Advisory Committee Tuesday.

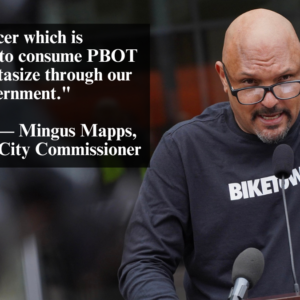

(Photo by M.Andersen/BikePortland)

Portland voters could decide as soon as November whether to approve a per-household and per-business fee that budget committee member David Hampsten said would raise about $25 million a year for street upgrades.

Alternatively, the proposal to pay for transportation infrastructure might simply be approved by the city council after extensive public outreach, a citizen committee member said Tuesday.

With that in mind, Transportation Commissioner Steve Novick and Mayor Charlie Hales have created a new committee of stakeholders expected to vet the plan and, over the coming months, help persuade the city of its merits.

“It’s a sales team,” Steph Routh, a member of the new “Transportation Needs and Funding Advisory Committee,” said last week.

The city says its aging street network is badly in need of maintenance, with $1.5 billion required just to clear the maintenance backlog for the city’s $15 billion transportation system. Novick also frequently mentions the importance of better sidewalk and crossing improvements in East Portland, including them in a $1.3 billion wish list shared with the media last month.

In a potentially related effort, the city is preparing an online community survey intended to gather a sense East Portlanders’ top priority. There’s a meeting about the multi-lingual survey, expected to be usable on a range of phones and devices, 10 a.m. tomorrow at the East Portland Neighborhood Office, 1017 Northeast 117th Avenue.

David Sweet, a member of the city transportation bureau’s standing budget advisory committee, said Tuesday that though Novick hadn’t expressed certainty that the proposal would go up for a direct public vote, the commissioner seemed adamant that this November, which will also see two city council races, the national midterm elections and a high-profile ballot measure to allow gay marriage, would be the best time to put a new fee before voters.

“It’ll be a better attended, higher-turnout election than a primary or a special election or an off year,” Sweet said. “High turnout generally favors progressive ideas.”

Sweet also warned the Budget Advisory Committee Tuesday to expect pushback from people who will say the city should be spending even more on auto infrastructure than it plans to.

“There’s going to be an argument that the revenue needs to be spent to facilitate the unimpeded movement of motor vehicles at all times,” Sweet said, referring to an Oregonian editorial published last week.

Well, the newspaper’s editorial board won’t have a seat on the new committee, Portland Business Alliance Vice President Bernie Bottomly replied, to laughter.

Update 1/17: Here’s the committee listing:

Charlie Hales, Mayor, City of Portland

Steve Novick, Commissioner of Transportation, City of Portland

Leah Treat, Director, Portland Bureau of Transportation

Craig Beebe, Member, City Club of Portland

Richard “Buz” Beetle, Business Manager, Laborers’ Local 483

Bernie Bottomly, Vice President of Government Affairs & Economic Development, Portland Business Alliance

Corky Collier, Executive Director, Columbia Corridor Association

Noelle Dobson, Associate Director, Oregon Public Health Institute

Marie Dodds, Local Dir. of Government and Public Affairs, AAA

Deborah Dunn, President, Oregon Trucking Association

Marianne Fitzgerald, President, SWNI

Maxine Fitzpatrick, Executive Director, Portland Community Reinvestment Initiatives, Inc.

Leslie Foren, Executive Director, Elders in Action

Deane Funk, Local Government Affairs Manager, Portland General Electric

Chris Hagerbaumer, Deputy Director, Oregon Environmental Council

Tom Lewis, Chair, Centennial Community Association

Matt Morton, Executive Director, NAYA

Stanley Moy, Organizer, APANO / Jade District

Linda Nettekoven, Past Chair, SE Uplift

Jonathan Ostar, Executive Director, OPAL Environmental Justice Oregon

Vic Rhodes, Rhodes Consulting, Inc Rhodes Consulting, Inc.

