky thinks the business interests will be satisfied.

The $64 million — or should we say $500 million — question

Does any of this matter? Does a transportation package even have a chance to pass? That’s a good question any session; but this time around it’s particularly relevant. With the failure of Measure 97 at the ballot, the Legislature has a $1.8 billion hole to fill. If Governor Brown has to raise taxes for basic state services and expenditures, some think it’s unlikely she’ll have enough political capital left over to ask Oregonians to tax themselves yet again for better roads and bridges.

Pressure from the budget shortfall might encourage lawmakers to be too timid with their transportation funding request. But if they don’t ask for enough (say, $300-$500 million), the package will lack the exciting bells and whistles needed to garner the public’s support. Lessons from other states make it clear that ambitious packages often do better.

It’s a great sign that Oregon is at a place where everyone agrees our transportation funding crisis is urgent. Whether that urgency translates into passage of a law to pay for it remains to be seen.

— Jonathan Maus: (503) 706-8804, @jonathan_maus on Twitter and jonathan@bikeportland.org

BikePortland is supported by the community (that means you!). Please become a subscriber or make a donation today.

Thanks for reading.

BikePortland has served this community with independent community journalism since 2005. We rely on subscriptions from readers like you to survive. Your financial support is vital in keeping this valuable resource alive and well.

Please subscribe today to strengthen and expand our work.

RE: bike excise taxes. I wish we would stop talking about paying for “the infrastructure ‘they’ use”, and instead talk about the costs “of the damage vehicles inflict on the infrastructure”. Further, any talk of a bike excise tax should be dismissed until there is a studded tire excise tax.

Drivers are so used to massive subsidies for their transportation choices, that their view is completely skewed. Drivers are the real free-loaders, not those who use no gas and cause zero damage to the roads.

Exactly. You would think that lawmakers would have to be in command of actual knowledge of funding sources and the cost associated with automotive road use, but this Transportation Vision Panel is exhibiting a very public and glaring ignorance on these topics. It isn’t as though these are just random people whose opinions we have asked, this is their job?

At least I can still get a tax break on my SUV!

http://www.marketwatch.com/story/heres-a-way-for-small-business-to-save-on-taxes-buy-a-heavy-suv-or-pickup-2016-05-17

My buddy traded in his Subaru Forester and bought a Dodge RAM pickup for his business (well, really to carry his camper). $45,000 depreciation…

Bleagghhhhh! So despicable! The break, I mean. Not your friend. These tax breaks should be going to cyclists, walkers, skaters and users of mass transit. Why are we actively encouraging people to buy SUVs and heavy trucks? Just crazy.

“…you buy a heavy pickup with a long bed for $45,000. For federal income tax purposes, you can deduct the entire cost on this year’s return under the Section 179 deduction privilege. The pickup can be either new or used.

Nice! In contrast, if you buy a used $45,000 sedan, your first-year depreciation write-off will be only $3,160. For a used $45,000 light truck or light van, your first-year write-off would be only $3,560.”

$1K buys a decent road bike, but not many people buy fourty-five of them. That’s not helping out the bike industry a whole lot, or the U.S. economy, at least not in the way people buying giant big dollar pickup trucks does.

Lots of people seem to like buying 45K pickups, and the auto industry and lots of people in the U.S. that appreciate a healthy economy, loves them for buying them. There’s nothing quite like the thrill of riding alongside a huge hi-rise four-wheel drive crew cab out on the big thoroughfares through Beaverton.

Shudder! Be safe out there. Yes–amazing how many people can afford a $45,000 (and up) vehicle. Or the level of debt people are willing to live in for a (for most) nonessential item.

The whole “business expense” economy distorts everything.

” Regardless of the facts and principles of the issue, a tax on bicycle users is seen as a way to quiet those critics. ”

Critics will never be quieted. I have theories as to why, but they will always be against transportation spending not involving passenger vehicles.

Bingo. This will do absolutely nothing to quiet our opponents. We need to frame this as a BICYCLE SALES TAX. Oregonions hate sales taxes, after all.

All of us that pay income tax already do this.

If only that were true. In most states and at the federal level, income taxes are mixed with other revenue to pay for transportation infrastructure, but not in Oregon. Your Oregon state income tax pays for schools, prisons, pension funds, etc, but only a tiny portion goes for transit subsidies and none goes towards bike lanes, roads, sidewalks, and highways. Instead, your legislature decided long ago to restrict the use of gas and vehicle taxes just to transportation infrastructure; it can’t be used for general expenditures. While the legislature could use general funding towards infrastructure, in practice it rarely has done so.

That is all very interesting, David.

“While the legislature could use general funding towards infrastructure, in practice it rarely has done so.”

So how do we in Oregon make up the infrastructure shortfall from vehicle related fees and taxes?

I don’t know. IMO, Oregon and many other states are at a crossroads (no pun intended) – you have more infrastructure than you can afford to maintain and most of your state income tax is already over-committed to the pension fund and debt. You could mix your revenue, which has its’ own pitfalls; raise current revenues, which you’ve tried already; raise new sources of revenue (sales tax always fails in Oregon); declare bankruptcy (which may eventually happen anyway); or privatize government services (as in New Zealand.) Given how conservative Democrats are in Oregon, I’d say your only realistic option is to engage in infrastructure triage: decide through careful planning which roadways and other infrastructure you are no longer going to maintain and let them crumble. Essentially, by doing nothing, that is exactly what you are already doing.

