After a long pause to gather its strategy and thoughts, Portland’s city council is expected to launch its latest plan Wednesday to raise money for the city’s streets.

The new concept, a public vote for a temporary local gas tax of 10 cents per gallon, comes endorsed by a 93-page report from the City Club of Portland and at least two mayoral candidates (Jules Bailey and Ted Wheeler) as the least bad way to slow the city’s deepening pavement problem while getting some high-priority safety improvements on the ground.

And in a new development, it looks as if some resources have been found for one of such a ballot issue’s biggest needs: an organized “yes” campaign.

If approved by voters on May 17, the tax would raise $16 million each of the next four years.

It’s not nearly enough to stop all the city’s roads from falling apart further; that’d require $50 million a year, according to the City Club. Nor is it enough to achieve the city’s “Vision Zero” to eliminate preventable traffic deaths.

But the campaign’s backers say it’s a start, one that would give the city a burst of new revenue that could address pressing problems like damaged pavement on Southeast Foster Road and Southwest 4th Avenue; missing sidewalks on Southwest Capitol Highway; car and bike traffic that mixes haphazardly downtown; and speeding traffic near schools like Lents Elementary and David Douglas High School.

Gas taxes are always a hard sell politically. But unlike other ways of raising money, a gas tax would let the city get some revenue out of people who use Portland’s streets without living here.

Because richer people tend to drive more than poorer people, backers say, a gas tax is also modestly progressive.

Advertisement

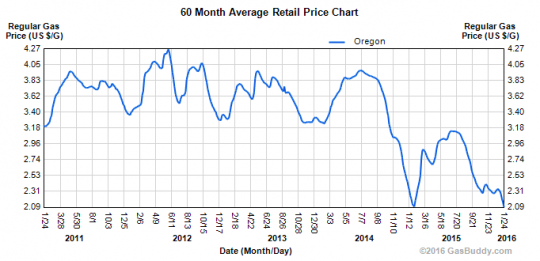

Finally, the gas tax proposal comes after a long and lasting drop in the actual price of gas.

In Oregon, the average gas price is down more than $1 since winter 2014. For context: It’s actually fallen by 10 cents, the amount of the proposed tax, in the last 10 days.

You can read the city’s full description of how it would spend the gas tax on this PDF that auto-downloads from its website.

In an interview Saturday, Fix Our Streets campaign manager Aaron Brown said he thinks the campaign will appeal to a wide number of local institutions.

“I don’t want to speak ahead of other organizations that wish to come out and make their own announcements about this, but I am optimistic that this is a proposal that a variety of organizations with different interests in Portland can and will get excited about,” Brown said.

Brown said he couldn’t yet share details about the funding of the Fix Our Streets campaign but that “we’ll have a full release about where the money’s coming from and that sort of stuff on Wednesday.”

Brown, who also serves as the president of the board of Oregon Walks, also said that to pass, the campaign will need a lot of volunteer support.

“This is it,” said Brown. “We’re going to vote on it, May 2016. Everyone who has ever sat around thinking about how great it would be that they had a chance to tell elected officials how they deeply care about road safety and maintenance and show that they care about investing in their infrastructure, should save May 17, 2016, as the day they need to get their ballots in, and should prepare to help out with the campaign.”

He hopes people will be able to show up to city council on Wednesday to support a council vote to refer the issue to the ballot.

“If you’re interested in providing electoral support for livable streets in Portland, we need you Wednesday at 2 o’clock,” Brown said.

— Michael Andersen, (503) 333-7824 – michael@bikeportland.org

BikePortland can’t survive without paid subscribers. Please sign up today.

Thanks for reading.

BikePortland has served this community with independent community journalism since 2005. We rely on subscriptions from readers like you to survive. Your financial support is vital in keeping this valuable resource alive and well.

Please subscribe today to strengthen and expand our work.

Let’s just hope “fix our streets” means redesigning to put people first and eliminate traffic violence, instead of making pavement smoother for easier motoring.

I think you’ll be pleased with our campaign. Hope to see you on Wednesday at 2pm.

https://www.facebook.com/events/1136749633011214/

Unfortunately, I will not be able to attend this event, but look forward to future ones! Is there a web site or Twitter account to follow so we can be informed of upcoming events?

Would you support a levy on bicycle ownership to help pay cycling’s share of transportation budget? maybe a one time excise of $50 per bike sold?

“Would you support a levy on bicycle ownership to help pay cycling’s share of transportation budget? maybe a one time excise of $50 per bike sold?”

This question is premised on a misunderstanding of what modes exact costs that the tax payer (or someone) must fund. Please tell me what costs bicycling exacts that are not derivative of the overwhelming presence and danger of the automobile (except bike parking)?

I would only support a levy on bicycle ownership that was reflective of the amount of damage bikes cause to the road surface. Let’s call it, one cent per year? 😉

“I would only support a levy on bicycle ownership that was reflective of the amount of damage bikes cause to the road surface. Let’s call it, one cent per year?”

If you aren’t using studded tires, passenger vehicles do very little damage to roads as well. Aside from weather, the real damage is from buses and trucks, with lots and lots of weight per axle. Good luck taxing them.

Someone here knows how to compare these: bike, car, truck in terms of the damage they do/yr. My guess would be that although the truck’s potential for road damage is orders of magnitude greater than the cars, the car’s is not negligible.

And while we’re talking here I think only about asphalt deterioration, there are hundreds of other costs that automobility exacts that the taxpayer picks up: nasties that drip from cars drivetrains and tires that make their way into water ways, parking infrastructure, police presence, hospitals, air quality, and the list is nearly endless.

Right, and don’t forget the unmeasurable costs to our livability, land use, loss of life, and health damage that car dependency causes.

Somebody flatted a road sign in my neighborhood that had to be replaced. Pretty sure it wasn’t somebody on a bike.

duh, flattened

I have read that road damage is proportional to the 4th power of axle weight… therefore a vehicle weighing 2x as much would do 16x the damage, and one weighing 3x as much would do 81x the damage.

