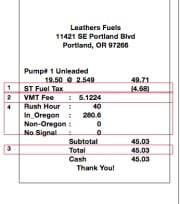

showing VMT charge.

(Graphic: ODOT)

At all levels of government, transportation officials are running scared due to a severe lack of funding available to maintain and improve our roads. The major reason for all this anxiety is the failure of the gas tax to evolve with the times. Truly a “dinosaur” of a funding mechanism, the gas tax hasn’t kept up with inflation, and it is dwindling as Americans drive fewer miles and cars become more fuel-efficient (and electrified in some cases).

While it’s widely accepted we must move beyond the gas tax; no one has figured out a way to do it. Until now.

It turns out the State of Oregon has been working on this for over a decade and they’re on the verge of some major breakthroughs that could lead to implementation of a mileage-based tax system by 2014.

Jim Whitty has managed Oregon’s Road User Fee Pilot Program since it was passed into law by the Oregon legislature in 2001. The project is independent of, but staffed and funded by ODOT, with a mission to figure out how to replace the gas tax. After 16 months of research, Whitty and his colleagues determined that a mileage-based fee, or vehicle-miles traveled (VMT) tax, was the direction to go.

Given all the recent headlines about funding, I recently called Whitty to learn more about what they’ve been up to.

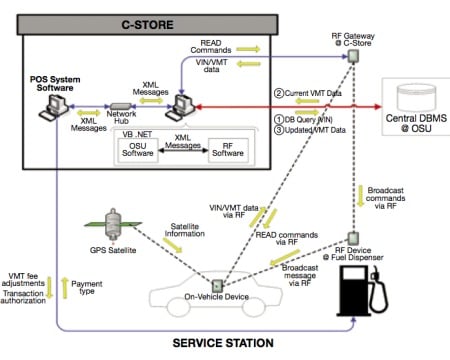

Whitty spoke excitedly about the project and with good reason. Since a pilot of the VMT tax concept in 2006 “didn’t work,” Whitty says they’ve now, “reconceptualized everything and have developed a whole new architecture” for the system.

While they learned a lot from the 2006 pilot, it was ultimately unsuccessful, Whitty says, because they took an “engineer’s approach,” which he characterized as “a bunch of smart people in a room working on something until it’s done.” It didn’t take into account the broader, public and political issues surrounding the project.

“The trouble is,” explains Whitty, “It’s a political issue, not just an engineering one. You have to get public acceptance and there were some policy flaws in that pilot.”

The VMT tax has been saddled from the start with privacy fears due to its reliance on a GPS tracking system attached to the car. Others opposed it due to concerns about government overreach and unresolved questions about how it would work.

With lessons learned, Whitty now says they’ve listened to the public and have designed the program accordingly.

A new pilot, set to begin in September of this year, has been developed around an entirely new paradigm. Here are some key elements (as relayed to me by Mr. Whitty):

— The new system is “open” so that it can evolve as technology evolves.

— The fee would be about $0.0156 (1.5 cents) per mile (which is based on 30 cents per gallon gas tax and a 21 mpg vehicle).

— People will be able to choose how they will meet requirements for paying the fee. “We’ll keep it as easy as possible. People can send in a check, use debit account, and so on,” says Whitty.

— If people don’t want to use GPS, they won’t have to. “There won’t be a push towards GPS,” says Whitty. Technology currently being used in cars like the Ford Sync and Nissan Leaf already send data to the Internet. “All those people would have to do is direct that data to the tax processor.” Whitty also mentioned a device currently used by Progressive Insurance that doesn’t include any location data at all. With a special dongle, users just plug into the car’s diagnostic port (the same one used by mechanics to ferret out engine trouble) and it reads a mileage number.

— A flat-fee option – estimated at about $500 per year – would allow people to purchase an unlimited mileage plan for a set price. Whitty says the maximum mileage would have to be set relatively high, like at 30,000 annual miles, so that people who drive a little don’t end up subsidizing high-mileage users.

— An online form for reporting mileage is also under consideration as an option. “It would be intelligent,” says Whitty, “We want to make sure everyone pays and that no one’s cheating the system.”

— Private sector fee collection. Whitty says they’d like to leave this option open. Not only would privatizing the collection allay fears of increased government bureaucracy, it would also help make the case for the program as a private sector job creator. “ODOT’s role could evolve to simply being the auditor and enforcer.”