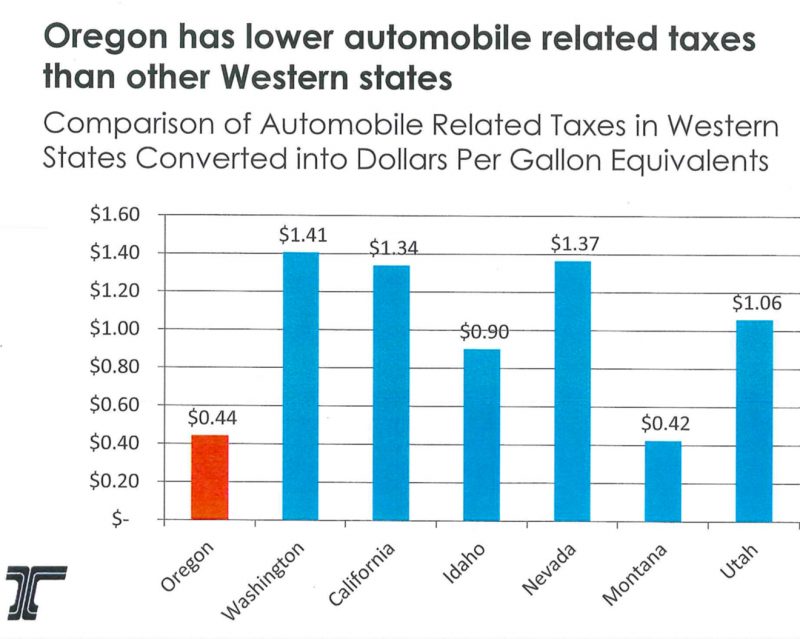

You’re focusing on the future; my question was actually about the past. As far as I know we in Oregon have lower gas tax and other vehicle related fees than most states, so if what you’re saying is correct, the shortfall is being/has been made up from some pot of money. My question is what is that pot? Property taxes?

As for the present/future, ODOT has managed to borrow so heavily that a growing share of gas tax revenue doesn’t go to roads or anything even remotely useful to the public anymore, but to servicing the debt.

To be honest with you, Oregon has fallen way behind on not only maintenance but also needed upgrades. It hasn’t kept pace with population growth. What little it has done is through the use of existing revenue sources: State & local gas taxes, vehicle taxes, federal grants, income tax (transit only). And it’s not the only state in such a sorry situation. Illinois, for example, is even worse.

All you have to do is look at the sorry state of 82nd, Lombard, Barbur, outer Sandy, or outer Powell to see that the state highway system is far from well. Portland streets are no better – they are again predominantly paid for with the same revenue sources as ODOT. The city has the option to use other sources, such as hotel taxes and property taxes, but it has a terrible record of actually doing so. In 1988 the city even found a new street-repair revenue source, the Utility License Fee, a tax on utilities that rip up streets to put in cables and wiring. It raises $70 million annually today, but only $2 million now goes to PBOT; the rest goes to pay for Fire, Police, Parks, etc. And it’s been like this, getting worse every day, for years. Living anywhere, there are trade-offs. Oregon has a lot going for it, but its infrastructure is not well, and is likely to get a lot worse before anyone finds money AND the political will to fix it.

David, thanks for pointing that out. In my own research I always came to the same conclusion. OR is different and there really is not that great a contribution to infrastructure from anything else other than fuel taxes.

I always wanted to try and support the argument that cyclists pay a “fair share” in OR, but I could never find the data to support it.

Mind you, even if they did it would not change perception.

You still have to explain how it is possible for Oregon, which takes in fewer vehicle-fee related funds per mile than do many other states, can somehow cover its costs when the average transportation bill in the US is only covered about 50%+/- by those fees. Something’s not adding up here. We here in Oregon are not twice as frugal with our transportation dollars as everyone else.

No, you’re not twice as frugal, just penny-foolish. What you see on the interstate highways of Oregon the result of heavy borrowing; you’ll pay back big time “down the road” (pun intended), unless your population or wealth somehow grows exponentially, which I dare say you’ll collectively do your best to prevent. In general, Oregon grinds and repaves roads that ought to be rebuilt (i.e. ripped out and completely replaced). Outer Powell is a good example: the roadway from 99th to 176th ought to be completely rebuilt, which would cost over $80 million, but the $22 million currently available will only replace the roadway from 122nd to 136th – the rest of the roadway will continue to slowly deteriorate without curbs and certainly without sidewalks, given its heavy truck traffic. Past fixes have been cosmetic grinds and repaves. Ditto with parts of outer Sandy, Barbur, 82nd, and Lombard, as well as state and county highways across the state.

Your interstates are paved with asphalt which has to be replaced every decade or so. States with more money prefer building roads with concrete, preferably reinforced with rebar, which can last over 40 years. Even when worn, concrete is still drivable, whereas asphalt easily gets potholes. Same with city streets.

And then there’s your sidewalks. Portland annexed SW Portland over 50 years ago, but still hasn’t built most of the promised sidewalks and storm sewers. Ditto with East Portland 25 years ago. Parts of North Portland have lacked sidewalks for over 75 years. Most of your existing sidewalks in inner NE & SE Portland were built to last 80-100 years, about a century ago. Have you noticed dust and pitting on the old sidewalks? The concrete needs to be replaced. My point is that your current infrastructure is “not up to snuff” at even a basic level, let alone a platinum level as called for in your planning and comp plan. You simply cannot afford it. You can’t even afford to maintain what you have.

And it’s not just your highways, sidewalks and streets. Your sewers also are designed for 100 years and now need replacing.

And it’s not just you and Oregon. These issues are nationwide, even here where I live in NC. But how you are going to pay to fix them is a local issue. Good luck.

My sis and I were just talking again about the rise of PPPs (Public-Private Partnerships). I’m worried that’s the direction we’ll be going more and more here, and everywhere.

Oregon can’t cover it’s costs for roads. That’s why our roads look like they do.

According to this link based on 2011 information Oregon only covers 55% of the cost of state and local roads/highway costs from user fees, tolls, fuel taxes and licensing fees. So the question is where does the rest of the money come from if it isn’t coming from income taxes? https://taxfoundation.org/gasoline-taxes-and-user-fees-pay-only-half-state-local-road-spending

You are right, the money has to come from somewhere: Borrowing against future revenue, for the next 20-30 years, using municipal bonding; also Federal grants and “local matching” funds for state and federal grants; some transit funding for rail/LRT/buses; “donations” of land from other public agencies; lottery funding.