Taxpayers get an excellent return on investment in infrastructure for motor vehicle use, which is the reason that investment continues to be gladly made by the public. Motor vehicle transport and travel supports personal and family income, as well as city, state and national economy in ways that no other transport system currently available can match.

Bikes alone simply can’t substitute for motor vehicles in this capacity today, to a level of service most people desire. So you can laugh and sarcastically refer to motor vehicle transport and travel as “automobility”, but the plain and simple fact is that motor vehicles continue to be very much what people today want and are willing to budget for.

Which doesn’t ignore the fact that bike travel and transport can be a very effective and enjoyable adjunct towards meeting travel and transport needs. More people may come to discover this to be true for themselves personally, especially where better community planning can provide the conditions for that discovery to happen.

“Taxpayers get an excellent return on investment in infrastructure for motor vehicle use, which is the reason that investment continues to be gladly made by the public.”

Actually the public isn’t making the investment, ODOT or PBOT are, which your claims notwithstanding are not the same thing as the public.

“Motor vehicle transport and travel supports personal and family income, as well as city, state and national economy in ways that no other transport system currently available can match.”

That is kind of circular wouldn’t you agree?

A century of lopsided overinvestment will get you into that predicament pretty easily.

“Bikes alone simply can’t substitute for motor vehicles in this capacity today, to a level of service most people desire.”

That too is tautological, but the question is how do we get out of this bind?

“So you can laugh and sarcastically refer to motor vehicle transport and travel as “automobility”, but the plain and simple fact is that motor vehicles continue to be very much what people today want and are willing to budget for.”

I am not being the least bit sarcastic.

“Which doesn’t ignore the fact that bike travel and transport can be a very effective and enjoyable adjunct towards meeting travel and transport needs. More people may come to discover this to be true for themselves personally, especially where better community planning can provide the conditions for that discovery to happen.”

Except that your assertions above don’t exactly encourage this sort of prioritization, do they?

ICE emit a bunch of pollutants that diminish our air quality and cause health issues like asthma, that is a very real cost of passenger cars

you sort of negated your own statement.

most damage is actually from weather/water in the NW. lots of damage on side streets that never see a bus and very few trucks.

Yet, we have sidewalks that are more than 100 years old, and looking pretty good.

It would seem that cars and trucks do damage roadways in ways that multiply the effects of weather and water.

I keep hearing this argument that cars cause 1/1000 the damage to the roadway that large trucks do. I have two problems with its. First: We all need freight where driving a car is often a personal choice. Second: If cars cause so little damage why is the fast lane in the freeway worn out almost as much as the slow lane? Wouldn’t it last 1000 times longer since there are no trucks? As for the one time bike fee I would propose that various modes could pay respective of their subsidy cost to the city vs their economic impact on the local economy. In this case cars would pay hundreds of additional dollars each year to cover free city wide parking and the impacts of congestion and pollution. Where cyclists walkers and skateboarders would each receive a check for not clogging the streets and right of way, not causing pollution and offsetting public health costs by living a healthy active lifestyle.

Just sayin…

It would be possible to deliver the freight with more smaller vehicles, each with a lower axle weight, that each would do less damage to the roads. So there is an element of choice in that side of things as well.

If freight really is damaging our roads, it’s only reasonable that the cost of that damage be included in the cost of freight.

I guess I would start by looking at the physical amount of roadway space and infrastructure dedicated to bicycle transportation. For example, with the Springwater I would determine the % use by cyclists and the capitol costs of construction and upkeep. Similarly, I would calculate the % of the roadway occupied by bike lanes. Now I would add a incentive credit because cycling is a something we want to encourage as a societal good, but cycling would need to begin to have its own independent sources of funding and not ride the coat tails of automobile infrastructure. Only in the way will we move the development bike infrastructure out of the margins and identify major projects and funding sources to build them.

Road building and maintenance are only half-funded by fees and taxes on cars; the rest comes out of general taxes. Since motor vehicles are doing quite a bit more than half the damage and have access to quite a bit more than half the road space we have built, it is quite clear who the free-loaders are.

Add in the societal costs of the 35,000 direct-hit annual deaths 50,000 annual deaths caused by the air pollution that exits motor vehicle tail pipes, the hundreds of thousands of cancer deaths due to the same, the cost of dealing with climate change, largely caused by the same, the cost of the hundreds of thousands of cases of diabetes and heart disease, also caused by sitting in these motorized couches, and it should be clear that we are subsidizing the over-use of these awful machines to an extent that is as horrifying as it is gigantic.

Cycling infrastructure still costs money.

Sure, but you get more of a return on your investment from bike infrastructure. Protected bike lanes are cheaper than roads for cars, so for the same money, you can get a larger network. Bikes also do little to no damage on roads, so the cycle paths will last longer and require less maintenance. Studies have shown that people who arrive to businesses by bike spend more money than those who arrive by car. And that’s not even counting the social costs to society that cars impose, including injuries from crashes, reduced health, increased land use, etc.

Sure, but think for a moment: why do we need it in the first place?

“Cycling infrastructure still costs money.”

So do sidewalks.

But we wouldn’t need either but for the automobile.

See how this works?

They were building sidewalks long before cars came along. I guess folks didn’t like walking in the mud and horse manure.

And they were building roads long before cars came along. I wonder why people think roads belong to cars?

Hilarious response. An order of magnitude cleverer than what I was going to write. Thanks!

No

Do we forget that most of us make a choice to ride a bike *instead* of driving a car? Other than a small percentage of recreational riding on city streets, my bike trips replace car trips.

Riding my bike instead of my car, is the same as paying a tax. When I ride, I make a contribution to society that is more valuable than the current gas tax or the proposed street fees.

Also if you read Todd Litman’s Whose Roads (linked here many times), he makes the persuasive case that those of us who do not drive actually overpay for the maintenance of our transportation infrastructure to the tune of several hundred dollars a year (through general taxes, mostly). You see perhaps why some of us find the ‘but bikey folks are freeloaders’ perspective tiresome.