“There won’t be a push towards GPS.”

Key to the new approach is that the public won’t be forced to use any single option. “It’s not a push from the state,” is how Whitty puts it. He feels if people have a choice, and can use technologies already available in the marketplace, the program will succeed.

One high-profile fan of the idea is U.S. Congressman Earl Blumenauer. Blumenauer picked up on Whitty’s work, and in 2009 he even introduced legislation around it, saying,

“… with the highway trust fund flirting with a dangerous deficit, we need innovative solutions that will create a steady source of revenue… it is time to expand and test the VMT program across the country… It is time to get creative and find smart ways to rebuild and renew America’s deteriorating infrastructure.”

Next week, Whitty and his team will begin a three-day workshop consisting of face-to-face meetings with companies developing, “leading edge technologies in mileage taxation systems.” 19 firms have already signed up and Whitty is confident that by the end of the week, “We’ll know what the marketplace can give us.”

Besides the technology itself, and convincing the public this isn’t just “Big Brother” creeping into their daily lives, Whitty has to contend with the automakers’ lobby. A bill in the Oregon legislature last year (HB 2328) attempted to implement a mileage-based tax on electric vehicles. Despite uneasiness by EV drivers and advocates, It did better than many thought it would, passing through two committees with bipartisan support.

In the end, Whitty recalls, the bill was killed by a lobbyist hired by a group representing auto makers. Whitty says they were concerned about how exactly the mileage tracking would work. “It was an early attempt and we didn’t have all the answers. We were saying, ‘Hey, trust us.'”

Whitty says they plan to introduce legislation to implement a mileage-based tax for electric vehicles (to start small and work out any kinks in the system) in 2013. By that time, he thinks they’ll have all the answers.

“You can never predict passage, but I can you that all nearly all the issues will be resolved by then and I think think it’s very likely that we can make this happen.”

— Learn more on ODOT’s website.

NOTE: I’ve made an edit to the story to clarify that the $500 fee I referenced is for the annual flat fee option.

Thanks for reading.

BikePortland has served this community with independent community journalism since 2005. We rely on subscriptions from readers like you to survive. Your financial support is vital in keeping this valuable resource alive and well.

Please subscribe today to strengthen and expand our work.

Thanks Jonathan!

As usual, you’re ahead of the curve 😉

I must be missing something. Just raise the gas tax until it is on par with the costs imposed by vehicles on society. That has to be cheaper, technically simpler, less prone to error and evasion, etc.

I am well aware of the non sequitur that ‘raising the gas tax is politically impossible,’ but that is unhelpful, anachronistic, and I don’t think this complicated computer based system necessarily gets around the political challenges of raising fees from drivers/driving.

Obviously fuel consumption is but one measure of the social, infrastructural, environmental damages done by vehicles, and road wear could occur from vehicles that don’t pay gas taxes (el. cars) but that alone doesn’t convince me that the complexity of this system is justified.

Agreed, I’m lost on this point, too.

The number of gallons of gasoline consumed in Oregon is roughly the same as the number purchased.

Heavy vehicles and/or studded tires figure into gas mileage, therefore the users pay a higher rate per mile.

The state already collects a gas tax. Raising it, if necessary, is no less politically feasible than spending more on technology and bureaucrats to collect a new, very similar fee.

When the world is less petroleum-dependent, there’s the existing technology to collect freeway tolls, since those are the only roads financed by user fees at all, anyway.

Completely agree. The administrative and logistical costs of the VMT system seem astounding.

I’m a driver (and a bicycle commuter) and I got no problem at all with cranking up the gas tax. Bring it on!

I’ve long advocated that to pay for invading Afghanistan & Iraq, we should have hit the federal gas tax hard in 2001 and raise it every year since then. Make EVERYONE feel it, not just me (6 middle east/combat deployments 2000-2005).

Ok, sorry for the slightly off-topic rant.

Is the problem that it’s politically volatile, and subject to instability depending on who’s in office?

I agree.

It is ironic that a lighter fuel efficient vehicle will pay as much for the damage to the roadway as a larger beast yet the damage would be much less. At least this brings to problem of automobile taxes to the front.

The next questions is: How do we get to a more acceptable public transit or alternatives (ie bicycles)?

This is not just a vehicle issue as we know. It is a social issue we have ignored.