Steph Routh, past Director, Oregon Walks

Carmen Rubio, Executive Director Latino Network

Rob Sadowsky, Executive Director Bicycle Transportation Alliance

Mychal Tetteh, Chief Executive Officer Community Cycling Center

Joe VanderVeer, Chair Portland Commission on Disabilities

Dan Zalkow, Executive Director of Planning, Construction, and Real Estate, Portland State University

Publisher/editor Jonathan Maus contributed reporting.

Correction 5:45 pm: An earlier version of this post incorrectly implied a direct link between the city’s project list and a forthcoming East Portland priority survey, and incorrectly reported the new committee’s name. Also, it failed to cite general PBOT budget advisory committee member David Hampsten as the source of the $25 million figure.

Thanks for reading.

BikePortland has served this community with independent community journalism since 2005. We rely on subscriptions from readers like you to survive. Your financial support is vital in keeping this valuable resource alive and well.

Please subscribe today to strengthen and expand our work.

Regressive taxes, no thanks

Raise the stinking gas tax already. Enough with the surveys.

100% agree. Raise it. Nuff said.

9watts (and others),

Not that you don’t already know this, but I can’t say enough how these policy decisions rarely have much to do with what actually works best in theory. This is all about politics and public perception. Right now the conventional wisdom Novick and others are following is that a gas tax increase won’t be popular with the public. They believe “street fee” does much better in focus groups and polls and therefore — along with its policy credentials — it’s the strongest option.

Not saying I don’t agree that the gas tax has merit. Just wanted to point this out. (and interestingly, my hunch is that the gas tax is actually becoming less of a toxic political concept on the national level).

They are going to to have to sell a method of revenue generation, why not sell something worth having, ie a gas tax! and fees on studded tires! And increased taxes on surface parking lots. And raise parking fees across the city.

I agree with MaxD. There is a political effort to do anything. Spending money and political capital to do something asinine, that doesn’t solve the problem, that makes a bunch of people (who are smarter than PBOT may think we are) mad, that undermines public confidence in the veracity of our public officials, etc. is just a waste of time and energy. The writing is on the wall suggesting we’re going to soon have to do a lot more than this paltry gesture could ever achieve, so why not start doing the smart thing now. Will pursuit of a street fee make a carbon tax or a gas tax hike easier down the road? Hardly.

The ‘it’s not popular with the public’ trope is tiresome, self-fulfilling, just like widening a freeway leads to predictable and unhelpful results. Pandering to what consumers who whine about how much gas costs never leads to good public policy, which is what I thought we’d elected them for.

small disagreement perhaps:

you wrote “these policy decisions rarely have much to do with what actually works best in theory.” I don’t think that raising the gas tax (or failing to seriously consider that option) is a theoretical matter at all. Everywhere this is done, has been done, it ‘works’ in a pretty unambiguous fashion. Lots of money is raised, and driving is fiscally penalized. How hard is this?

I may never understand why we here in the US tell ourselves over and over and over that we’re special, that unlike nearly every other country we here won’t stand for a gas tax. What is up with that? How did we get to this ridiculous impasse? Are we really special?

So creating a whole new tax is more appealing to people than increasing an existing one? That sounds unlikely to me. I’d vote for a gas tax increase but not a per head or per house tax.

RAISE the GAS TAX, Increase deisel tax, and charge for tonnage

Since it’s cars that require the broadest reaches of asphalt, and since it’s cars that damage the asphalt disproportionately, causing the necessity for repairs, why not charge a car tax proportional to the weight, footprint, power, and motive power of street vehicles? I outline such a plan here:

http://t.co/p8SYEJr3mR

That may be behind a paywall, so another version (less financial info) is here:

http://tinyurl.com/mta468t

I own a house and work in Portland and I would be happy to pay the extra cost provided that any fee proposal that shifts the cost away from drivers also results in loss of priveledge for drivers or stricter enforcement.