No! There aren’t enough bikes out there to make much of a dent in that kind of funding anyway, even in a seemingly bike commuter heavy town like PDX.

I’m already paying my share of the transportation budget. More than my share, I’d guess.

Since I already pay cycling’s share of the transportation budget, and then some, no, I would not be in support of that.

Let’s do same for every pair of shoes sold. Because sidewalks. Not.

For the amount of money the suggested tax will bring in…64 million over four years…just patching up existing infrastructure will be an accomplishment. Better work towards an additional, separate and specifically designated gas tax to raise money for redesign.

I wonder how much gas is sold inside city limits? Tax should be county-wide (including Clackamas and Washington). Plus, an excise tax on parking. Upping fines for speeding, distracted driving, etc., would be nice too. Heck, by simply enforcing existing laws would go a long way toward paying for street improvements.

I am with you on this Mike. Personally as a cyclist and motorist living ON an ODOT street. 10 cents is a drop in the bucket. I am for a minimum of $.25 or 25 cents a gallon in Portland and the surrounding counties including Columbia county.

Here are the gas taxes in Oregon from jurisdictions other than the state. Washington and Multnomah county already have a gas tax.

But why do Washington and Clackamas county need a gas tax to fix Portlands roads?

MULTNOMAH COUNTY $.03 per gallon

WASHINGTON COUNTY $.01 per gallon

CITY OF WOODBURN $.01 per gallon

CITY OF EUGENE $.05 per gallon

CITY OF SPRINGFIELD $.03 per gallon

CITY OF COTTAGE GROVE $.03 per gallon

CITY OF VENETA $.03 per gallon

CITY OF TIGARD $.03 per gallon

CITY OF MILWAUKIE $.02 per gallon

CITY OF COQUILLE $.03 per gallon

CITY OF COBURG $.03 per gallon

CITY OF ASTORIA $.03 per gallon

CITY OF WARRENTON $.03 per gallon

CITY OF CANBY $.03 per gallon

CITY OF NEWPORT (NOVEMBER 1ST – MAY 31ST) $.01 per gallon

CITY OF NEWPORT (JUNE 1ST – OCTOBER 31ST) $.03 per gallon

CITY OF HOOD RIVER $.03 per gallon

And I can attest that Hood River city councilors fought very hard for years for that measly $.03. People in the county fought equally hard against this ‘social injustice.’

Mike,

How does enforcing existing laws ‘pay’ for roads?

Most of the traffic citation collected goes to the County Courts and the State.

Sorry, but PBOT does not need even more money. If PBOT would stop wasting dollars on equity and diversity nonsense, marketing nonsense, etc., etc., etc. PBOT has tons of case that it wastes on outside consultants that do work the department has people already on staff to do.

Just like education, just like welfare, enlarging the government’s wallet will not fix the problems. It fact, it almost always makes the problem worse.

The federal gas tax has been static for 23 years, and all the while our transportation infrastructure has deteriorated to alarming levels. The argument parroted by misinformed people and cowardly politicians that “government has enough money and get them people off welfare” is one of the biggest problems in the country. If you can’t afford $.10 a gallon, fill your Escalade in Beaverton.

Huh, continued to deteriorate despite hundreds of billions collected at both the federal and state and local levels…yeah, lets just throw more money at these irresponsible people.

Just like hundreds of billions of welfare and tens of billions on education at the federal levels…welfare is always worse.

Sorry, but the answer is not feeding the monster more and more money.

I think you’re misunderstanding. The federal gas tax has been fixed at 18.4 cents per gallon since 1993. Everything has increased in price since then. The population of the US has gone up almost 60 million people, putting more strain on the transportation infrastructure. Vehicles have gotten more efficient which means the gas tax income per mile is lowered.

Effectively Americans are getting a gas tax cut with each passing day.

Exactly. Everything has gone up and construction costs, especially for things like asphalt and steel, key components of transportation systems have gone up more than the average.

The Corps of Engineers’ Construction Cost Index for streets, roads, and bridges has gone up by 70 percent since 1993.

Even cutting all the “waste” (and I do agree there is some) would not come close to matching the loss of purchasing power due to construction cost inflation.

I’m with you on everything you said but this:

“Vehicles have gotten more efficient which means the gas tax income per mile is lowered.”

This has been found to be a trifling share of the mismatch (Sightline Institute study that has been linked to in past conversations here). Inflation in the cost of things like asphalt and gravel and concrete is a dramatically bigger deal when it comes to the shortfall.

The increase in efficiency of the vehicle fleet is mostly a myth or at least vastly overstated.

Yes, there are more high mileage autos, but they account for a small portion of the fleet. In 1993, the average fuel economy of the light-duty vehicle fleet was 20.6 mpg. By 2012, it had risen to 23.3 mpg. For the “long-wheelbase” component of the light-duty fleet (think, pick-ups and large SUVs) the fuel economy had actually fallen from 17.4 mpg in 1993 to 17.1 mpg in 2012.

Interesting that the federal govt goes out of its way to provide tax write-offs for 6000lb+ vehicles. For example, if you buy a $50K heavy SUV and claim 100% ‘business use’, you can claim depreciation deductions of ~$30K.

“…If you can’t afford $.10 a gallon, fill your Escalade in Beaverton.” ron

Escalade? Hah! Right there along the ‘let them eat cake’ line of sensitivity to the dilemma people of modest income have to deal with. Lots of people are lucky to have a 20 yr old economy car. A dollar isn’t throwaway money to everyone.

Portland’s transportation bureau is given an operating budget by the city’s residents. Why is the money for road repair not being figured into, and drawn from that budget? Maybe the city has a justifiable need for additional money outside of the transportation bureau, from a gas tax, but if so, it had better be able to make a better case for it than it has so far.

In some cases I think education might make things better.

https://www.youtube.com/watch?v=B1lfgrs2sKM

http://youtu.be/M689xuNgJyA

yeah, because everyone knows that Beaverton’s hasn’t built any roads in the past 23 years which need maintenance.