I completely agree – this funding and fairness issue could be resolved simply by raising fuel taxes and annual registration fees. A 50% increase in the Oregon fuel tax would increase it by just $.15 / gallon to $.45. As was just reported today, fuel prices have increased by about 12 cents nationally over the past couple weeks, just due to market forces. Basically, a local annual increase would be less than the volatility of the market on a monthly basis. Fuel taxes on biodiesel or other non-petroleum fuels should stay the same. Registration fees could be tiered for Gross Vehicle Weight of the vehicle and fuel type, such that electric vehicles pay their part for infrastructure in lieu of gas taxes. This seems vastly simpler than collection of vehicle miles traveled, GPS receivers, and the potential for cheating by tech-savvy individuals or retailers.

Why is nobody talking about how regressive the VMT tax is?

No one has offered an adequate explanation of how I won’t be subsidizing my neighbors choice to drive the F450 King Ranch over my choice to drive a Focus when if we both have the same VMT.

Well, he’ll be getting 12 MPG city while you get more like 30, so there’s that…

Durr, sorry… mileage tax, not gas tax. Ignore my comment!

Keeping the gas tax in addition to the new tax (which is likely what will happen, anyway) would fix this problem.

Hm. Indeed. Seems the only “fair” way to go would be a weight * mile tax such as trucking companies pay. Or at least have mileage tax “brackets” based on vehicle class. What would motorcyclists pay? Seems like for them, paying at the rate of a 21mpg passenger vehicle would be pretty skewed.

What if you drive in Washington and Oregon? Do you not have to pay of Miles Driven out of state?

This solution is over engineered. (guess that is what you get when you put engineers in a room) Just do the politically unpopular but simple solution of raising the gas tax to cover the cost of maintaining the roads.

Why stop with miles driven to tax? What about weight of car, type of tires, type of road, what bridges you use.

It’s called fuel tax. Magically, it accounts for distance * MPG.

yes karl, the reason why they have to have GPS is that Oregon can only charge a mileage tax on miles driven within the state.

Yet if I fill ‘er up in OR, then drive around in WA without buying gas until I get back to OR, then OR benefited from my gas tax tax revenue, yet WA bore the burden of my driving around on their roads. Nothing accounts for interstate driving now, except the assumption that if you drive around enough in a place you will buy gas there eventually.

Can’t wait for the feedback from OregonLive! Why do we need such a ridiculously complex system to calculate mileage when our odometers are checked every couple years when we DEQ? Just tack on a per-mile fee right then & there, before you’re cleared to register your vehicle.

See above, the tax is only charged on miles driven within the state. I am still curious to see how it works when out of state folks drive through Oregon. Seems like a lot of lost revenue.

“Seems like a lot of lost revenue.”

Seems to me like a lot of wasted expense to design, test, administer something so unnecessarily complicated.

“While it’s widely accepted we must move beyond the gas tax”

I am inclined to disagree with that assertion. If you had said, “it is widely accepted that the current approach to a gas tax in the US/Oregon is obsolete, has been overtaken by inflation, provides far too little disincentive to discretionary driving, does not raise anywhere near the revenue to cover the costs driving imposes on society…” I’d agree with you. But implicit in your statement as written is the belief that the gas tax we have is the only gas tax it is possible to have. I don’t see any reason to think this is accurate.

Index the gas tax to inflation, infrastructure needs, looming climate change, the arrival of Peak Oil, or better yet all four. Then we might be able to talk about a gas tax worthy of the name.

http://en.wikipedia.org/wiki/Fuel_tax

Fuel taxes in Germany are €0.4704 per litre for ultra-low sulphur Diesel and €0.6545 per litre for conventional unleaded petrol, plus Value Added Tax (19%) on the fuel itself and the Fuel Tax. That adds up to prices of €1.42 per litre for ultra-low sulphur Diesel and €1.55 per litre (approximately USD 8.10 per US gallon) for unleaded petrol (November 2011).

….

Fuel taxes in the United States vary by state. The United States federal excise tax on gasoline, as of February 2011, is 18.4 cents per gallon and 24.4 cents per gallon for diesel fuel. In January 2011, motor gasoline taxes averaged 48.1 cents per gallon and diesel fuel taxes averaged 53.1 cents per gallon. For the first quarter of 2009, the mean state gasoline tax is 27.2 cents per US gallon, plus 18.4 cents per US gallon federal tax making the total 45.6 cents per US gallon. For diesel, the mean state tax is 26.6 cents per US gallon plus an additional 24.4 cents per US gallon federal tax making the total 50.8 cents US per gallon.

