The paving and safety projects scheduled to be built with Portland’s proposed gas tax will be spread quite evenly across the city.

But votes on the gas tax definitely weren’t.

Of the 81 Multnomah County precincts in the City of Portland, only 19 tallied “yes” votes between 45 percent and 55 percent. In more than half of precincts, the vote on the 10-cent local gas tax, one of the country’s largest local fuel taxes ever approved by popular vote, was a blowout victory or loss by 20-point margins or even more.

The southeast Portland precinct that includes the Sunnyside neighborhood gave the “Fix our Streets” proposal its strongest margin in the city.

Disregarding two tiny precincts that had fewer than 100 voters (one of those voted yes, the other no) the “Fix our Streets” campaign was most popular in Precinct 4207, the Sunnyside district along Belmont Street and Hawthorne Boulevard on either side of Cesar Chavez Way. More than 69 percent of voters there supported it.

But the tax went down hard in every precinct east of Interstate 205. The further east, the more “no” votes it saw. In Precinct 5009 along the Gresham border (which also happens to be the eastern endpoint of the 4M Neighborhood Greenway that will be funded by the tax) only 20 percent of voters voted “yes.”

In all, 43 precincts voted “no” on the tax and 38 voted “yes.” But (unlike in national presidential elections, for example) every vote cast in the city has equal power, and precincts that voted “yes” generally had more residents. The tax slid into a 4-point victory (52.1 percent to 47.9 percent) on May 17.

Did votes split along income lines? By the amount of driving people do? By the perceived viability of alternatives to driving? By environmentalist or social justice sentiment? By trust in local government? Those are all possibilities but without exit polls, it’s hard to say.

Here are three two details worth noticing in the map above, though:

Advertisement

1) Southwest Portland said “yes” even though east Portland didn’t.

(Photos: J.Maus/BikePortland)

Two parts of Portland, outer east and outer southwest, were built mostly on Multnomah County roads, without sidewalks, in the era after 1959 when the city had banned multifamily housing from most areas, required on-site parking for commercial lots and avoided street grids. Decades later, all those decisions shape transportation habits, development patterns, housing prices and culture.

People who live in east and southwest Portland alike will tell you that their streets need a lot of work.

But last month, one of those two areas — the richer one — voted something like 55/45 “yes” on the gas tax and the other voted more like 70/30 against. What happened? One possibility is that it’s related to this map from a recent city study:

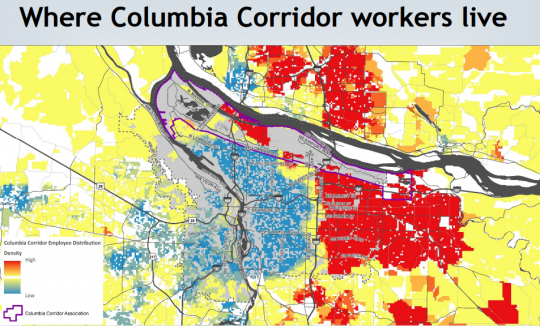

Southwest Portland is far from homogenously rich and east Portland is far from homogenously poor. But east Portlanders’ job market is hugely dependent on the city’s most important jobs center that’s virtually inaccessible except by car: the industrial and port land along the Columbia River. East of Interstate 205, transit lines and bikeways to central Portland and Gresham are scarce and mediocre, but they do exist. Transit and bike routes to the Columbia Corridor, though, basically don’t exist at all.

Southwest Portland, by contrast, can also be unpleasant to navigate on foot or bike, but it’s likely that more people there work in areas such as downtown that are relatively well-served by transit — or if they car-commute to Washington or Clackamas County, will be easily able to avoid the tax. Maybe that’s part of the reason the proposal did better in southwest.

2) Central Portland said “hell yes.”

If we assume that in the long run the gas tax will be a smart, money-saving and justice-advancing policy (as, presumably, most people in Portland government do), then we can’t ignore the single most important thing about this ballot measure: It passed.

Why did it pass? In part because of the 20 to 30 percent of east Portland voters who backed it despite their neighbors’ disagreement. In part because it broke 50 percent support in the southwest. But more than anything, it was because the proposal, which was very explicitly organized around the narrative that walking and biking should be safe and pleasant, racked up massive support in central Portland.

This support wasn’t limited to people who don’t buy much gasoline. Far more than half of people in central Portland drive to work, and almost every precinct in and around the central city saw more than 60 percent “yes.” Whatever the reason — some of it probably in self-interest, some of it probably cultural, some of it probably ideological — a gas tax that was once assumed to be politically impossible was successfully sold to overwhelming majorities in these neighborhoods.

Political action requires coalitions. Against odds, the gas tax built one.

Correction 3 pm: Due to a transcription error, an earlier version of the map and post reported an incorrect figure for inner northwest Portland, conflating it with the results from outer northwest. Since the revised figure is less surprising — inner northwest Portland voted overwhelmingly for the tax, like other central neighborhoods — we’ve deleted a section discussing this.

— Michael Andersen, (503) 333-7824 – michael@bikeportland.org

Our work is supported by subscribers. Please become one today.

Thanks for reading.

BikePortland has served this community with independent community journalism since 2005. We rely on subscriptions from readers like you to survive. Your financial support is vital in keeping this valuable resource alive and well.