I bet transportation SDCs are a growing share of the 45% although probably not a large portion of this residual.

I studied this question in Jackson County Oregon 20 years ago and federal timber payments paid for a lot of county roads but those have declined dramatically in recent years.

Historically federal forest payments to counties (in-lieu of property taxes) have funded many rural roads.

“and at the federal level.”

Yes, and I pay quite a bit of federal income tax. And, while I don’t have numbers handy, I know that federal highway spending is massive. So where’s the disagreement?

It’s massive but even without inflation it’s value has been declining. The US gas tax was last raised in 1993. $1 in 1993 today costs $1.68, and construction inflation is even higher. The problem is that the US has far more infrastructure than it has money to maintain it, especially with all the wars we seem to get into…

quiet those critics? Au contraire! It gives away the game, concedes the mistaken notion that bikey folk don’t pay their fair share right now, which we know to be bunkum. Please!

So…what percentage of transportation funding do non-drivers pay as compared to those who own motor vehicles and buy gas?

We’ve had occasion to discuss this here a bunch in the past. The most authoritative source I know of is VTPI’s Whose Roads: http://www.vtpi.org/whoserd.pdf

“Contrary to common perceptions, cyclists do help pay for roadways. Currently, only about half of U.S. roadway expenditures are financed by motor vehicle user fees (Henchman 2013).

The portion of roadway expenses funded by user fees is declining, as indicated in Figure 3 because roadway costs increase with inflation, but fuel taxes and registration fees, are fixed fees that do not. Vehicle user fees would need to double to fully fund roadway costs. The rest of highway expenses are financed by general taxes that people pay regardless of how they travel.

In 2011 (the latest data available) U.S. governments spent $206 billion on roads and motorists drove 2,946 billion miles, so roadway costs averaged about 7.0¢ per mile (FHWA 2012). During that same year motorists paid $127 billion in road user fees, which averages 4.3¢ per mile –the remaining 2.7¢ spent on roads is from general taxes. A typical motorist who drives 12,000 annual miles imposes $840 in roadway costs, pays $516 in roadway user fees and $224 in general taxes spent on roadways. Non-drivers tend to travel less, people who rely primarily on bicycling for transportation typically ride 3 to 6 miles per day or 1,000 to 2,000 annually. If their costs are an order of magnitude smaller than automobile travel (0.7¢ per mile), a typical cyclist imposes $7 to $14 in roadway costs, and pays $224 in general taxes toward roadways, a significant overpayment.”

There’s lots more good stuff here.

I’m talking about Oregon…not nationally.

These might be good arguments for residents in other states, but our funding structure seems to be different.

Well until someone explains how transportation is actually funded here I am going to fall back on what Todd Litman has discovered. My hunch is that Oregon is more like what he describes than you perhaps imagine.

I would like to see someone actually explain it. Stating “we pay our fair share” should be quantifiable. Otherwise it is just a statement if one can’t prove it.

It would be like saying (in general) my taxes are too high and I don’t get all of the benefits back. We all want to think we have it bad, when it may not actually be the case.

Litman did just what you are asking – for the US. You are the one who seems to think Oregon is somehow different in ways that would change the calculus. I think the onus is on you to show us how this works. Until then I’m going to take Litman’s detailed calculations over your repeated hand waving.

This is actually a pretty useful resource for breaking down funding sources for various modes and infrastructure.

https://www.oregonlegislature.gov/citizen_engagement/Reports/BB2016FundingTransportation.pdf

The first few pages provide most of the answers to this thread. The brief specifically says “The state has rarely used General Funds to finance highway improvements.” As far as I can tell (from reading just the first 5 pages)- the primary place you see non-user fee taxes going to transportation is when cities, counties use those funds to close some gaps on their local matches. I think this is probably unusual, and definitely not the case when it comes to financing the federal Highway Trust fund. However I was also (apparently incorrectly) under the impression that more general funds were used toward roadways in Or.

Thanks for that document, Kate.

Note that the copy reads ‘highway improvements.’ Given my proclivities I’m inclined to read that as a careful word choice. Note also that bonds are not mentioned until page 4, and then not really again. The pie charts are also I think misleading in that they never show the whole funding picture but only the parts that show what we want our audiences to believe.

The ODOT document I linked to above suggests that for the state share of the revenue, 67% comes from user fees and taxes. Something not mentioned here. What a mess this all is!

An interesting quote from Kate’s linked document is found on page 3 (emphases mine):

Some of the sources for the non-State-provided Other Half of local highway (street) revenue appear to be auto-related (e.g., parking fees/fines, local fuel taxes), but many of them come from other sources. I don’t claim to know what they are or who pays for “traffic impact fees”, but I sure know who pays property taxes and SDCs: anyone who buys, owns, or rents real estate. The other mystery is the unknown portion of the Other Half of street revenue that is “of federal origin”. Not knowing what portion of local funds comes from the federal government, and not knowing exactly what the mix of sources for those funds is, makes it hard to determine how much of it can be tied directly to “user fees” supposedly paid exclusively by drivers.

There are two general arguments I hear from those who believe bicyclists aren’t paying their “fair share”. The first is related to new construction and the share of any given roadway that may be dedicated to bicycle use (e.g. bike lanes). The thinking is that bicyclists (assuming they could be singled out) ought to directly contribute a proportion of the funds that matches the proportion of the roadway that will be dedicated to them. For example, if a road widening project aims to add two 12′ lanes for auto use, but also two 6′ bike lanes, then “bicyclists” should contribute half the amount that motorists do, since half the new pavement will be dedicated to bicycles. This argument gets trickier when it comes to re-configuring/re-striping a roadway without widening or repaving—should bicyclists be expected to “reimburse” drivers for the loss of a lane in the case of a road diet?