So based on these numbers we could jump the tax on gasoline by a factor of 15 and still not have pulled even with Germany (where still plenty of driving occurs).

My understanding was that this is about the future when more electrics/hybrids are on the road. Plus hopefully a more direct link between miles driven and money paid will make people aware of the cost driving has on our roads. Congestion charges should be the other half of this, of course. A car is still a huge waste of space when it’s parked on public streets weather its gas or electric.

Yes, under our current system, a Nissan Leaf with studs is doing a fair amount of damage to the roads, without paying gas tax. I can see how this is a problem. However, under the new system, a Hummer with studs will be paying the same rate as a Miata, while doing more than twice the damage to the roads. How does this make sense?

We need to have some sort of vehicle weight class multiplier. 2000-3000lb vehicles would have a multiplier, 3000-4000lb vehicles would have a slightly higher one, and so on.

KISS – Keep It Simple, Stupid

This is anything but KISS. This is overhead, complexity, and anyone in network security knows how easy RFID/GPS can and will be spoofed when it involves $$$

Increase car registration fees and/or gas tax. These are no-cost, no privacy measures that take a legislature with balls to pass and then we move on.

I don’t know about this. It hardly seems fair to me that I would have to pay the same per mile tax in my tiny Civic that my neighbor has to pay driving his massive Yukon. Which one of us does more damage to the road?

Or maybe I’m completely missing something.

A far easier solution would be to just do the politically unpopular thing and raise the gas tax.

$1.56 per MILE?

you missed a few decimals. $0.0156/mile

Thanks! I saw the $1.56 in Jonathan’s copy and my jaw dropped.

Of course this is over-engineered, it’s a govt solution.

It seems to me that roads, like public safety, is a natural govt function. Perhaps if we stopped wasting money on nonessential govt activities we’d not devise new and evee-more fantastical ways to tax people.

So what’s your solution? Keep the current system?

I would like to you see you try and define non-essential. Your non-essential is someone else’s essential and vice versa. The government doesn’t spend money unless their is a significant constituency that supports that expenditure.

No, we’d be subsidizing the really high-mileage road users.

I wish my insurance company would charge by the mile as well.

I support a weight-mile tax, preferably in addition to existing fuel taxes (which I’d like to see go up as well).

I absolutely oppose a pure mileage tax that doesn’t take the size of the vehicle into account.

There should be a huge surcharge for studded tire use, as well.

Not a bad idea. When you pay to register your tags every two years, you simply pay based on the weight if your car (easily kept in a database), and the number of miles you drive, on average, in a year (I’m sure that DMV could figure that out based off of odometer readings as well).

So, just make everyone pay this at the DMV every other year.

so what’s stopping Washington residents from driving over, filling up at less expensive gas stations (I assume the gas tax will be eliminated with this proposal) and driving back over the river where they’re not paying the VMT?

I have a feeling this will go nowhere.

What about people who drive through the state but don’t live here? At least now they pay the gas tax is they buy gas here.

And I HATE the “unlimited miles” option.

Interesting. I thought the only thing wrong with the gas tax is the rate is too low.

I have lost the link but there used to be a paper on the web done by my state DOT (TxDOT) that to pay for existing roads maintenance the gas tax would have to be raised a bit to something like $2.60/gallon. This study was done in 2006, and the prices for road-building materials has gone through the roof since then, so $5/gal now?

The VMT based tax is really stupid for lots of reasons.

As pointed out in other posts, the collection costs for the existing gasoline tax is very efficient. The tax is collected at the distributor level and there are a small number in Oregon. The VMT proposal will end up making something like 1.5 million people individually submit remittances to the state. Which is cheaper to administer? I’m like some others who have a significant portion of my auto mileage out of state. There will have to be some accounting for that, which means additional administrave costs, plus whatever docmentation I must submit.

We all know that the gas tax has not kept up with inflation. Since 1993, the highway construction cost index has incrased by 66 percent. Since 1993, the federal gas tax has gone up by 0! Since 1993, the Oregon gas tax has gone up by 25 percent (and that was only two years ago). The failure to index gas tax is what has left us with inadequate money for road maintenance, repair, and modernization. And, it has led to forcing us to make false choices – say between bike lanes, pedestrian crossing signals, wheelchair ramps, pavement overlays, and replacing the Sellwood Bridge.