I supported the Arts Tax. I supported the creation of the Library District. I’ve supported every school measure that’s ever been on the ballot, but I will not support this measure.

Raise the gas tax. It generates more money from people who put more demands on the system (lots of driving and inefficient cars and trucks). It gets some money from those who don’t live in Portland for the use they make of the system. Administrative costs for a gas tax are minimal. These attributes are not found in the utility fee.

get ride of the stupid arts (regressive, head) tax and I’ll give them $35/year.

Go ahead and assemble that “sales team”…I’m voting NO.

I’d be happy to pay a street fee… AFTER Portland converts most of its free car parking into a revenue stream. Expecting to park for free on streets like Division is just crazy.

Bingo. A new regressive tax with additional administrative overhead is crazy when we have neighborhoods where you can’t find a parking spot due to high demand. Add meters to every commercial district with a peak occupancy rate above 90%, then we can talk about street fees.

Milwaukie charges street improvement fee to my PGE billing statement for 3 years or so. $3.50 per house. The city has made small improvements on streets every summer. It is long way to go…

It only funds repaving streets.

benefits of raising/indexing the gas tax:

(1) discourages driving

(2) raises real $$

(3) funds raised are proportional to degree of damage to infrastructure (4) administrative mechanism already in place

And the street fee?

It does none of the above. What is wrong with PBOT?

To summarize: a lusty bump in the gas tax indexed to inflation (or 2x inflation or whatever) is fair, free of overhead, brilliantly simple in that it both penalizes the activities which burden our infrastructure while raising funds to pay for that damage, and it works the world over.

9watts, I may be missing something about your argument so I’ll ask: isn’t the gas tax becoming increasingly regressive, as hybrid & electric vehicles don’t pay much gas tax per mile? One could also hypothesize that these fuel-efficient vehicles are driven by the more affluent, which would add an additional layer of regressiveness.

I think the key difference is that citizens have a choice. You can choose to drive a smaller, fuel efficient car, or to not drive at all. You have to live somewhere; it’s not really an option. So, yes, while the gas tax is somewhat regressive, the street fee would be far more regressive. But until a weight-mile tax is a viable option, raising the gas tax is our best bet.

Ironically, our biggest allies in fighting this street fee will be the Lars Larson, anti-tax crowd. Although, I would like to see what he has to say if you tell him that it unfairly taxes cyclists!

The gas tax as I understand it is a dynamic variable in this admittedly complex mess we call transportation. Let’s say we raise the gas tax steadily into the future (no sunset, just a gradual ramping up and up and up). What happens?

Well, we raise a hell of lot of money with which we could do many things: fix roads is just one of them. Other ideas could be to spend it on alternatives to the car since we’ve recognized the car to be such a problem for children and other living things, not to mention our fiscal health.

Another option, currently pursued by British Columbia, is to rebate the funds raised from a gas tax (or in their case a carbon tax) to households. Those households that don’t use any gas earn lots of money; those who drive more than the average, get rebated less than their cost of gas increased. And best of all gas use goes down because of this – by a lot!

I’ve posted this link here before in a prior discussion of this topic –

http://www.bloomberg.com/visual-data/gas-prices/

and an article about the chart:

http://grist.org/climate-energy/why-we-should-raise-the-gas-tax-and-why-we-wont/

The chart isn’t about equity/regressiveness per se, but it suggests that dynamically countries with gas tax rates from very low to very high see individuals/households spending very similar amounts of their income on gas. This should give those who object to raising the gas tax pause.

You can get an old toyota corolla or geo metro that gets 30+mpg for under $2000. Affluent people buy hybrids as a eco-status symbol. And regressive or not, a gas tax charges the most to people who drive the most. Isn’t that the most fair way to do it? It’s also a fair way to charge a carbon tax because the people who burn the carbon are directly paying the tax. Win-Win!