When someone takes the position that bicyclists don’t pay their fair share for new or major re-construction, the arguments against it tend to be of a more philosophical or social/ethical nature. “Well, we wouldn’t need bike lanes if you drivers could share properly without threatening and injuring—or killing—bicyclists”. “Well, Mr. Driver, would you rather have a bicyclist riding in front of you, going slowly, or would you rather have them out of your way? You’re paying for the convenience of getting those pesky bikers out of your precious way”. There are also arguments to be made from the standpoint of harm/benefit, such as “we should encourage bicycling by providing a safe(r) way to do it, and we should discourage driving by making it less convenient”, and so forth.

The second argument pertains to maintenance, and is usually the one bicyclists focus on when refuting “fair share” complaints. I think the analyses of funding sources we’ve seen tend to support the notion that when it comes to maintenance, the cost that using multi-ton motor vehicles imposes on the existing system does indeed outweigh the amount that the average motorist ends up paying via direct “user fees”, and there is a defensible claim that bicyclists, who cause near zero wear on the same roads (especially if they also own a car that they rarely use, yet still pay license and registration fees for), are indeed paying at least, if not more than their “fair share”.

Here’s a start: http://www.oregon.gov/ODOT/COMM/key_facts/kf_funding.pdf

As I’ve been saying here, since Oregon takes in (much) lower fees from cars and trucks than do other states, the assumption you seem to be under that in Oregon we’re somehow unlike the rest of the US in that motor vehicle operators shoulder a LARGER share of the costs their transport exacts simply doesn’t compute.

The fact that ODOT doesn’t provide a straightforward accounting of the funding sources (a piechart would do just fine) is no surprise, and suggests they are only too happy to bury the truth in lots of word strings, just as they disagreed with the BTA’s ill-conceived infographic some years ago. I smelled a rat then and still smell it.

I’ve looked at this before. This is just for ODOT roads.

What about Portland roads – the funding is not just from the state.

Can you answer what percentage of your taxes go to paying for car infrastructure versus bike infrastructure? What percentage of the taxes that go to car infra are also leveraged for cycling lanes? I know I can’t.

For me to say “I pay my fair share” is disingenuous unless I know if I really do or not. I can say “my taxes are too high” but that does not make it true.

We can compare things in different states, but that doesn’t mean they are the same situations. I pay $2200 a year in property taxes…my mom pays $12k in Illinois. Am I paying too little or is she paying too much?

Your question –

“Can you answer what percentage of your taxes go to paying for car infrastructure versus bike infrastructure? What percentage of the taxes that go to car infra are also leveraged for cycling lanes? ”

is based on a misconception: Cycling infrastructure is 100% derivative. Were it not for the overwhelming and dangerous presence of the automobile we wouldn’t need an inch of cycling or pedestrian infrastructure. So suggesting a symmetry here is completely erroneous.

One problem with the bike excise tax is that it’s going to hit families that need a cargo bike harder since most of these bicycles are typically much more expensive. It is also outrageous to put a tax on bicycles under the banner of bikes “paying their share” when it is not reasonably safe for people of all ages and abilities to use a bicycle on roughly 99% of the road space in Oregon.

Don’t like the (proposed, idiotic) excise tax? Try Craigslist.

If that’s what happens, the tax will really hurt bike shops. But if this really does mean better cycling infrastructure, maybe that will encourage more people to get out and bike.

A bike tax? Seriously? How many times has this been proven to cost more than it would take in? Yet our geniuses in congress keep pushing the idea.

I think you’re confusing proposed bike licensing with this proposal (a tax at the point of sale). They’re not the same.

Still, it’s going to be an administrative nightmare, as bikes are rarely registered anymore.

Isn’t it proposed to be just on new bikes at the point of sale from commercial shops? If so, I don’t know that it will be as hard as you are suggesting. If they tried to include every bike sale (including person to person) then yes it would be nearly impossible.

Let’s propose a sales tax on everything. So far we have sales taxes on pot, this smells like a sales tax on bikes. Taxing everything would be so much simpler. Probably wouldn’t pass, but no one would feel targeted and they’d raise a ton of money on car sales.

Give over half the streets to bicycle only use and then talk about “our share”.

…And may as well implement a shoe tax for pedestrian sidewalks too…fair is fair. 😉

I hate those freeloading pedestrians.

That’s not so far fetched. The federal government already tariffs shoes at a rate of 37.5% for many shoes, since the 1930s. Its technically a tariff, but with 99% of shoes made in other countries, it could practically be considered a tax.

In recent years there have been efforts to pass a bill to reduce this federal tariff, which would open up the possibilities of states backfilling with their own tax, with likely exception for kids and cheaper shoes. The current tariff generates ~3 billion a year, which unfortunately does not go back into pedestrian infrastructure. This would equate to ~40 million potentially for Oregon pedestrian infrastructure if the federal tariff was converted to a state tax.

Perhaps the Trust needs to develop a fact sheet – how many bicyclists do not either own cars outright / or their direct families do (or purchase services that directly pay for gas taxes to deliver these goods, etc.)

Finishing my thoughts: What the larger audience would find is that most OR (and WA) cyclists already pay for roads access through car ownership fees / fuel taxes either directly or indirectly through purchase of services (or by parents payments).

Plus it would be great to remind them that many of the historic paved arterials in Portland and Vancouver were originally developed by cycling groups circa 1900 with donations / fees and lobbying per the Great Roads movement.

So this whole cock-up is cyclists fault??? What have we done?!?

That’s a good point. Most of us are drivers as well as cyclists.

People who regularly ride bicycles pay more than their share of road construction and repair costs. Here’s how: https://www.thestreettrust.org/nofreerides/

How do you define “your share”?