Please subscribe today to strengthen and expand our work.

Perhaps the Dunthorpe district wants a massive road / trail overhaul after approving it by 72 %. They understand the significance of the big cut-through auto traffic on the way with the upcoming massive sewer / creek projects on the way over the next few years.

Low-income people in outer east Portland know who is going to predominately pay this tax.

Gentry liberals in inner Portland, with easy commutes and little need to drive a lot, also know who is going to predominately pay this tax.

The vote isn’t a surprise at all.

Gentry liberalsVoters in inner Portland, with easy commutes and little need to drive a lot, also know who is going to predominately pay this tax.There. Fixed that for you.

“fixed it for you” is such a Gentry Liberal thing to do.

Hey, at least I know the HTML for emphasis and strikethrough.

Outer East Portland also knows who will get the lion’s share of projects from the gas tax: definitely not them.

Have you read the project list?

http://ppdx.co/fixourstreetsportland/FixOurStreetsPortland_Project-List.pdf

Yes. And it’s guaranteed actual amounts collected will be far below the rosy projected numbers (see: Arts Tax). Cuts to the project list will be in areas where commissioners spend the least amount of time.

“Yes. And it’s guaranteed actual amounts collected will be far below the rosy projected numbers”

It will be interesting to see how much money is actually collected – not only are you going to see some shift of gas sales to the suburbs, but if gas prices go back up, the amount of gasoline sold in Portland will decline in any case.

If the amount of money collected is more like $54 million, instead of $64 million, which parts of the planned spending get cut.

Bike projects will be the first to be cut.

“Bike projects will be the first to be cut.”

My bet is on street maintenance.

Potholes are just emergent traffic calming devices. Lets see fewer paved streets and more cracks and potholes in the ones we have!

Stock up on fat tires!

>If the amount of money collected is more like $54 million, instead of $64 million, which parts of the planned spending get cut.

http://efiles.portlandoregon.gov/Record/8519330

>If revenue or expenditure amounts differ from projections, the ratio of street repair to safety projects will remain the same (56% street repair to 44% safety projects)

Unless I’m looking at an outdated version of the ballot measure, it looks like they’ll cut from both. Which in practice might mean the city council making up the funding for street repair, safety projects, or both using general revenue.

It’s not so much as the lack of funding for East Portland infrastructure, but rather the lack of implementation of already-funded projects by PBOT. There are already over $50 million worth of projects funded for East Portland, but PBOT is taking their time implementing most of them, unlike in inner affluent Portland, where PBOT will build stuff even before they have funding to do it.

It is also worth noting that the folks who most voted against the tax in East Portland are those who live closest to the gas stations along 181st in Gresham or near Happy Valley, who already get most of their gas from outside of Portland anyway, and thus will have the easiest time evading the tax.

“This support wasn’t limited to people who don’t buy much gasoline. Far more than half of people in central Portland drive to work”

Yeah, but if you have a four mile auto commute, the gas tax isn’t much of a burden, as opposed to a twelve mile commute from outer East Portland.

I have a 14 mile commute from inner NE Portland to NE 185th. Guess how how I get to and from work 75% of the year, and guess I how I voted.

A lot of our bike commutes are further than that. If your car makes 12 miles to the gallon (hopefully, it makes more than that), that’s adding a dime to the cost when you go out. If your car makes 24 miles to the gallon, it’s a nickel. If you consider what else you’re paying for fuel, let along maintenance, depreciation, insurance, etc, this is not what’s making it expensive for you to drive.

from “let them eat cake” to “let them bike 45 miles”…

Should the person who requires three times the roads pay more tax or less tax?

Should the inner-Portland person whose, on average, much greater wealth enabled them to outbid and displace the outer-Portland person from their former inner-Portland home pay more tax or less tax?

Not saying this applies to everyone in either location, or even a majority – but just giving another perspective on what’s “fair.”

Why do you want to publicly subsidize behavior that is dangerous and hazardous to our health? Let’s get rid of the cigarette tax while we’re at it. After all, it is disproportionately paid by lower-income members of society…

Well, I voted for the gas tax (reluctantly) – but only because it would raise money for good things, not because I thought it was a good funding mechanism. Good public policy choice is more complicated than point-in-time fairness and “proper incentives.” It also needs to include history, equity (which is different from fairness/equality!), the ability of incentives to actually impact behavior versus other strategies for changing the negative behaviors, etc.

Not every individual tax or user fee has to be perfect and equitable. On balance the entire system of taxes and user fees should be. There are plenty of taxes that contribute much more to inequity than the gas tax user fee. Prime example would be the absence of social security tax above $120,000 or whatever the exact number is this year.

The person who takes transit into work every day?

The person who telecommutes with the same salary?

The person who drives to Mt Hood from their downtown condo four times a week during ski season?

The retired widow who’s been in her house for four decades?

The company that has a fleet of traveling salesmen or repair trucks on the road constantly?

We have always funded roads primarily with the gas tax specifically because of use, and the idea that maintenance costs come from this use. I’m not even talking about income, and some are talking about nothing but. If we were a decrepit downtown ringed in wealthy suburbs, the people defending the poor would still be doing so. The displacement argument is irrelevant.