I’ll agree that PBOT and the whole City of Portland are probably doing equity wrong, and probably spending the money wrong in pursuit of it, but – and I can’t say this loudly enough – equity and diversity are NOT nonsense.

If you don’t understand yet that deeply systemic racism is embedded at every layer of Portland’s history, design, and current condition, I encourage you to get interested in the subject and inform yourself. It’s not some random accident that “poor” and “minority” tend to be overlapping categories. It’s not some fault of character that drives those people out of the urban core to car-dependent outer-ring neighborhoods.

And it’s emphatically not a mere coincidence that those areas keep failing to get sidewalks, paved streets, bike facilities, and good traffic control. The City preferences its rich, white core and inner ring areas consistently, and has always done so.

A great place to start is the new, locally-produced podcast, Why Isn’t Anybody Talking About This?. From its About page: “An inquisitive, authentic look into the relationship between justice and the built environment. Conversations with leaders, fighters, and everyday people hoping and working for change. Unapologetic, well-informed, and ready to challenge you. Are you ready?”

This is also true of basically everywhere in the US.

Absolutely. The more I read and listen, the more that fact comes out. Portland has an unusually high white population, and Oregon has an especially egregious history with regard to race, but the inequity problems here aren’t unique by any means.

“…And it’s emphatically not a mere coincidence that those areas keep failing to get sidewalks, paved streets, bike facilities, and good traffic control. The City preferences its rich, white core and inner ring areas consistently, and has always done so. …” hawley

Highest income return from investment is a big factor in determining which parts of a city tend to get the best engineering and infrastructure. Tax revenue. It’s not simply racism or poverty that has some parts of the city missing out on basic amenities such as paved streets, sidewalks, street lighting and traffic signals. It’s not fair, but you know how that fact of life goes… .

“Highest income return from investment is a big factor in determining which parts of a city tend to get the best engineering and infrastructure. ”

I assume you are saying this with a straight face?

What does that even mean – return on investment? We’re talking about public infrastructure here, not a manufacturing facility.

It is, however, systemic racism that keeps certain groups in greater poverty and drives them to “poor areas,” where they then have a harder time getting to crappier jobs, and so, quite rightly, pay somewhat less in taxes.

If ROI is a big deal to the City (and I’m not saying it shouldn’t be), helping to increase prosperity and opportunity for under-served communities should be a top priority. The incremental gains from freeing people to prosper go smack into the public coffers.

Maybe, though, increasing opportunities for poor and non-white people is simply the right thing to do. We privileged, ROI-oriented middle-class white folks owe it to them. We may never get to actual reparations in this country, but could we at least get to where privileged white people don’t bitch and moan about money “wasted” on attempts to help include the excluded?

Unless this is some novel, non-economic riff on the term, ROI is the wrong measuring stick for deciding about *public* infrastructure priorities.

“Finally, the gas tax proposal comes after a long and lasting drop in the actual price of gas.

In Oregon, the average gas price is down more than $1 since winter 2014. It’s actually fallen by 10 cents, the amount of the proposed tax in the last 10 days.”

“Lasting” – i.e. gas prices have been lower than usual for all of a year and a half.

I’d stay away from that argument – I don’t think that a lot of people out there (including the backers of the initiative) think that gas prices are going to stay low indefinitely – unless you are proposing to get rid of the gas tax if gas prices go back up.

Given the absurd number of new SUVs and trucks on the road, people apparently do think that. Or they are just really stupid. Or both. Probably both.

Here’s why I included “lasting,” more or less:

http://www.barchart.com/commodityfutures/Crude_Oil_WTI_Futures/CL

http://www.nytimes.com/interactive/2016/business/energy-environment/oil-prices.html

i think that oil is going to become virtually worthless over the next few decades. it’s probably only a decade or so behind coal on the progression to energy/fuel irrelevance…

It’s not worthless, it just has less value. With these lower prices why pay a premium for a hybrid or electric car? These low prices if they last, will extend the life of oil based energy.

why pay a premium for water pipes not made from lead or insulation not made from asbestos?

Those with less money, will buy the best value for them, not what is best for society. If everyone is so socially conscious, then why isn’t everyone driving a Prius, or a Volt or a Leaf….. Economic realities seep in and with gas below $2 a gallon that reality is here and now. You assume that lead pipes and asbestos went out of favor because people stopped using the material. Or is it more likely that government banned the use of those products?

Taxes are comically rarely temporary. When the city realizes that no street in the city should have a greater speed than 25, I am all for it. We know that won’t happen… But how about putting usable lanes on every street downtown? Let’s start there. How about let’s remove any lane in the city greater than 3 on a street and make it just for bikes and runners/walkers? Let’s start there.

Any city that has a mural painted praising bikes framed by two racing one ways seems a bit hypocritical.

I think it is very disingenuous that they are selling this as “temporary”. Let’s be realistic. We need a permanent local gas tax to fund street safety improvements. This is how they should sell it.

This gas tax is “temporary” in the same way that the diverter at Clinton and 32nd is “temporary”. Once the tax is in place, it becomes much easier to maintain the status quo by renewing at the end of the four years. Additionally, it makes it easier to come to a compromise solution by passing something lower now, but raising the gas tax later once everyone sees the benefits outweigh the drawbacks.

I am all for a gas tax (of any stripe) but will note that a short two years ago everyone from Novick to Jonathan Maus were convinced that a gas tax hike was out of bounds, a dinosaur, inconceivable. Glad to see this quick turnaround.

I’m a fan of gas taxes in a pluralistic democracy with a minimal social safety net. I’m not a fan of gas taxes in the USA.

i would support a gas that is paired with progressive taxes that offset inequity.

A had tax disproportionately targets the poor, who mostly drive ourselves to workplaces to make their boss rich, to the grocery store to repair our tied bodies, to bring the future workforce to schools and daycares. The transportation infrastructure mostly serves industry, offering routes to commuters. The trucks which deliver profitable goods disproportionately induce wear and tear on the streets.