Does it change if you drive never/occasionally/frequently? If you make shorter or longer trips? If you drive or ride on or off peak? Does “your share” change if you buy more (or fewer) goods (that are delivered by truck to the store)? If you buy more heavy goods like beer and wine? If you drive for work? If you ride the bus? Do children have a smaller share than adults? Does it matter how long you’ve lived here (for amortizing construction costs)? Is your income a factor? Is the age of your house/apartment a factor?

I’m not asking for answers to all these questions, only trying to illustrate that defining “your share” is both complex and open to considerable interpretation.

Gerik,

I have my doubts about that graphic. As you no doubt recall, an earlier version with a different spread was thrown together; ODOT said BOO! and the BTA immediately conceded the point, which I don’t think was even accurate, and re-wrote the graphic. I’ve not had much luck getting to the bottom of this since then, but remember quite clearly that ODOT claimed that bonds = user fees which struck me as totally weird. No one’s yet explained how this supposedly works.

Screw an excise tax on bicycles, motor vehicles are the vehicles they should be taxing.

I get so incensed by this idea of mollifying the critics by collecting a symbolic pittance to make a political point. My household pays combined income and property taxes that exceed the median income in the state of Oregon. And they say I’m freeloading when I ride to work in a gravel-filled potholed door zone bike lane? This tax will quiet no critics, build no (real) infrastructure and drive down new bike sales. Hey, maybe that last one is really the goal.

We are so minuscule in the scheme of things, what a dumb idea..

Should be a Bike CREDIT.

Indeed. If the federal government will give me a $7500 tax credit for a 2017 Ford Focus electric ($29,120, so essentially a 25% rebate), then why would neither my federal nor my state government offer the same 25% tax credit on the purchase of a new bike that runs on eggs and toast?

Oh, probably because I couldn’t prove that I would use it to replace car trips. Well, that’s OK, as long as claimants of the electric car credit can prove they never use their cars for trips to the beach, or to go out for dinner.

or run their cars on electricity generated from non-renewable coal…

That may be true today, but less so tomorrow. Thanks to the BPA, Oregon depends less on coal than many states, and most utilities are phasing coal out for cost reasons (so this will likely continue under Trump). The nice thing about electricity is you can switch fuel sources more easily than you could if people were using liquid fuels.

No you can’t. Unless things have changed recently, Pacific Power customers in Oregon get mostly coal in their (electric) stockings.

Here – 63%

https://www.pacificpower.net/ya/po/otou/fsei.html

The point is it can change by upgrading the plant rather than every electrical item out there.

Or electrical mix overall is better than what PP produces/buys. Could be better, should be better, will be better.

In theory, sure.

We see it happening all over the world, so it’s more than a theory.

You wrote: “The nice thing about electricity is you can switch fuel sources more easily than you could if people were using liquid fuels.”

This is a relative statement and is no doubt true on its face, but the implication (that it is easy, that it is already well underway here in Oregon) is what I was contesting. Germany, Spain, Denmark have made serious strides in this direction, and yet they have a long, long way to go. Many decades or even lifetimes I’d venture. There are real physical, economic, theoretical, not to mention political hurdles to accomplishing this, and climate costs to a large scale renewable rollout. And I think it important to push back against the wishful statements often made about progress on these fronts.

If we did not migrate more of our energy consumption to electricity, that transition would be far more difficult, so I see it as a necessary, but not sufficient step towards reducing our emissions of carbon.

Reducing consumption is another important and viable strategy. There is no need to do one or the other; we can do both.

“There is no need to do one or the other; we can do both.”

In theory.

In fact, however, for the past thirty five years we’ve put all our eggs in the energy efficiency basket, leaving very little protein for the renewables, and none for using less energy (which is often confused with but is entirely different from energy efficiency).

Renewables are growing at an astounding rate. I don’t think they’ve been neglected. Also we are using less. We used to make aluminum in the Gorge, for example.

“Also we are using less.”

Really?

This (greenhouse gas emissions over time) is I think the relevant parameter, and fy this measure we’re not making any progress:

https://www.epa.gov/climate-indicators/climate-change-indicators-us-greenhouse-gas-emissions

We need to eliminate 90% to 95% of our GHG emissions tomorrow/yesterday, and right now they are rising year over year.

On a per-capita basis, yes, and, more importantly, historic growth has stopped.

But, regardless, we’ve been here before. You and I agree that we (collectively) need to take action. I believe we need to depend on technology to fix this because I see no signs that society is willing to simply stop using electricity and oil and go back to a pre-industrial lifestyle. You argue that is the only way forward. And I say that if you’re right, we’re hosed because of our (collective) lack of willingness to adopt a low-energy life, so we’d better hope for a technological fix. And around we go.

I see signs for hope; you don’t; and the world carries on regardless of what either of us thinks.

“On a per-capita basis, yes, and, more importantly, historic growth has stopped.”

Neither of these have any bearing on our climate obligations, which is absolute, sustained negative growth in energy consumption/GHG emissions. The longer we diddle around the more severe the cuts will become. There is really no mystery about this.

“But, regardless, we’ve been here before.”

Correct.

“You and I agree that we (collectively) need to take action. I believe we need to depend on technology to fix this because I see no signs that society is willing to simply stop using electricity and oil and go back to a pre-industrial lifestyle. You argue that is the only way forward. And I say that if you’re right, we’re hosed because of our (collective) lack of willingness to adopt a low-energy life, so we’d better hope for a technological fix. And around we go.”

I am right; and we are hosed, if we carry on like this.

Hoping for a technological fix is an understandable, familiar reaction, but it also utterly wishful.

We do appear to lack any collective willingness to tackle this, as you suggest, but this is largely due to the fact that no one (except Kevin Andersen) is making any serious pitch for these kinds of reductions, so it is not very meaningful to say no one is willing to do this when virtually no one is even aware that we’re on the hook to accomplish such a historic reversal. We can’t have an intelligent, broad ranging conversation about something that is studiously kept off the table, out of view. The constraints climate change places on our lives, our autonomy, our future prospects is the independent variable; the degree to which we are willing to change our behavior, our habits is the dependent variable, not the other way around. We will simply one day need to get over ourselves and come to terms with which way causality runs here.