———

I voted against the tax (and I don’t own a car) because I feel that the city has a history of spending infrastructure money on other things, then coming back to the people for special fees, bonds, and taxes to fund the things residents really wanted paid for to start with. I’m not opposed to road repair and improvement. I think it should come from the bucket of money they already have. Which, coincidentally, would mostly resolve the equity complaints people are making.

It’s very much like Fritz’s new 3% weed tax proposal to fund police, roads, etc. Of course you want to be safe right? You want decent roads right? Well then why would you possibly oppose a measly 3% tax on lipstick… golf balls… oh sorry… evil marijuana. Most importantly, it frees up that amount of general fund money to be used on the less popular things they would have never gotten you to sign off on. Notice the lack of a vote about whether to spend 4mil + ongoing costs on the Joyce.

To clarify… I’m not anti-tax or opposed to a general increase. It’s the nickel and dime, around the edges, increases, the lack of transparency and lack of defined plans that I find problematic.

I have a 100 mile daily commute and live in inner SE I eagerly voted yes for the tax.

… because you can fill up in Portland-gas-tax-free Salem, you tax-dodger! (I kid, I kid)

There’s also a widespread sense in SW Portland that they pay more than their fair share of property taxes, because of the weird math spooling out of Measures 5 and 47. (For example we paid about 30% MORE property taxes on our old house in SW, which was worth about 30% LESS than our current house in SE.) A common theme among my former SW neighbors was that we were paying for sidewalks & greenways in other neighborhoods.

On top of that, for historic reasons related to the development of SW, many residential streets there are not able to receive sidewalk/curb improvements that accompany stormwater runoff projects (e.g. bioswales) — which is how a lot of those improvements happen on the inner eastside. I admit I never understand these reasons but I know they were a factor in why we couldn’t apply for those improvements on our street.

Yea, I understand the tendency. I have to think, though, that something is important enough to keep the people living and moving there. Something is providing value, or they would live elsewhere right? Part of it is tax values holding down home values in the area.

The system doesn’t make a lot of sense, but it is what it is and people have been buying and selling for decades now based on those rules.

Meant to have a question there…

Does anyone view it this way, or just resentment towards the people who made different choices?

It’s the logic of moving into an established neighborhood vs. rolling the dice on one that’s gentrifying. Ritzier schools, less crime, bigger parks, slower development pace, etc.

SW is pretty car dependent. People drive a lot. If we were still in SW we’d be paying more of this tax than we are now.

It’s also a reliable neighborhood for yes votes on school levies, art tax, the Multnomah income tax etc.

My point I guess is that SW Portlanders already demonstrate a tolerance for taxation, so I object a little to Michael’s subtle characterization that they maybe voted for the gas tax because they won’t feel the impact.

The Central City has a good foundation of bike and transit to build on. Residents who live there understand the benefits. Someone living in East Portland and working near Kelly Point might see this as their money continuing to go down the drain. It will a heavy lift to create a bike/ped and a transit network that works well for the outer neighborhoods of the City. This gas tax is a step in the right direction.

Compare and contrast incomes and political views between inner Portland and outer east Portland – I think that the phrase “gentry liberals” is perfectly appropriate.

It’s name-calling based on assumptions, and totally unnecessary. You made your point with “easy commutes and little need to drive.”

some stereotypes have a kernel of truth. the limo-liberal political “in group” has voted for regressive tax after tax that economically represses the lower income “out group”. it’s no surprise that neighborhoods populated by lower income people did not support yet another tax that redistributes income upwards.

All stereotypes have a kernel of truth. My objection is to name-calling. The kernel of truth was contained by the more factual “easy commutes and little need to drive.”

You’re missing the truth-kernel of “In general much wealthier” to describe inner Portlanders (I know this is not true for everyone).

http://zipatlas.com/us/or/portland/zip-code-comparison/average-income-per-person.htm

AllMost stereotypes have a kernel of truth.Fixed it for you 🙂

In the popular imagination, gas taxes are hard on the wallet. The reality is far different. Ignoring that the cost of fuel is a relatively small part of owning a vehicle and adding a few percent to historically very low gas prices wouldn’t even be noticed if it weren’t reported as gas prices fluctuate by way more than a dime. AAA explains the general situation quite clearly at http://newsroom.aaa.com/2015/04/annual-cost-operate-vehicle-falls-8698-finds-aaa-archive/ Low fuel costs are a specific reason that American vehicles are so huge and why high mileage cars don’t sell well.

Especially in this area, there are good options for people who live some distance from work other than driving single cars. Speaking for myself, I lived 45 miles from work for 7 years and more than 20 miles from work for another 10 — and I did not find it necessary to drive despite having way fewer commute options than here and no telecommute option. In addition to alternatives frequently discussed here, there are carpools and vanpools for people who can’t ride a bike. This idea that you have to drive just isn’t true. I’ve lived in rural areas and small towns where I was far from work. There is always an option for those who seek it and it.

People who never get on a bike benefit when more people bike, walk, and take public transit because that frees the roads up for drivers. During rush hour, MAX moves about 1/3 of the commuters along the Banfield and Sunset. Do they really want to add 50% more cars on these roads that are so slow that you could easily bike from Beaverton to NoPo in less time than you could drive? Do they really want already hard to find parking spots more scarce and more expensive?

the reality is different for some people — and especially for limo-liberals who keep on voting for taxes that disproportionately target the poorest of the poor — but for others an extra $62 a year comes out of disposable beer money they do not have.