The repair of our failing infrastructure, subjected to insufficient budgets by neoliberal technocrats, should not be on the shoulders of the exploited, but from the profits they create.

Don’t want to pay the gas tax? walk, bus, max, carpool, bike there are numerous alternatives.

you do realize that society can choose to implement a tax gas with progressive provisions. i wonder why this is politically off the table…in…”liberal”…portland.

“i wonder why this is politically off the table…in…”liberal”…portland.”

The political establishment still remembers the Multnomah County income tax, which had some impact in encouraging affluent people to relocate to adjacent counties, while it was in force.

good riddance.

“good riddance.”

Most affluent people in the Portland metro already live in the burbs (all three suburban counties have higher household incomes than Portland). Depends whether you want to accentuate that or not.

Why do you want affluent people to leave Portland?

What would this “progressive” gas tax look like? Show your W2 when you fill your tank? Gas coupons for those making below a certain income threshold?

If you are truly poor, then a motor vehicle is about the worst thing you can own in terms of sucking money out of your pocket. We have a heavily subsidized public transportation system. Use that and save some money.

noblesse oblige.

I feel like this attitude completely ignores the fact that poorer people are now forced to live on the outskirts of Portland, where public transportation is of much worse quality than in the center of the city. It just comes across as “they should sit on the bus for four hours and thank us for it”.

I live in a lower than the median income neighborhood in Portland, and I’m going to guess that there is a higher level of car use and ownership here than many other neighborhoods in Portland.

I think Michael’s statement about poorer people driving less is likely true if you’re looking at the extremely poor, but in categories above that, I’m not sure that it is.

““they should sit on the bus for four hours and thank us for it”.”

AKA – “I live at 20th and Belmont and bike to work downtown. If I can do it, so can everyone else.”

Not to mention wanting to bring your children safely home from school. No sidewalks, dangerous roads, and more sketchy neighborhoods. It’s always easy to wag the judgmental finger when you know relatively little about the realities that others face.

“…I think Michael’s statement about poorer people driving less is likely true if you’re looking at the extremely poor, but in categories above that, I’m not sure that it is.” davemess

People with good incomes by new cars. People with relatively modest incomes by those cars when they come up for sale used. This system works progressively downward according to the relative income of the persons needing transportation to get to work. There’s plenty of decent quality old cars on the market for 5000 bucks and less. Insurance is the big ticket. If the daily drive isn’t too far, gas, especially with current low prices, isn’t a big deal compared to mass transit.

In short, I think it’s fair to question correlating people’s income levels with their ownership or use of motor vehicles as “…richer people tend to drive more than poorer people, …”. There’s many variables figuring into whether a person walks, rides a bike, takes mass transit, drives a car or carpools in order to put food on the table.

“People with relatively modest incomes by those cars when they come up for sale used.”

In these days of “no money down” and “0% financing”, I suspect that’s not really the case, and likely a large cause of the ballooning American consumer debt.

This is why improving public transport in car-dependant neighborhoods must be included in any conversations about “fixing our streets”.

I would have no problem supporting a gas tax if it also included a direct subsidy of mass transit for lower income residents.

(IMO, mass transit should be free for anyone below the median household income. And I’m willing to pay for this subsidy via higher taxes.)

This is certainly possible if we consider a gas tax as more of a “sin tax” than a user fee. Gas taxes and other fees for car usage should be used to offset the cost they burden society with; by improving bike infrastructure, increasing public transport frequency and reliability, and by rebuilding roads to remove space for cars.

They’re really not. They are free to live anywhere in the country they choose.

Low income people are constrained to housing choices by what they can afford. Most of the cheaper neighborhoods in Portland and around the country are far more car-dependent than denser, more multi-modal neighborhoods where people can live car-free. This forces people already struggling to pay rent to have to pay for and maintain an expensive automobile just to get to work, the grocery store, etc.

No one deserves the burden of car ownership to be forced upon them, and this is why denser neighborhoods like the Pearl have affordable housing. A neighborhood is no longer affordable if residents are forced to pay for a (relative to other modes) expensive car. Transportation costs are typically the second-highest cost after housing and are unfortunately often left out of the affordability conversation.

All people, regardless of income level are “constrained to housing choices by what they can afford.” Or, as evidenced by the recession and home loan crash, should be.

“Free to” and “able to” are not the same thing. I can’t tell if you’re being sarcastic here and aping well-off libertarians, or what.

Poe’s Law

Hey, in today’s environment and based on some apparently quite sincere comments on this very post, it’s extremely hard to tell.

We actually have very good numbers on how much people drive by income category. Yes, the increase in driving does flatten out somewhat after you get above $40k, but even people who make $40k-$60k and live in a “dense” urban area (which includes Portland in this category) drive about 10% less than people who make $100k or more. Here’s the chart and citation:

https://twitter.com/andersem/status/691709731828727808

Below $40k there are big drops in driving. Urban households that make $40k-$60k drive about 50 percent more than urban households that make $20k-$40k, and urban households that make $20k drive about 30 percent more than urban households that make less than $20k.

Part of the reason for this is that even though many of them choose to own cars, poor and lower-middle-income people *make a lot fewer trips* of any kind, including with the cars they may own. To my mind, this is a huge burden on poor people, including on their ability to stop being poor. That’s fewer times taking the kids to their grandparents, fewer trips to build adult friendships, fewer trips to just have fun, etc.

We could address this problem by trying to shave the price of car transportation, or we could address it by taking steps that reduce the pressure for people to use more expensive modes of transportation.

Thanks for the reply. Do you have any other citations for driving by income category?

I’m not doubting the report you cited, but it definitely has some caveats.

1. it wasn’t written with the question of looking at income versus miles driven (That report (as far as I can tell) is looking to show that their method of estimating miles driven (VMT) is better than previous standards).