“I see signs for hope; you don’t; and the world carries on regardless of what either of us thinks.”

You’ve said this before, but I don’t understand the logic behind this. If that is your general stance (and I don’t think it is) then why post anything, discuss any of this? It sounds escapist or defeatist.

I guess I don’t feel defeated because I trust we’ll find a technological fix. You argue that’s an unacceptable gamble, and you’re right, but the only alternative is a collective decision we are utterly unprepared to take.

If I am wrong, that’s great; I am not working against you. If you and Kevin Andersen can change the world, you have my support. But until that process gets rolling, we’re stuck where we are, having an endless, unresolvable, and ultimately pointless debate.

In the meantime, I’ll continue to ride my bike.

“But until that process gets rolling, we’re stuck where we are”

I think we are the process. Or should be.

I’m not waiting for or expecting anyone else to solve this.

At least one nice thing about electric cars is they get the pollution out of the cities. This makes it nicer for us when we’re cycling. A little less poison we’re heavily heaving in and out of our lungs.

out of sight, out of mind?

My understanding is that your coal plants are east of you, downwind, if you will. The irony, of course, is that a lot of the smog you do get comes from China, from coal-fired power plants in Manchuria.

Most people in PDX purchase power from PGE whose current ~33.8% coal mix will plummet when Boardman closes in a few years. People also have the option to purchase RECs so that their energy consumption funds *new* renewable energy generation.

When all is said and done coal and fracked gas are probably a wash when it comes to their climate significance. The closing of Boardman is a PR gimmick. They’re planning expanded NG plants out there as we speak.

Renewable credits are another gimmick. If everyone in Portland bought credits tomorrow what do you think would happen? Nothing. Credits are pieces of paper, not a set of grid connected brand new wind turbines.

RECs are audited by a 3rd party and specifically fund the creation of new renewable energy.

I agree with you that there is zero sense of urgency (even among so-called environmentalists) and that the overton window of proposed solutions is both too little and too late; however, I don’t think this justifies being dismissive of incremental change that can lessen/delay negative impacts.

“I don’t think this justifies being dismissive of incremental change that can lessen/delay negative impacts.”

Except there is nothing whatsoever that assures the teeny weeny steps you’re pointing to will add up to something meaningful. It is I think more likely that they could instead lull us into thinking someone is attending to this and are well on their way to solving it, when the opposite is true, and that kind of attitude takes attention away from how immense the task is; the fact that we need a collective, entirely different approach.

put another way – the zero sense of urgency you note is I think a direct consequence of the wishful nonsense surrounding renewables. Why should there be any urgency if renewables are poised to take over the world, solve this at negative cost?

I was worried about my carbon footprint, so I bought smaller carbon shoes. Problem solved!

For Hello, Kitty and soren –

http://www.resilience.org/stories/2017-03-02/renewable-energy-advocates-hurting-climate-cause/

“The U.S. Energy Information Administration’s 2015 statistics show that 4.7 percent of the country’s electricity was generated from wind, with 0.6 percent coming from solar. That’s a 14-plus percentage point difference between what Americans think and the truth.”

Not sure how that meshes with this (they may both be true): I heard on the news yesterday that wind capacity now exceeds hydro capacity, and actual wind generation will likely surpass actual hydro generation by the end of the year. (They have different capacity factors so actual generation rates differ between sources.)

https://www.eia.gov/tools/faqs/faq.cfm?id=427&t=3

2015 US electricity production: hydro – 6%; wind – 4.7%; solar – 0.6%

http://www.utilitydive.com/news/eia-wind-outpaces-hydro-to-lead-us-renewable-energy-capacity/437636/

…and my first link should have been to here

I agree. What happened to the notion of taxing things you want less of and subsidizing things you want more of? Just the simple economics of it, where every dollar spent on motoring requires something like $12 of public expenditure (while bike use is pretty much break-even) should dictate an increase in car taxation and a credit for bike use.

I want more income, so I propose to taxing that less.

There is – it’s $20/month!

http://bikeleague.org/content/bicycle-commuter-benefit

Oh wait, you have to work for someone who actually administers it…

I hear you. I thought it was a pretty cool incentive when I heard about it, however, my partner has always had corporate jobs and she has never been able to get her employer(s) to participate. She’s tried since it was created in 2009 with at least 5 companies.

Call it what it is: a sales tax on bicycles.

A *sin* tax on bicycles. 😉

Raise the gas tax until it breaks-even with maintenance costs and recovers the deferred maintenance within a decade, then raise it enough again to pay for freeway-widening if anybody still wants it. Schedule regular increases until there is no gas tax revenue, ramping-up studs / tire / mileage taxes as needed.

Or, subsidize burning gasoline until the world ends. It’s faster!

I’ll be odd man out here and support a bicycle purchase tax. However, in the interests of fairness one should also be assessed on motor vehicles and the rates should be proportional to the damage each vehicle does to the infrastructure.

Let’s see, road damage is roughly proportional to the fourth power of weight, so for every dollar a typical bicycle pays (let’s be generous and add in rider weight too, for a weight of 200 pounds) an SUV, at 6000 pounds, should pay $810,000.

Yep, I’m all in on this one.

How about metal-studded tires from cars? Fee or tax ?

I support that! If my math is correct, then a 10 ton truck, would have to pay 10 Mio. (10 ton is 20,000 pounds, or 100 times the weight of a bicyclist; 100^4=100,000,000).

Roads are a common good.

They used to be. Today, not so much. Our roads today are, by and large, designed for fast, heavy, fossil fuel combusting machines, not for people. That is why we ‘need’ sidewalks and bike paths, because they are not very common and not very good for anyone not in a car.

We need a carbon tax.