What exactly is a “limo-liberal” and what do you hope to convey by using the term? Is it possible you could try to find a more descriptive, less derogatory-sounding phrase to express the same general idea?

Ignore the self-hating, limo-liberal.

Shaming hipsters is the ultimate way to display your hipness.

http://www.nytimes.com/2016/05/01/books/review/listen-liberal-and-the-limousine-liberal.html?_r=0

i am conveying my *anger* over the support for regressive economic policies from those who purport to care about working class americans.

It’s a liberal with a tropical taste.

I’ve got to agree with rain panther on this one. “Limo” is actually pretty inaccurate too; we don’t have a huge (by national standards) population of the truly wealthy in Portland; what we have a large and quickly growing population of is people in the upper-middle-class. Generally – white-collar workers making $60,000 and up. I’m in that income bracket and limos are not happening – the difference (and it is a huge difference!) between me and a truly middle-class person is that I never, ever have to truly worry about money if I am at all responsible in my spending and don’t have some sort of financial catastrophe.

How does this target the poor? Were they driving a few months ago when gas was 10cents more expensive? If so, I don’t think you have much of an argument there.

It targets the poor because it’s a much higher portion of income for almost anyone who drives who makes $30,000 than for almost anyone who drives who makes $130,000. Consider that local government is by and large funded by property taxes, and that property taxes that are in general much higher as a percent of value in east Portland than in gentrified inner Portland. That means the poor are paying a higher percent of their income to fund public services than the rich.

If someone can’t afford an extra 10cents per gallon, they should probably look for cheaper ways of getting around.

I make $30,000. I don’t own a car, because that would take a significant amount of money that I don’t want to spend on just getting around.

As someone who used to walk 6 miles a day to and from work at 6AM while living in Outer East Portland, I understand the realities of what you are saying.

But the math simply doesn’t add up. If 10cents per gallon is a hardship to anyone, what were they doing when the price of gas was $2 more expensive?

What will they do when the gas price goes up again?

I doubt your claim that the property tax as a percentage of property value is higher in east Portland than elsewhere. Maybe it’s true, but I’d like to know your reference for this claim. Thanks.

It is because the property tax increases are capped per year and the values of houses in inner Portland are rising at a greater rate than those in East Portland. Inner Portland house values are rising at a higher rate than the maximum allowed rate increase for property tax. Thus, people in inner Portland are underpaying taxes whereas East Portlanders are paying taxes closer to the value of their house.

Here’s an Oregonian article about it. It’s actually MUCH higher in East Portland than in North & Northeast Portland due to Measure 50. Basically, places (like N/NE Portland) that had low property values in 1995-6 but have appreciated tremendously since get an awesome deal on property tax, but places that haven’t appreciated much get a bad deal.

“Residents of the Boise neighborhood are getting the best deal. The average owner of a home valued between $250,000 and $300,000 there pays $1,459 per year.

In Lents, where property tax burdens are the highest, owners of homes valued between $250,000 and $300,000 can expect to pay a tax bill of about $4,463 per year.”

http://www.oregonlive.com/portland/index.ssf/2014/10/how_do_your_property_taxes_com.html

https://multco.us/auditor/property-tax-equity

Measure 5 (and subsequent 47 and 50) are a huge reason why Oregon continues to struggle to fund basically anything, including education, infrastructure, and transportation.

My property taxes on a townhouse valued at under $200,000 are around $2,600/year in East Portland.

http://www.bls.gov/cex/2014/combined/decile.pdf

This puts gasoline+motor oil at ~29% of motor vehicle expenses, not the 19% from AAA. New cars have a high depreciation charge.

http://www.bls.gov/opub/btn/volume-5/using-gasoline-data-to-explain-inelasticity.htm

Not Portland specific, but this estimates 700 gallons/household/year. That’s $70. A burden for few.

Summary of the vote:

If you shop at New Seasons and Whole Foods, you probably voted for the gas tax.

If you don’t shop at New Seasons and Whole Foods, you probably didn’t vote for the gas tax.

I reject the idea that only affluent people voted for this. I can’t afford to shop at either, and purchase only odd items there on very rare occasions.

But I paid less than $1.50 a gallon the last time I filled up my car at Fred Meyer. I think it is both true that this has never been more affordable, nor could we ever afford not to more so than right now.

random did not write that only affluent people voted for this.

I shop at winco and I voted yes.

It’s hard to make an accurate assessment by neighborhoods because of the precinct boundaries, but I see that the precinct between Burnside and Lovejoy in NW (and includes some of the West Hills) supported the gas tax measure by over 60 percent, and the other one that includes the Pearl had 45 percent support, so you really can’t conclude that NW as a whole didn’t support the measure.

Thanks to Michael for an interesting article!

“Safety advocate Roger Averbeck on SW Capitol Highway, which will get a $1.7 million repave and a $3.3 million stretch of sidewalk thanks to the gas tax. (Photos: J.Maus/BikePortland)”

A few clarifications: SW Capitol Highway is not a highway, but is a 2 lane arterial with no sidewalks or bike lanes. SW Capitol Highway is designated as a Major City Bikeway and City Walkway that connects a historic business district / neighborhood center with a town center and civic corridor that may someday have a new light rail line. The project funded by gas tax dollars will be leveraged by SDC funds and BES storm water improvements will include bike lanes (not mentioned in photo credit above).