2. It looks only at Indiana

3. It only looks at licensed drivers. (I’m going to guess that more unlicensed drivers are in the lower income brackets)

Regardless, this tax (which I am not against) won’t fund TRIMET, right? So I don’t really see how this helps get poorer Portlanders out of their cars? On thing though that seems to get overlooked when talking about gas taxes being regressive, is that gas stations in lower income neighborhoods (at least in the Portland area) often have lower gas prices.

I’m still not completely convinced that some of these models apply as well in Portland. WE have a lot more higher income residents who leave near (or in) downtown than a place like Indiana. We still have some rich suburbs for sure, but our city is not the typical US type where the poor have had to stay in the central core, and only the rich have fled to the suburbs. We have actually seen the opposite recently where many wealthier residents have moved back into the central city area, and the poor have been pushed much further out.

“Part of the reason for this is that even though many of them choose to own cars, poor and lower-middle-income people *make a lot fewer trips* of any kind, including with the cars they may own. ”

I would be careful with using “a lot”. Again that was a national study, and even in the lowest income bracket the difference was still only an average of 1 trip a day. In the second lowest bracket you’re talking 1/2 or less trips a day.

On my block alone there are 5 prii and one leaf (mine).

Having lower-income rate-payers subsidize my vehicle charging is idiotic. Having lower-income gas tax-payers subsidize my road use is reprehensible.

Fair points, Davemess. I responded here.

http://bikeportland.org/2016/01/25/low-income-households-drive-much-less-than-high-income-households-173261#comment-6619662

“…Part of the reason for this is that even though many of them choose to own cars, poor and lower-middle-income people *make a lot fewer trips* of any kind, including with the cars they may own. To my mind, this is a huge burden on poor people, including on their ability to stop being poor. That’s fewer times taking the kids to their grandparents, fewer trips to build adult friendships, fewer trips to just have fun, etc. …” andersen

What again, is the ‘huge burden”? At residents where I live, Central Beaverton, it’s apparent that lots of people have and drive old cars. Many of them are probably valued at no more than 5000 bucks. My own included. For work trips and shopping is the use I make of my vehicle. Same with my neighbors. I ride to the parents, ride for fitness, ride for fun, so the motor vehicle is just being used for essentials.

Bus passes aren’t cheap anymore, and riding mass transit isn’t convenient, unless your residence, your job, and your shopping happens to be within a well served mass transit area. That leaves may people out.

“they should sit on the bus for four hours and thank us for it.” No, they should sit in traffic for hours and thank us for it.

underneath, i agree completely.

so in addition to sharply regressive property taxes, sharply regressive mortgage subsidies, and sharply regressive capital gains subsidies this city is going to further subsidize wealthy central city residents at the expense of the peripheral poor.

With the price of oil per barrel so low right now it is also a prime time to get road resurfacing and rip-up-and-replace projects started.

Asphalt is wholly a petroleum waste product from the refinery process of cracking and distillation of crude oil. In the 2005 oil spike refineries increased gasoline production over asphalt and applied more advanced techniques to extract more diesel & gasoline from the asphalt waste. The spike in asphalt costs caused most state DOT budgets to go bankrupt far earlier than ever seen.

When the price of oil goes back up, and it very certainly will, asphalt and thus road construction costs will mirror the increased cost of asphalt.

It is low now and this may be the lowest it will be ever. Eventually concrete will be directly cost competitive; it too has big environmental downsides.

Now may be the least painful time to get this done.

I just love how people insist that any department that looks to get funds must suddenly achieve perfection, otherwise the funds should be withheld. Of course, if PBoT was indeed perfect, then we shouldn’t fund it because they seem to be managing just fine.

Gas is cheaper now than it has ever been in my adult life (a long time, I assure you), in real dollars. Our roads, and many other government-provided goods and services, have limped along for as long as possible in the face of a four-decade tax revolt that has unfunded government. Taxes are the price of admission to civilization. I’m tired of the cheap carnival version, I want the Disneyland version. Time for an increase in the price of a ticket.

Unfunded government? Yeah, not really…at all.

Stop with the junk spending on diversity and equity and marketing and I’ll gladly give PBOT more money.

Do you currently give PBOT any money, given that they are primarily funded by property taxes paid by people that live in the City of Portland?

How else do you propose PBOT overcome racial and economic segregation?

Why is it PBOT’s job to overcome segregation?

What an excellent response. It is high time for residents to critically question why city departments do what they do. Mission creep is not limited to the military, in fact, public bureaucracies are even worse than thr military in this sense.

Every year since 2001, when I call to pay our annual HOA registration fee, I ask the Oregon Real Estate Agency what services our fees are paying for. I haven’t had an answer yet.

Multinational corporations (like my parent company) frequently bargain with governments all the way down to the city level over how much of a share of revenue they will let them share. I’ve watched Google do this with The Dalles and Steve Jobs do this with Cupertino.

So maybe not “unfunded”, but underfunded.

These sorts of deals should be outlawed, in my opinion. In the end, everyone loses, except the corporation.

Yes, absolutely… except that it’s the lawmakers that the deals are generally made with. Their rationale is that the jobs would go elsewhere if the deal isn’t made. The CEOs and CFOs making the deals, of course, are squeezed by the shareholders, so they have no choice. The shareholders, by the way, are pretty much anyone with a pension or retirement account or mutual fund or stock. (And it’s always the government’s… no, the President’s fault for making taxes too high… 😉

When Jobs told the Cupertino City Council that he didn’t want to have to take his company away from his home town, he also told them he didn’t plan on hiring any more people, thus addressing their concerns about traffic (I think you can find the meeting on YouTube). Fast forward to today, Apple hasn’t even opened the new ‘spaceship’ campus (Jobstrosity) yet, and they’re already planning to build a larger facility on their property in north San Jose. Anyone reading this with a mutual fund is likely an Apple shareholder (and your company just reported its first revenue drop ever).

It’s endemic to our society’s entire focus on “growth”, including those of us practicing what our parents taught us to do to ‘outpace inflation’ so we can, basically, afford to pay for medical insurance after retirement. My point is I’m always entertained by the irony and hypocrisy built into our society; we try our damnedest, but ultimately we’re to blame for something!