Absolutely. It’s the only tax scheme that makes sense for financing infrastructure and scaling it per the demands upon the global commons. It would scale well and take responsibility for the cost placed upon the greater community. Basically, it’s a survival mechanism that makes sense akin to skin-or-swim. This is where Salem must place their discussions around transit and not on bandaid excise taxes.

I hate this idea. Restaurants will start serving soda will less bubbles to save money. Gross!

I don’t know… the British have been leading the way with their flat, sudsy beer; they also save energy by serving it warm. I think we can learn a thing or two from them.

Where is the tax on metal-studded tires for cars? Washington has a new fee !

How about they spend some of the budget on educating people instead of just playing along with their wrong ideas.

I mean the guy said “however mistaken” so pretty well admitted that it’s wrong. Shouldn’t he be setting them straight instead of this stupid bargaining chip that the people with the wrong idea will feel is too low anyway?

Bizarre!

I think that how roads and streets are funded should be part of the driver’s test.

Soooo where’s all this Trump money to fix infrastructure and stuff? Seems he’s only focused on some of the more negative campaign promises so far.

You bought that?

I do not think that “deconstructing” the administrative state, sounds very promising as far as infrastructure spending goes.

Anyone who believes this blowhard really deserves all this chaos….

I buy it, though I do question his ability to deliver, given opposition in Congress and all the own-goals his team is scoring.

trump’s “infrastructure” proposal was comprised entirely of subsidies/tax breaks for his construction/real estate buddies.

Never bought a word he said. Man is a megalomaniac who will say anything he believes will please his ‘base’.

“Soooo where’s all this Trump money to fix infrastructure and stuff? …” andrew

Right now, the money may be going to medicaid, which, after being eliminated by way of repeal and replace ACA, will be available for building border walls, wider highways and more bridges…important steps towards “making america great again”. Expendable participants are essential to success in battle.

My opinion is that this is a ruse to get his name on roads and bridges all over the country.

Come drive on Trump Highway. It’s the best. You’ll see. Really, the best.

What about bicycle retailers who’s customer base is 90℅ out of state? Do all our customers need to pay the sales tax, or only those who live in Oregon?

And worse yet, will Oregon residents who purchase out of state be able to avoid the tax, thus further hurting local bicycle sales.

The last bike I purchased new, a custom tandem, I purchased in Seattle. While WA has a sales tax, as an out of state resident the tax was waived. How many people are going to mosey across the state line to avoid a 10% tax penalty once this thing is in place? How many WA and CA residents already do that for other retail goods? (A lot, if what I see in Medford when I visit is any indication.)

This whole thing needs to go back to the committee on silly ideas and be shelved forever.

Getting the local state sales tax waived by Oregon residents only works in Washington, due to a law between the two states (you have to fill in a form and present Oregon ID). It doesn’t work for an Oregonian purchasing an item in California, or anywhere else for that matter, nor for folks from other states without sales tax.

Any resident of a state without sales tax can get the WA tax waiver.

http://dor.wa.gov/Content/FindTaxesAndRates/RetailSalesTax/Nonresidents/default.aspx

After doing a bit of research, Washington seems to be the only state that allows that for in-store sales, at the discretion of the dealer, but several others allow it for all out-of-state online and phone orders (Ohio for example.) A few others require the sales company to collect sales tax regardless of where somebody is ordering from, but most are required to charge and report the sales tax of the originating state, if any. Interestingly, while Oregon doesn’t have a statewide sales tax, it allows Oregon cities to do so, and Ashland apparently does so.

So, Copenhagen moves half of their people by bike with 1/4 or less or none of the road. How much of Portland moves by bike with how much total space of all Portland roads? The return you get with bike lanes in urban spaces with per person per mile traveled is greater than car space if you include parking.

With skyrocketing rent prices, my bet is that we are going to see around 30% of bike shops in Portland fail in the next 18 months or so. Just a hunch, but when your rent doubles like that of Bike Gallery in Woodstock, the numbers just don’t work out for an industry that already has tight margins.

An excise tax might just be the fastest way to kill the bike industry in Portland.

Yet a new shop just opened down the street in Woodstock the year before (Missing Link). And the Woodstock Bike Gallery branch actually moved to a more expensive area (West Moreland/Sellwood), although I can’t comment on their specific rent differences.

Is it possible we have too many shops now? Or at least too many in the inner neighborhoods?

They need to put a tax on shoes so sidewalk users will pay their share and quit freeloading off us exploited drivers.

1% excise tax on bicycles is not enough to cover administrative costs. Then again a 1% excise tax on ALL VEHICLES might cover the administrative costs.

As far as the fuel tax is concerned a $1 fuel tax is not very high. even compared to other states. when gas was $0.259 per gallon. The US Highway administration built freeways in all 48 states and the Alcan highway to Alaska. the tax was ten cents or 40% of the total price. As it is over 80% of the costs of maintaining the highways are from income tax. Everyone except the Uber rich pays for that.

Except in Oregon, which uses vehicle and gas tax only, by law, and the various states without income tax (Washington, Texas, etc.)

My naive thought of the day: “If only there was a way to penalize elected officials for exploiting people’s misconceptions, because when they target relatively small groups they don’t lose support.”

That’s got to be some flavor of pandering, or very close to it. The problem is that many of those elected officials seemingly subscribe to the same misconceptions—but then maybe that’s just my naive thought of the day, and really, those elected officials know exactly what’s true, they just choose to ignore it in favor of scoring political points. How to tell when you’re the victim of ignorant power or deliberate machinations?

9 times out of 10, it’s ignorant power.

The thing is, everyone thinks they are that other 10%.

No that is actually not the thing at all.

The truth is that those who drive exact costs on society above and beyond the trivial fees and taxes they pay. No amount of your wishful thinking is going to change this.

And mind you this is true merely for direct, transportation related costs, *before* we get to the really big burdens their driving places on the planet and public health and security. Include those costs, and the whole exercise blows up.