I voted for the gas tax because of the need to provide safety improvements across the city, especially East Portland, and not because my community in SW Portland is “relatively transit served” – what does that mean? Also, not because I can easily avoid the tax by filling up in Washington or Clackamas County…

Thanks, Roger. I didn’t mean to imply that every southwest Portland resident voted for the tax for self-interested reasons, only to try to explain why it was so much more popular in the southwest than in the east.

“Relatively transit served” referred to transit service at people’s work location, not to their residential location. I’ll try to rephrase.

Would it not be prudent to also examine to which ballot this measure was attached (i.e. primary), voter turnout and the demographics of those likely to vote in political primaries?

An unfortunate consequence of our political structure, is that a measure like this which almost certainly would fail if there were 100% voter turnout, is able to be passed by its inclusion on a primary ballot. Sadly, those constituents most likely to be negatively affected economically by the measure are very likely based on historical trends, those constituents who did not vote on the measure.

That part of Captiol Highway needs a world-class overhaul.

Downtown resident. No car, or plan to own one anytime soon.

Yes vote was easy.

East Portland resident, poor to non-existent bike infrastructure.

No vote was easy.

NW Portland resident who does commute by bike, walks and runs on public pathways. No vote was easy because last I checked 10% of my paycheck, and property taxes are already feeding the government sufficient revenue to adequately perform a fundamental responsibility (transportation infrastructure) if said funds had not been grossly misappropriated.

Or you could vote according to the rationality and ethics of the measure.

affluent inner PDX resident who drives and will never pay a single cent of this tax.

my yes vote was not easy and i’m still hopping mad that the progressive street fee was taken off the table by our commisioner’s wealthy donors.

Thanks for the great article. What is sad is that we are forced to fight over a nickel and dime tax which will create positive improvements in the future of transit and its macroeconomic effect will also be positive as it nudges us one more step towards getting off planet killing fossil fuels. But at the same time the real attacks on the wallets of the poor and working class are coming from the things we can’t seem to control or be to express our displeasure by voting. Unaffordable rents, Health Care Costs that are double the rest of the developed world as a percentage of GDP, Price gouging cell phone and cable companies and the list goes on. If we are to move forward as a civilization we must figure out how to increase the cost of burning fossil fuels while decreasing the cost of non-fossil transport and the other costs that are side effects of our current economic and political system. To paraphrase an old environmental slogan ” There are no commutes on a dead planet”.

Unless I’m misreading the data on this page, Precinct 3301 (which includes the Pearl and parts of the Northwest District) voted for the gas tax (question 26-173) by 64.73%:

https://multco.us/file/53337/download

That would place it in line with the very similar precinct 3602.

Looks like you might be right, I knew the results for 3301 looked fishy.

You’re right, I’m wrong. I was so surprised by this that I checked it twice … but failed to go all the way to the source data when doing so. I’ve deleted the inaccurate section on inner northwest and noted the correction.

Check the numbers on Capitol Highway, the total will be around $12 million with 12ft lanes and just painted bike lanes. $4-5M sounds more like just the gas tax share, and the rest from SDC funds and possibly state. Stormwater management is expensive, especially when you pave a 45ft swath. This is for only 0.8mi, sidewalk only on one side, got to leave that free on-street parking. Painted bike lanes at 45mph… nope. Expect sidewalk biking. $15M/mi congestion relief and free parking is what this is.

Please cite the source of your facts. Have you been involved in the planning for this project, attended any meetings or field trips with community, staff and decision makers, or done anything to influence the design?

Yes, and thank you for the time you’ve put into these meetings. see http://portlandoregon.gov/bes/article/575737 (pdf) page 65, BES trying to reduce the cost from PBOT’s $24M 2011 estimate, see http://www.portlandoregon.gov/transportation/article/353046

But why do people need to chase after the city’s engineers to beg for a place to walk or ride a bike on a Major City Bikeway and City Walkway? Our elected leaders have adopted a plan with the correct priorities. Yet somehow, here we are designing a road which prioritizes vehicle speed and through traffic above all else, allocating more than half of the space to autos, optimizing cost by *only* cutting bike/ped space, and claiming we can’t do better because we’re out of money. Nevermind all of the other unsafe roads we’re not even considering fixing right now. We’ll get to them eventually, but won’t do anything to upset the status quo of cars, cars, cars. The $30M/mile 60ft cross-sections could sure be nice for everybody, but let’s quit the delusion of thinking we’re going to build it like that everywhere (and have free parking) if we just hold our breath until we find the money.

Meanwhile, the traffic of 8500 autos per day here will continue to increase, paying a total of $20k/year of gas tax (generously assuming they drive along this 0.8mi stretch averaging 12 miles per gallon *and* bought the fuel in Portland.) So, what design can we build and maintain for tens of thousands of dollars per year? Maybe not a 45mph one. We’re off by 10^3, or did I miss a meeting?

Fast, cheap, or safe — we get to pick two, maybe one.

That part of SW Captiol Highway is currently 35 mph.

It’s posted at 35, but the actual speed of traffic is what people will use to decide their comfort and risk, sidewalk or bike lane, bike or drive. Given lane widths, sightlines, and turning radii designed for 10-15mph over the posted speed, how fast do you think the traffic will be?