And I don’t know about “everyone” losing… for a while most of my expertise was moved to India, and now it’s tending toward being on “home turf.” People like me with jobs at these companies may be just pawns, but we still pay county taxes, and I’d rather the profitability resulting from my productivity go to benefit local schools and roads than those in Hyderabad or Bangalore. (No offense to my Indian friends, of course).

My point is there’s not necessarily a clearcut ‘right’ or ‘wrong’ to the practice, rather a compromise or tradeoff.

When cities “bid” to attract a company to their town, they are essentially “racing to the bottom” in what kind of incentives they can offer. These incentives are not offered to everyone equally. If no one could offer tax breaks, the incentive to do this would be gone. It hardly seems fair if one company has to pay more in taxes (or get less in other “incentives”) than their larger competitor because they don’t have the size to drive a hard bargain.

I would rather companies just go where they wanted to go, with no special incentives, and let the chips fall where they may.

And, I will admit, I don’t feel much sympathy for those poor CEOs who are being “squeezed” by shareholders, most of whom (like mutual funds) are absentee landlords at best.

Yes, very good points!

Well said!

“Taxes are the price of admission to civilization. I’m tired of the cheap carnival version, I want the Disneyland version. Time for an increase in the price of a ticket.”

Because Portland city government is so tragically underfunded, compared to other cities of an equivalent size in the United States.

Do we aim for average? Must we always fall back on “Thank God for Mississippi”?

(By way of explanation, by most quality of life measures, Mississippi is generally the worst in the nation. It provides a buffer that keeps every other state from ever being the worst.)

The one thing Mississippi is winning on is vaccination laws

Yes. I really trust examples like Chicago.

Raise it a dollar state wide. People might occupy gas stations.

Hales and Novick wasted 4 years pushing the homeowner fee for roads. The gas tax is the easiest collect and the lowest administrative cost. The original proposed fee on homeowners, was going to raise the cost of housing, which has it’s own problems and doesn’t need any help.

Don’t want to pay the gas tax? there’s plenty of alternatives. If the price of gas is a make or break for your lifestyle choices, you have bigger problems than just the price of gas.

I almost forgot, Why fix the roads without addressing the studded tire issue. It’s time for a Snow-park type permit $100-$200 per year, so everyone who lives outside the city can pay for coming to Portland and damaging OUR roads and there’s a way for them to help fix them.

Would a Snow Park permit system be legal? I’m not sure but their legal on Mt. Hood, there’s no reason it couldn’t work in Portland. If your going to address the road maintenance problem- EVERYTHING should be on the table.

I’m done.

I like it! I was thinking just the other day of how a local sales tax on studded tires would likely cause people to buy the tires elsewhere. But a Portland permit system–brilliant. An easy start would be two prices for metered and neighborhood parking permits–a normal tire rate, and a studded tire rate. When parking enforcement makes their rounds, checking for all sorts of things like expired plates already, they observe studded tires and make sure the right permit was purchased.

Not sure Snow Park has any relevance to legality (it’s administered by USFS, right?), but I can’t see why differential parking rates couldn’t be applied. Minimal administrative burden, quick to implement.

How about a straight tax on studded tires? Like $5000 a set?

Is there (recent) data supporting that the rich drive more? I support the gas tax hike, but I’d be careful about calling it a progressive tax. Because housing prices are so high in the central city, lower income people get pushed to the outskirts and the burbs and often have to drive much long distances to commute (if they have a car of course).

I strongly suspect that the opposite is true in central portland. For example, I drive but have not payed for gas in approx. two years.

Also, do those in lower income brackets drive hybrid vehicles?

While I support increasing city, county, state and federal gas taxes to boost revenue, I will not be voting yes on any ballot initiatives until there is a comprehensive tax reform proposal that covers all local and state taxes and is designed to ensure equity for all taxpayers. At this stage the property tax is so iniquitous, I cannot lend my support to any other tax proposals.

“At this stage the property tax is so iniquitous…”

Do you mean against childless renters and homeowners, because over 70% of the taxes go to schools?

27% OR state and local spending goes to education (including universities); but regardless, schools benefit everyone, not just those with children. We all want to live in an educated society, and it’s today’s youth that are going to have to figure out how fix the planet and pay for us in our old age.

So think of good public schools as an investment in YOUR future.

Agreed, but yet the schools still claim to be suffering financially, and the high six figures that administrators get are purported to be the ‘price we need to pay for good leadership.’ Meanwhile we claim a deficit of STEM graduates to fuel our tech boom, as corporate execs lobby to raise H1-B visa limits to attract educated immigrants (which in turn fuels regional growth, ironically further burdening roads and school systems).

Also, if the breakdown of my property tax bill(s) shows me that over 70% is going to local grade schools and community colleges, how does that figure get down to 27% at the budgetary level? (I’m gonna guess “administrative overhead”).

Your point is completely valid in my opinion; it’s the analogy I use when people argue that “bicyclists should pay for roads.”

The statistics I found probably include income taxes. If less of your property taxes were used for education, more of your income taxes would be, so I think that is the total amount is a more accurate measure of what we’re spending (including administrative overhead).

I will not defend the administration of our school system, but I do think the STEM “shortage” is talked up by corporate leaders in order to strengthen arguments to increase H1-B visas, which are primarily used to reduce wages paid in the tech sector. I am sure there are some legitimate uses of that program, but mostly not.

I’m curious what “equity” would look like to you. Everyone pay the same, sharply progressive, sales tax… how would you improve things if you could?

I’m curious about where this idea that Portland’s roads are tragically falling apart.