Bike shops don’t need more challenges, and this will help put more people out of work. They are already challenged with increasing rents and minimum wages, aggressive competition from online sales, and unfair pricing from their own suppliers (I’m looking at you, Shimano). Witness: https://calmarcycles.com.

Bike shop owners and their employees should not be the people paying for infrastructure; this is another red herring.

“… this will help put more people out of work.”

But it’s those people (hippie bike lovers), so it’s ok, right? They should all go sell cars like normal people.

Congestion mitigation is, I think, what bike travel represents, here in the U.S., potentially, if not realistically…because so far, people traveling by bike are really quite a small percent of overall road users.

Were that percentage of use of bikes for travel to rise to say 50 percent of all road users, then perhaps some more direct means than property tax for example, of generating infrastructure funding from people that ride, might be reasonable. With bike travel mode share’s very modest road use is at present, taxes on that mode of travel is self defeating. In the sense that communities and cities have major problems with traffic congestion due to how extensively motor vehicles are used for travel.

Even as I recognize the importance of motor vehicles’ for meeting the travel needs of many people, that mode of travel commonly takes up huge amounts of space on the road for comparatively few vehicles. The old two lane country roads succumbing to transition into arterial, can provide a very strong illustration of this. Twenty five motor vehicles, mostly personal cars, traveling in one of the directions of a two way, two lane road posted for 40mph, occupy many linear feet of the road. I’ve never exactly figured out how to come up with a close estimation…so I’m going to guess 1000′ or maybe up to a quarter of a mile. Often it seems, for likely not more than 25 people, they that are doing the driving.

How much linear road space does it take for 25 people riding bikes to travel, in one direction at a speed realistic for many people biking, say 15-25 mph?. Haven’t sat down to seriously figure out that one either, but just guessing, no more than 300′, and maybe much less, considering that people biking can ride two abreast in the same approximately 12′ width, give or take, needed for roads to be used with most motor vehicles.

“Congestion mitigation is… what bike travel represents”

Bingo! Were the people debating this to ask a single question – how much more traffic does the public want us to create with policy – then I suspect there’d be a simple answer.

I find it disgusting that the car/oil/tire cartel has expended massive amount of public funds for profit driven infrastructure. This is after forcing self propelled transport, pedestrians and cyclists, off the roads, and deliberately leading public transport into bankruptcy in the 1950’s. Today the cartel wants more funding to feed it’s profit frenzy. A bicycle excise tax? An auto excise tax is the fair payback in my opinion.

Keep voting the same inept leadership in time after time and be surprised why you get the same results. Right.

Now we’re trying a whole new level of ineptitude, and so far results are not good.

I don’t see what the big deal with a one time decal on new purchases. Ohv users have one and so do users of parks around the state. However, every dime needs to go to grant applications put forth for enhancement of bike use…None go to any other entity….Ever.

We should probably start taxing solar panels and composting bins too.

in general, composting generates more GHGs than not composting. portland’s composting program should be shut down until it can switch to anaerobic digestion and biogas energy generation.

Aerobic composting produces little methane.

Aerobic composting often produces about as much methane as the landfill.

A recent review:

http://faculty.washington.edu/slb/docs/slb_JEQ_08.pdf

A classic *study*:

http://agrienvarchive.ca/bioenergy/download/hao_composting_2004.pdf

“However, the emission of CH4 during composting is a concern, raising the question of the net benefits of composting on C sequestration.”

Based on the abstract (interesting, thanks for posting), it looks like the C:N ratio is critical for determining whether methane or CO2 production is favored (with high C, composing is a clear win over landfilling). It also references the use of energy to operate machinery to manage the composting operation.

So, as usual with these things, it’s complex, and it depends.

If we mixed our sewage sludge with wood chips, leaves, or shredded newspaper, we could generate a steady source of methane that could be used to run a small generator or provide heating. The city has a lot of leaves available, and an endless supply of sludge.

imo, the city should emphasize landfill gas burning (significantly reduces GHG emissions) and biogas generation over its current composting program.

Many landfills do this; ours might. The problem with landfill gas is that no one really knows how much is produced, or what the capture rate is. The gas has been shown to travel underground, and production is highly variable even within the landfill itself.

Next step: bicycle excise taxes will be designated as the _only_ source of funds for bicycle infrastructure…

Maybe

I managed the only known Bicycle Excise tax in the country (in Colorado Springs, CO) for quite a few years. I would be happy to talk with Bike Portland about the pluses and minuses (there were both) of that tax (which is still in place – originally approved in 1988) if your interested.

As a long time reader and comment writer to bikeportland stories, I’d definitely like to hear a first hand account of your experience with csprings bike excise tax. This bikeweblog’s owner doing a formal interview with you would likely be better than your trying to post a summary here and field comments to it. If you feel there’s a good city info page on that revenue system, your posting a link to it might be helpful.

For anyone living Portland, the proposed tax would be unbelievably easy to avoid. Simply go across the bridge to Vancouver and buy your bicycle there and claim the out of state resident exemption, which I do every time I shop at Costco in Vancouver (less crowded on the weekends when all the Washington state residents are shopping at Costco in PDX to avoid WA sales tax.

Yep, doesn’t sound like a problem for Portland bike shops at all.

Most likely, Washington will bake that in to the sales tax credit, and make WA bike shop owners add it in for Oregon residents who claim the sales tax credit. So it’s unlikely to impact Portland bike shops much. Especially when you consider that the gas spent going to Vancouver and back would exceed the excise tax. (as would transit costs)

Yep, ever wonder why there is a shopping center at Janzten Beach? Even back in the days when you had to pay a toll to get across the Columbia, Washington resdents would come south to shop.

It’s even easier than that: make every bike purchase used and private-party. Then repair it and keep it going for as long as possible, buying only spare parts as needed.

That’ll show ’em. #proudtobecheap

Hear, hear!

I’ve long espoused this kind of thinking.

also called a Maintenance Economy.