Sept. 2014 traffic count put the 90th percentile southbound at 39, northbound at 38. 70th percentile both directions at 35. Northbound 0.2% over 45, southbound 0.4%

Thanks. Compare to this table: http://humantransport.org/sidewalks/SpeedKills.htm

From 30 to 40mph, a vulnerable user’s odds of dying from a collision increase from 40 to 80%. Maybe that 11mph “gimme” over the posted speed matters (drivers here might not be using it all, but tell me those numbers won’t go up when we rebuild it.)

The Columbia Corridor is difficult to serve with transit because, like most manufacturing and distribution districts today, it has a low job density per acre, because of sprawling one-story buildings surrounded by acres of truck parking and manouvering areas. ( Unlike, say, the Central Eastside in the 1920s, when it served a similar function.

Michael did make an excellent point in the article illustrating the conflict of visions in Portland (as reflected in the gas tax vote) – if you live in inner Portland, and commute downtown, your vision of needed transportation improvements is probably very different than if you live in outer east Portland, and commute to a blue-collar job in the Columbia Corridor every day.

Yet another reason why the current scourge of income inequality must be stopped!

Collective action on anything becomes impossible as the two distinct groups begin to emerge. Even in this realitively homogeneitc city there is a huge divide and it makes concensus impossible. Yeah if I’m earning $10/ hr and driving between 2 jobs all over the place in the only car I can afford I am not going to be able to contribute more.

“Yeah if I’m earning $10/ hr and driving between 2 jobs all over the place in the only car I can afford I am not going to be able to contribute more.”

Except that for some reason no one here in these hundreds of comments is willing to see this as a dynamic problem, imagine what every country on earth I can think of does with additional gas tax revenue, which is to build alternatives to driving alone, so that at the end of the process car dependency goes down and EVERYONE WINS. Are we unable to appreciate this logic because our politicians are too stupid or venal or we have no experience with this sort of thing?

http://www.bloomberg.com/visual-data/gas-prices/

Very nearly every country on this chart with higher gas prices also features the average adult spending less (sometimes much less) $ on gasoline than we do here. Must be a coincidence.

Having been an “Outer East Portland” resident since before the annexation, I clearly understand the outcome of the recent gas tax vote. For over 25 years the city and state have been promising transportation improvements for East Portland. To date, very little has been done. Many promises, little action. Hopefully that’s about to change as many proposed active transportation projects will occur in the next 3-5 years.

East Portland has been a great asset to the city for building inner city projects since annexation. We provide a great deal of revenue for improvements in the inner city, yet receive so little in return. Well, things are moving east because of the great schools, lower home prices, and a great diverse and involved community. It’s finally time to go east and doing it by bike makes a lot of sense.

Thanks to all of you for paying, and voting for the fuel tax. Please note that many of the projects that will be funded with the fuel tax will still be west of I205.

We will do a follow-up in three years and see just how that went. It’s on my schedule.

Most of Portland is West of 205. Do you have any detailed stats showing the amount of taxes vs. the amount of money spent by area?

When I was living in the Outer East, I noticed that there were significantly more car crashes, fires and shootings. All of that takes public money. I doubt Outer East Portland is getting shafted as much as people believe.

Am I just being gullible, or are you actually seriously saying that if my area has a shooting that costs $1m to respond to and investigate and yours gets a $1m investment in a park, that those things cancel each other out in terms of funding “fairness?” Um, wow.

“Sorry little susie, if you wanted a park to play in so bad, you shouldn’t have let your neighbor shoot someone.”

Police and fire are funded by the amount of calls per precinct. Transportation dollars are not funded the same way. Look at a map of bike repair shops throughout Portland and you’ll notice a distinct lack of those businesses east of I205. 25% of the population of the city of Portland, and only 2 bike shops. Does that mean anything?

I think the area has fewer bike shops because there is less demand for bicycle services there, which results in bike shop owners looking to make their modest livings elsewhere. If you think there’s an unserved market, I encourage you to open a shop in that area.

Hm, do you think that lower demand (and money to pay for) for bicycle services in East Portland might be related to any public policies? Like, the installation of exactly one (and only one) greenway here in the last 25 years? Or, the displacement of a large population of on average poorer Black folks, largely to here, when N/NE Portland was gentrified (with public support from the Interstate Urban Renewal Area and Measure 50)? Or, the funnelling of money to downtown Portland to pay for the large concentration of government jobs there, plus improvements such as the Streetcar?

Nonsense. The gas tax is simply not where the costs are, nor is it like there is no benefit. If it were, you’d think people would scream bloody murder when fuel prices go up by many times that amount through normal fluctuation. It is only when the word “tax” is invoked that angst over the amounts gets so high.

If $62/yr is really busting peoples’ budgets with fuel at current prices, they absolutely must find alternatives now since fuel price increases we should logically expect will cost them hundreds.

There are carpools, there are vanpools, there are far more affordable ways than single driver cars to get around. I say this as someone who took these options myself for cost rather than philosophical reasons. Just because I can do math doesn’t mean I’m motivated by a political/social agenda.

Perhaps East Portlanders will vote to renew the gas tax if they see some results in their neighborhood.