The Province of British Columbia enacted a carbon tax. It levies a tax on petroleum products as well as natural gas, coal, etc. The tax is based on carbon content. The more you use, the more you pay in carbon tax. For gasoline, it works out to about 3 or 4 cents per gallon. So, the driver of the Suburban pays more than the driver of the Prius. Seems fair to me. So, why would we do away with a gasoline tax that has some of the same attributes? Oh, I know we could implement a carbon tax and a VMT tax. Replace one tax that serves both purposes with two different taxes. Brilliant.

For all those worried that the Leaf owner doesn’t pay for road upkeep, I point out that the gas tax is only one component of the ODOT funding picture. All motor vehicles are also subject to a vehicle registration fee, and title fee, plus we pay driver’s license fees. I drive so little some years that I pay more in registration fees than I do in Oregon gas tax. So my per mile cost is probably higher than most motorists.

Finally, if we’re all worried about the Leaf owner not paying a fair share, why are we giving him/her a $1500 Oregon income tax credit? That’s giving him credit that works out to 96,000 miles at 1.56 cents per mile. If we really want him to pay his fair share (whatever that is), why don’t we just cancel the income tax credit?

Will the VMT tax be any easier to raise than the existing gas tax? I doubt it.

The VMT tax is stupid. Let’s just raise the state gas tax to 41 cents per gallon (1 cent per year) since 1993 and keep it going up by a penny or two every year.

Exactly. The fact that they don’t pay the gas tax is the incentive for them to buy an electric car. And that will work just fine until 30-40% of people own electric cars. At that point, we can start a VMT program.

How ’bout we pay, if we choose, an estimated amount based on whichever way we think makes sense. Come DEQ renewal time, we reconcile to a weight x miles total. Works for me, although my ’85 econobox is doing less damage to roads per mile than it probably is to the atmosphere.

Stay with an indexed to inflation gas tax for now.

Yes, you lose the tax on all electric cars, but we’ve recently had what, a $5000 tax break on them because we want to encourage people to buy electric cars.

Down the line, a VMT would be necessary (and have that adjusted by weight) on E- cars, but as pointed out in the article, they have the capability already to send in their mileage. Bonus for not having to invent a bureaucracy (public or private) to collect VMT on a Model T.

Here’s a simpler solution:

1) You pay a gas tax at the pump. At the pump your VIN is scanned (using a cheap bar code reader) so the tax paid can be attributed to the vehicle you’re driving.

2) At re-registration time they look at your odometer & compare VMT to the tax you’ve already paid. If there is a discrepancy (i.e. you paid too much or too little) then you pay it then or receive a refund. They could even factor in vehicle weight at that time.

3) If you’re upset about having to pay tax for VMT in other states, then you have the choice of logging your VMT using a GPS (similar to the program in 2006) to save you $$.

This solves the following issues:

1) VMT + weight-based tax.

2) Not GPS based unless you want it to be (i.e. fewer privacy concerns)

3) Mostly pay as you go (i.e. you’re not saddled with a $1,000 bill after 2 years of not paying any tax).

4) Cheaper to implement (no mandatory GPS, RFID, etc).

5) You pay the tax, even if your vehicle isn’t registered in Oregon (ex: truckers, Vancouverites, etc)

6) Minimal infrastructure changes to the fueling station.

7) Generally no equipment cost to the vehicle.

8) You don’t have to continually deal with this (i.e. logging into some state VMT reporting website regularly).

I’m all for technology but this is definitely the opposite of a KISS solution. I think we should have a weight-based tax at registration (car registration here is incredibly cheap compared to other coastal states, I was paying 6x in CA what I pay in OR), studded tire permits, and higher fuel taxes.

However you do it, make it inconvenient and VERY expensive to drive a vehicle.

Why?

Just because you may have different needs than others?

In addition to this “mileage based” tax, I would like them to create technology that would enable a “single occupancy vehicle based” tax. With the “mileage based” technology and “single occupancy vehicle based” technology, we can tax the individuals that primarily drive themselves around in cars that can accommodate 5+ passengers.