I get annoyed sometimes when I see potholes in our roads, but traveling to many other places in the US, we have much better roads in comparison. We’re also currently seeing paving projects around the city. Is this an issue of people just not getting out and seeing what other city’s roads actually look like?

it’s from the auto-age assumption that all roads should be wide, open, free, and smooth…

my vehicles don’t like potholes and the roads aren’t a big problem for me yet…

More of a “squeaky wheel gets the grease” problem. Most people in Portland drive, so they get vocal when they encounter a few potholes. I agree with you that our roads for the most part are in decent condition. There are a few trouble spots, but by in large, we should be using additional revenues to pay for sidewalks, protected bike lanes, and public transport, rather than inequitably smoothing pavement solely for drivers’ benefit.

“rather than inequitably smoothing pavement solely for drivers’ benefit.”

Ever hit a pothole in the dark on a bike?

I have.

Yes. Me too.

But sometimes the cheap (private) solution (a good head light) is actually better since tax payer dollars aren’t going to keep deer out of my path, or nutria, or piles of leaves, all of which a good headlight will pick up.

Those damned Nutria! Davis should make them wear hi-viz.

15-foot flags.

Sure, but if we didn’t have to share the same road space with the vehicles causing all the damage, we’d have our own nice smooth pavement.

A lot of that is a reference to deferred maintenance, which ends up costing us more $$ in the long run. We have a lot of deferred maintenance in Portland and Oregon for that matter.

I wish there was a commissioner in charge of PBOT other than the person currently running it. That makes me reluctant to vote for this.

There may well be after the next election.

Some here view the gas tax as a deterrent, or perhaps penalty, for driving.

Not spending the money on roads is a better deterrent.

I will definitely support the proposed gas tax, though I predict it will lose by a margin of 85 percent to 15 percent.

As many have pointed out, the federal gas tax has not been raised since 1993. The state tax has only been raised once (by 6 cents per gallon) since 1993. Meanwhile, the construction costs have gone up by 70 percent since 1993.

It would be far better if the tax increase occurred at the federal or state levels and if it had been indexed to inflation. That would have resulted in about 1 or 2 cents per gallon every year for the last 23 years. Ten cents per gallon (even if justified) will generate too much opposition because people who are unable to perform basic arithmetic think it will cost them hundreds of dollars per year.

I agree there are equity issues with the multiple tax systems we have in place. I urge those who are upset with the overall tax system reconsider and support this tax as the best we can do at this time.

Pay per mile is a better solution. Allows charging to take into account vehicle weight, driving location, time of day, and owner income level. You can tweak the model to selectively reduce VMT by location to improve congestion , improve safety by charging more on transit corridors and greeways, and help the disadvantaged. This is the approach that California is currently testing, and the direction they are going.

Pay per mile, especially with refinements to charge more by time of day or location, has huge overhead and administrative costs. The gas tax automatically accounts for poorer fuel economy of gas guzzlers and big vehicles. It’s really simple to collect the tax; it’s done at the wholesale level so it requires very few people and very little administrative expenses.

After all of the subsidies California has spent on hybrid and electric cars, combined with lobbying from the refineries, I have no doubt the state will end up with a VMT-based tax to raise the $77B that Gov Brown is looking for.

I’d look into requiring trucks to have a permit to drive in the city limits (probably excluding the interstates). Daily or annual passes available, price tied to weight of the vehicle when loaded.

“backers say, a gas tax is also modestly progressive.”

From the city club report that endorses the temporary local gas tax:

And the citation refers to national data. In portland the highest income quintile is more affluent than in the US overall. The proposed gas tax is not mildly progressive but sharply regressive.

The relevant quote was chopped off:

I think you’re missing the dynamic aspect of a gas tax, soren.

You take a snapshot view of what might occur (on average) to a member of the lowest income quintile tomorrow. I’m far more interested in the kinds of things we could fund with the money raised through such a tax (I’d prefer a jump of a dollar rather than ten cents) that could more than make up for the regressivity you are so preoccupied with. Remember this? This is what we should be striving for:

http://grist.org/climate-energy/why-we-should-raise-the-gas-tax-and-why-we-wont/

“There is a counterintuitive relationship between gas prices and the burden they place on the average citizen’s finances: The more gas costs, the less gas people buy, and so the less they are weighed down by gas costs. Just look at this chart, courtesy of Bloomberg, which shows that the U.S. has the world’s 50th highest gasoline prices, $3.66 per gallon in September, but the fifth highest proportion of annual income spent on gas purchases. Those rankings are almost exactly reversed in European countries with high gas taxes. The Netherlands has the world’s third highest gas price, $8.89 per gallon, but the 34th highest proportion of income spent on gasoline. Italy ranks fourth highest in gas prices, $8.61 per gallon, and 38th in proportional spending on gas. Gas taxes in Italy and the Netherlands, like most of Europe, are about 10 times higher than those in the U.S. Furthermore, in a country such as Norway, where gas currently costs $10.08 per gallon, that revenue comes back to the public in the form of government programs, such as free college tuition. Lower gas consumption also means better local air quality and reduced greenhouse emissions, and more exercise and less obesity among the populace.”

And here’s the chart from Bloomberg:

http://www.bloomberg.com/visual-data/gas-prices/

Your complaints about the regressive nature of a gas tax are interesting, but, in my opinion, miss the mark.

In general, we should have higher taxes on things that are “bad” and lower taxes on things that are “good.” The easiest examples are the relatively high taxes on wages (social security, fica, income taxes area all levied on wages) even though having a job is “good.” For many people, the amount paid in tax on wages exceed what they pay on taxes for “bad” stuff, like gasoline, booze, and tobacco.

One of the ways that British Columbia made its carbon tax revenue neutral was by lowering income taxes.

I’d rather spend energy fixing the inequality issues associated with the income tax than trying to make every tax, such as gas tax, progressive.

I take just the opposite view. I feel we should make taxes on tobacco, alcohol, and marijuana more progressive. Why should it cost (relatively) more for someone with less money to get their buzz on?

Maybe because alcohol and tobacco have really bad long-term consequences for the individuals’ health and once they get on medicare, we all end up paying for their treatment.

It was actually a joke, but alcohol is only damaging if the dose is to high.

That’s a good catch, though as 9watts says it assumes that driving rates by income do not vary.