A case in point: In 2002 East Portland also voted against a Portland Parks Levy:

https://www.facebook.com/photo.php?fbid=10153386400439430&set=g.39917516044&type=1&theater

But after several recent years of investment in East Portland parks, East Portlanders voted yes for the Parks Bond:

https://www.facebook.com/photo.php?fbid=10153386400369430&set=g.39917516044&type=1&theater

The bond is different from a levy and the 2014 tax burden was less … but it it is reasonable to assume voters respond favorably to positive change in their neighborhoods.

Jim

One point that can’t be ignored in this discussion is the fact that low fuel prices built east Portland. It exists as it does today because of public policy and economic forces that required low density development, parking minimums, and failed to properly price gasoline to include the full cost of its impact on society. Now we have a huge part of the city where residents don’t have sidewalks, transit access is poor, and cycling is dangerous, and many feel like they are forced to drive.

Do we continue to repeat the mistakes of the past the created this built environment, or do we work to improve active infrastructure and transit access, while pricing gasoline to discourage excessive use? Giving citizens no viable options is bad policy: pollution, traffic violence, obesity, and unreliable budgeting for low-income families. I supported the gas tax because I believe it will help make east Portland a better place to live.

A ten cent per gallon does virtually nothing to reduce fuel use while continuing the microbrew liberal tradition of transferring yet another fraction of income upwards.

And let’s not forget the context of this last-minute compromise. There was broad community support for a progressive street fee (one that I would have had to actually pay); however, this option was discarded at the very last minute because wealthy business owners were upset that they would have to pay more than the poor.

The regressive nature of this proposal was highlighted by a city club report and several nonprofits. One proposed solution was to fund additional transit improvements — especially in east PDX. This was never even discussed by our “liberal” city council.

Wow microbrew liberals now… must admit that’s a refreshing change from limo or latte liberal! Had no idea liberalism was so wrapped up in beer, cars and coffee. Do you also have watermelon Blacks or taco Mexicans? I mean, why stop at liberals for debasing, unhelpful and alienating terms to delegitimize others? Just go full Trump and let’s dispense with any facade of trying to communicate or learn here, right? ‘Cause that’s not your goal anyway…

Funny that you mention Trump. I do believe he is a huge proponent of regressive flat taxes like the arts and gas taxes.

Trump’s going to give us a flat tax, and make Mexico pay for it!

I home brew, so I don’t really understand what you are saying here.

wood-fired pizza liberals?

What if we were to allow each neighborhood to opt in or out of the tax, and then we spent the money collected in the areas that had opted in. I don’t really know how that would play out, but it would be an interesting experiment.

It seems pretty obvious to me how that would play out. East Portland would be left to rot, like it has for decades, but at least it wouldn’t have to pay for transportation-related shiny things in other areas like East Portland has for a while. I think sprinkling the money around the city with a slightly heavier sprinkling in East Portland is about as good an outcome as we’re going to get for now.

You might be right, or it might encourage those “out” areas on the edge of the “in” areas to opt in, with the thinking that they might be able to buy cheaper gas in a neighboring “out” area, but get access to new transportation money.

We’re ALL mt. bikers now! :-/

I’m a “hell yes” voter living in the “hell no” part of town. And proudly so.

Here is how I look at it.

Most taxes I pay go into a black box of government budgets. For every extra dollar I pay in income tax or property tax, I really have not the slightest idea what it will be spent on. With a gas tax, I know it will be spent on roads, crosswalks, sidewalks, and bike lanes and so on. That is a heck of a lot more specific, more transparent, than most other taxes I pay. So I was happy to vote “yes”.

Yes, an extra 10 cents/gallon means an extra half-penny cost per mile driven (at 20 mpg) and that is a (very small) incremental burden on lower income people who have to drive. Since when does BP care about that? Removing traffic lanes, increasing congestion, charging for parking, slowing driving speeds are all burdens on drivers. Even more so for drivers who are low income, because those persons are more likely working hourly jobs (lost time = lost income), can’t telecommute or change their working hours, can’t pay for after-school care when they’re stuck in traffic, etc. And yet most of BP heartily supports those burdens.

Celebrates them, actually. Making life suck more for drivers is one of the most popular sentiments on this blog, among writers and commenters alike. Might as well fund some infrastructure improvements in the process.

(Close-in NE resident, commute to downtown and to Vancouver, using bike, bus, and car.)

One thing I didn’t see anyone mention. Delivery drivers. For those of you who are to lazy to get up and go get your groceries, furniture, whatever it is you order from amazon and what not. We are also going to have to pay more for gas but we can’t increase our charges because they are a contract. If we raise them they get someone else to do the job. When you drive a 24 foot box truck if your lucky you get 8mpg. So this tax is taking money from my family’s pocket to pay for the cities lack of plannng, and their spending on pet projects and bike lanes for a group of people who are supposed to obey the same traffic laws motorists are, but choose not to.

Poor thing. Being asked to help pay for the roads that you depend on for your livelihood.

You must have been out of business when gas was $4/gal?

Seriously, the 10c/gal tax is less than the normal quarterly volatility of gas prices. If you can’t cope with a 10c increase, you can’t cope with anything.

You could just say “thank you”.

i’m against this and i suspect many BP readers are against this.