DO NOT be fooled: Mileage-based taxes are a move in the wrong direction. Consider who the greatest proponents of mileage-based taxes are, “Big Oil” interests and drivers of gas-guzzlers.

Petroleum-fuel based taxes:

1) Reward those who find ways to use less petroleum, i.e. bicycle, motorcycle/scooter, use public transportation, EV’s/PHEV’s, biodiesel, or simply driving with a lighter foot on the throttle.

2) Shift the cost to heavier vehicles. Heavier vehicles wear on roads more, require more parking space, and are more dangerous to bicycles, pedestrians and other drivers in an accident.

3) Are exceedingly difficult to circumvent and require no technology.

We’re better off by not only keeping petroleum-based taxes, but also shifting other types of taxes such as income and sales taxes to petroleum-fuel based taxes.

Reading a Carbon footprint..

essentially Gov wants to equip every veh with a transponder much like an airplane. problem is, the cost to support it, from equipment to support & admin will put it back at square one, much like bicycle registration…to the 100th power.

It would be far more efficient, at least with the current level of technology avail, to ensure every veh on the road has a DIGITALLY DOWNLOADABLE milage device+ Weight class + number of operated hours on engine. A weight/fuel consumption formula can then be derived.

Monitoring doesn’t have to be so convoluted at every fuel stop…geez . GoV doesn’t do ANYTHING real time. …but really…trucks have been using these sorts of systems for a while now.

Admin/ support could fall to DOT -the same agency’s responsible for “clean air”

Milage based insurance could even use the data.

I just gotta say…Government trying to micro-manage anything like this will end up costing far more in taxes…far easier to track basic info, then tighten the classification data then surcharge the worst offenders…reward the best.

*gulp* not more taxes! 🙂

I know, I know, it has to come from somewhere.

I am just glad I don’t have to drive much. (just on the weekends) My work pays for my MAX pass, so its all good.

I recently switched from an econo car to a 4×4 FJ Cruiser. Cut me some slack, I am an avid Mt. Biker and Snowboarder… I needed it for my mountianous lifestyle. Guess I could have gone with an awd subie… but I dig the tonka truck styling a bit more.

Anyhow, I hate filling the thing up, especially compared to my old econo car, but luckily its not too often. If they are going to add a pump tax, at least let me pump my own damn gas. I hate waiting for the slacker jimbob to pump my already expensive gas. (I am used to midwest prices) With slacker jimbob out of the equation, the price should remain the same with the added tax; and I don’t have to wait!

I’ve got a Mazda3 with a roof rack. Works fine.

“Slacker Jimbob” is a person, too, and needs a job, so try to think of him as a human being, ok? (I know you probably didn’t mean it as harsh as it came across, and I don’t either.)

Mrs Dibbly & I recently realized that we only drove 1000 miles last year, including a trip to Sunriver for a professional meeting. Registration cost us more than gas tax, for sure.

I agree that a weight-based registration is the way to go. Florida does that (or used to, at least), based on the make/model of vehicle. I think there are 4 or 5 different weight classes for cars and several more for trucks.

Gas tax should be increased by 50 cents/year every year for 10 years. People will know it’s coming & will have time to adjust. Then you can look for a non-petroleum-based tax.

So the less fuel efficient my vehicle, the lower the tax? Great! Sign me up!

I heard Hummers are pretty cheap these days.

$40 on 82nd Ave.

One thing not discussed in either the article nor the comments (unless I missed it) is the Oregon Constitutional limitation on using gas tax on any thing but roads. Switching to a VMT fee could, if the legislation is crafted thusly, allow fees to be spend on transit, bike and ped infrastructure and generally allow much greater flexibility than ODOT currently has. Looking at the mess of a Transportation bill Congress is currently promoting, I think we’re better off having our own flexible source of state funds rather than relying on Federal $$$ for bike and ped infrastructure and transit funding.

Article IX section 3a of the Oregon Constitution limits the use of any tax on the “ownership, operation or use of motor vehicles” to the same uses as the gas tax, that is, “exclusively for the construction, reconstruction, improvement, repair, maintenance, operation and use of public highways, roads, streets and roadside rest areas…”

The mileage tax proposals are purely about obtaining more money for building roads. The meme: “it’s widely accepted we must move beyond the gas tax” is going to be repeated so often, just like an annoying TV commercial, that people will start to uncritically accept it as truth.