I am a homeowner in SE Portland and I favor an increase in the gas tax. A gas tax would effect my household evenly since 1 wage earner travels by vehicle and one doesn’t.

I do not need a “sales team” to convince me a per household tax is a good idea. I can already see it will unfairly tax those who have lower incomes and those who travel by alternate means of transport while those who drive heavily have no incentive to alter their habits.

That said, if a tax bill comes in the mail related to improving streets, I will pay it and then take the lane when using my bicycle for transport. I’m serious about taking the lane on streets like Powell, SE Cesar Chaves, Sandy, you name it and I would encourage all readers here, who feel comfortable with this, to do the same.

Please, Mr Mayor, raise the gas tax. Also, while you are at it, create a hefty tax on studded tires.

how does $25 million a year even put a dent in a $1.5 billion backlog?

You beat me to it. Let’s see, $1.5 billion backlog divided by $25 million per year equals… 60 years, and that’s only to bring the system back to where it is supposed to be today. That is, 60 years from today.

Core tax and VMT.

If a tax to provide a benefit does not target the users of the benefit proportional to their use—and does not account for the externalities of that use (i.e.: health and safety costs, property value multipliers, etc.)—then it fails as a viable and sustainable policy. Political considerations aside, this “fee” is a horrible idea.

This sales team idea really bugs me! If I understand it correctly (and please correct me if I am wrong) the City is about to spend a bunch of taxpayer money to try to sell an idea that will add a new, regressive tax on each household instead of simply raising the gas tax. The reason they do not raise the gas tax is because they fear “political backlash”. So, to keep their jobs and/or avoid attempting to explain making a rational choice, they spend taxpayer money to try to get more taxpayer money despite pretty widespread agreement that what they are proposing is not the fairest, easiest, more sensible or even adequate way of achieving their goal. Please tell me this is not happening!

This tax idea drives me insane. I work from home. My wife works from home. Our driving in PDX is incredibly limited. I’m not slapping studded tired on my car every year. Paying the same as my neighbor with a car twice the weight and studded tires makes no sense. There’s no incentive to drive less or to drive in a way that impacts the roads less.

Same. I don’t even drive, and my bus use is limited. I don’t object to increasing my contribution to Portland’s roads, but the idea that a per-household fee actually reflects “use” in any way is pure smoke. This is a regressive tax on residents and businesses in Portland.

I don’t understand all the whining about a reality based gas tax.

It is so obviously the best (fairest, linked to use, etc.) way to go. I get it that the anti tax crowd will scream at anything and assume it will all be spent foolishly. Do we seriously have to listen to them any more?

It is mysteriously interesting that when the price of gas goes up $.05, $.10, even $.20 or more, people wince but don’t complain- and it’s all money that is in no way coming back to them. Raise the gas tax $.02 and there is wailing and moaning- from a vocal minority- and our leaders cave.

By taxing ourselves, we are paying for things we want. Want better roads? Well, obviously, we have to pay for them. The tooth fairy isn’t going to do it for us. Are roads expensive? Hell yes. Is it a waste? Not if we’re not foolish about it. As a matter of fact, it can be a great investment.

Indeed. It’s so annoyingly obvious that I can only assume that, now that the CRC is (thankfully) dead as the proverbial doornail, Charlie Hales & his developer buddies need to drum up some fresh pork/idiot-projects upon which to waste their time & our capital. That, and maybe provide some future ‘credentials’ to their latest crop of junior political stooges.

WHY NOT PUT ON A BALLOT THAT ASKS: GAS TAX OR STREET FEE? WHICH DO YOU PREFER?

Sorry, but there is nothing left for me to give. My Multnomah County Tax Bill, which includes property taxes, AND local bond measures like schools and the Library TAX, went up $700 this year. And they want more? How about we first get a detailed line by line list of the expenditures from the PBOT, lets see where they are wasting their budget right now, before they attempt to ask me to pry even MORE money from my beleaguered bank account. It’s really low. Almost to the point there is nothing left for…..ME!