I don’t think he meant incremental burden only on lower income people. Many here (including myself) have extolled the benefits of making driving more expensive. Haven’t you been among them?

it is possible to be opposed to the automobile and opposed to regressive tax burdens on poor people who drive (often because they have few/no choices). the idea that people like me, who reluctantly voted for this flawed tax, oppose encouraging people to drive less is a straw man.

So you are opposed to auto use, but not in favor of making such use more expensive? That’s fine, just curious.

You responded to the comment below in April so you know my position. I’m not sure why you feel the need to lie about what I do or do not believe.

http://bikeportland.org/2016/04/27/editorial-vote-yes-to-fix-our-streets-181760

So you only support regressive taxes when they are high enough to be crippling? I don’t think I lied about anything. I was just trying to understand what seems to be a rather nuanced position you have. As I said, there’s nothing wrong with that.

>So you only support regressive taxes when they are high enough to be crippling?

I’d like to see an answer from Soren, but the way I see a lot of auto use taxes…a small car tax can be regressive, while a large car tax can have the opposite effect.

Accommodations for non automobile transportation are often rather poor. A small car use tax can force poor people not to drive (or at least drive less,) and leaves them with those subpar transportation options. Or to drive at great expense, making sacrifices elsewhere. This is sort of what a lot of people do right now. A large car use tax puts the middle class in a similar position, and would (hopefully) lead to public support for the development of better non car transportation options, eg. walk/bike/transit. Sometimes you need a large market to justify an improvement – a bus every five minutes, multi million dollar sidewalks/bikeways, reallocating existing pavement etc…require a lot of users to get support. Since right now a lot of people make sacrifices to get access to the mobility a car provides, and others are unable to afford a car even when making sacrifices, by providing alternatives that offer comparable mobility the larger tax can lead to a less regressive system.

I would also support a high has tax, especially as part of a carbon tax, but I think it would have to be phased in gradually leaving a period of maximum regressiveness. Hopefully out transit system would react sooner rather than later.

this is exactly what i believe.

and i’m not opposed to small regressive taxes if society make at least a minimal attempt to address distributional effects (with additional and/or targeted spending). the city club and others argued for this with regards to the portland gas tax and it’s sad that our elected officials and most tax proponents never pushed for this.

It will take a long, long time before bus and rail systems expand enough to allow a low income shift worker to get between far east Portland and his job in the warehouse/port area along the Columbia at 10 pm or 3 am without consuming most of their sleeping time.

By the time such a tax is burdensome enough to get large numbers of higher income downtown workers switching away from driving, It will be literally crippling to the low income workers. After all, the $100K household can always bear more expense burden than the $30K household.

Oh, give up on the hand-wringing. You want to reduce driving, you have to burden drivers, and lots of drivers are poor, so a burden on the poor is an integral part of what you are trying to achieve. Being opposed to your own aims doesn’t make a lot of sense.

there are ways to reduce driving without shifting the burden on lower income folk.

the city club report spelled several concrete actions that could ameliorate the regressive nature of this tax.

*crickets*

I don’t recall concrete proposals of this nature in the Sep 2015 CityClub report. Is there another one?

Speaking of concrete, it seems we’re planning to spend around $2-3k for every foot of “complete street”. That number looks to me like it comes out to at least 5000 electric bikes per mile.

They report mentioned increased spending on pedestrian and mass transit infrastructure as one way to address the regressive nature of the gas tax. And let’s recall that after dropping the well-supported progressive street fee due to the complaints of car-centric insiders, the city *SLASHED* spending on pedestrian safety.

A 24′ box truck is gonna run on diesel, not gas. Diesel is exempt from the $.10 increase. Nice try.

Also funny how you insult people for being “lazy”. What do you think would happen to your workload as a delivery driver if they weren’t “lazy”? You seem like a confused person.

“If we raise them they get someone else to do the job.”

Yes, but that someone else is also paying the tax.

“spending on pet projects and bike lanes”

1. That’s dog-whistle politics and doesn’t resonate here.

2. Bike lanes don’t cost very much. In most cases they’re added when roads are repaved anyway. The cost per user for bike lanes is a tiny fraction of the cost per user of roads overall.

“for a group of people who are supposed to obey the same traffic laws motorists are, but choose not to.”

1. Bikeway improvements benefit non-cyclists because they reduce the volume of motor vehicles on the road. You’re welcome.

2. Motorists violate traffic laws at a higher rate than cyclists do. It’s just that the mix of violated laws is different, and offends the sensibilities of the driving majority who refuse to see the logs in their own eyes. For every cyclist who runs a stop sign when no one else is around, there’s a driver who rolls stop signs even when others are present, another driver who stops past the line, blocking pedestrians trying to use the crosswalk, and ten more drivers going above the speed limit.

“For those of you who are to lazy to get up and go get your groceries”

So you have utter contempt for the people you’re serving, precisely because they create a demand for your service. Lovely.

I was nearly right-hooked by a driver in a large truck pulling a trailer who failed to notice me in the bike lane, or to signal that he was turning right directly in my path. I caught up to him a minute later when he again failed to signal right before pulling over to park (luckily I was in the middle of the lane at that point). I rode up to let the driver know that his right turn signal light might be ‘out’, but I had to wait for him to hang up the phone before I could talk to him.

But yeah, let’s go after those lawbreakers on their 20lb two-wheelers of death.