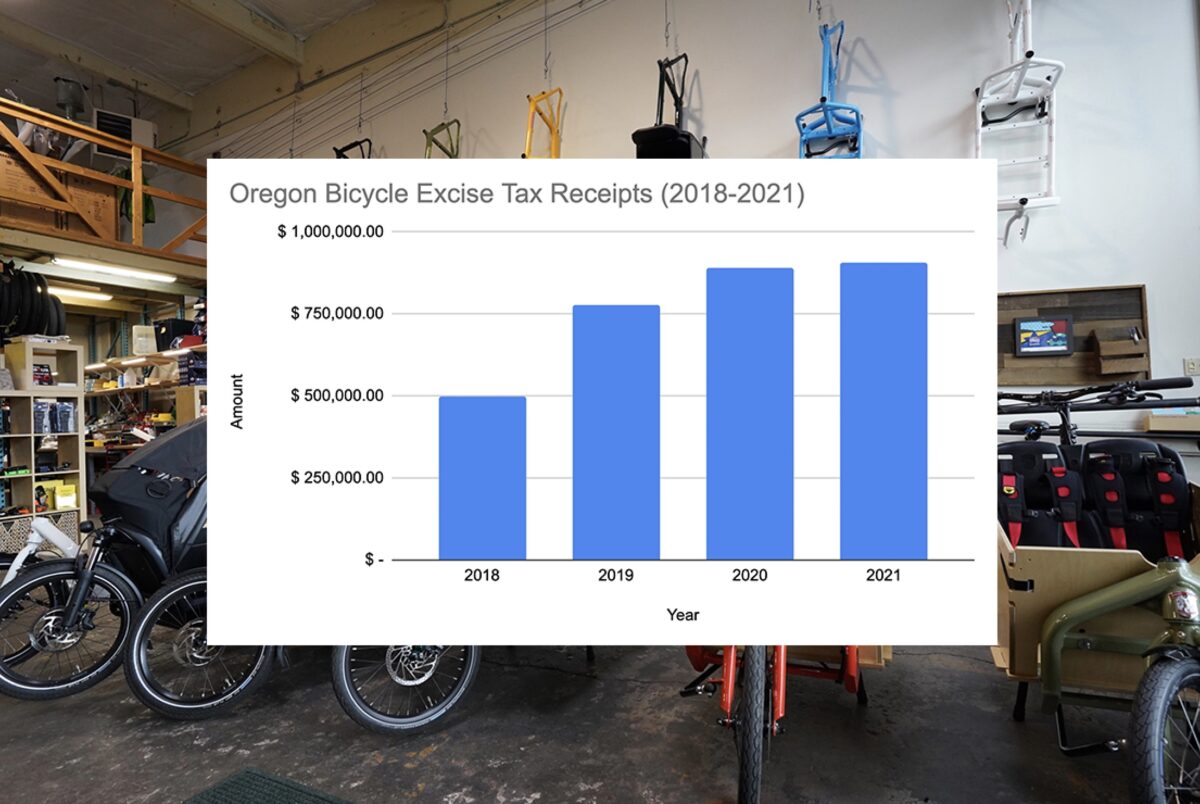

The bike boom is very real in Oregon and the latest way to prove it is to check in on the amount of money collected by the state for the bicycle excise tax. The $15 tax raised nearly $1 million last year.

Oregon’s bike tax passed in 2017 by legislators who thought it would give bicycle users “skin in the game” (gross) and tamp down anger from drivers who were being asked to pay a range of new automobile-related fees as part of the landmark HB 2017 transportation bill. Some advocates, including Portland Congressman Earl Blumenauer, supported the idea based on a notion that it showed cycling had officially earned a seat at the grown-ups table.

While it started off slowly, the revenue is now close to the $1.2 million per year figure state officials estimated it would raise and nearly double the amount raised in 2018, the first full calendar year it was collected.

According to figures from the Oregon Department of Revenue shared with BikePortland this week, the tax raised $498,670 in 2018. In 2021 the amount was $908,156.

Advertisement

One way lawmakers softened the blow of this tax was to tie the proceeds directly to infrastructure projects that make bicycling better. Under ORS 320.440, all bike tax revenue goes into the Multimodal Active Transportation Fund where it’s combined with a portion of the vehicle dealer privilege tax (also passed in 2017, this is a 0.5% tax on the retail price of any taxable car or truck sold in Oregon), and Transportation Operating Fund revenues (which are unrefunded gas taxes for non-road use fuel, such as for lawnmowers). From there the money goes toward the Community Paths program where it’s doled out in grants, “dedicated to helping communities create and maintain connections through multiuse paths”.

The bike tax applies to all new bicycles (both acoustic and electric) sold in Oregon with a retail price of $200 or more.

CORRECTION, 5/14: We initially stated the vehicle privilege tax was .005% of the retail price. That was wrong. It’s 0.5%. Sorry.

Thanks for reading.

BikePortland has served this community with independent community journalism since 2005. We rely on subscriptions from readers like you to survive. Your financial support is vital in keeping this valuable resource alive and well.

Please subscribe today to strengthen and expand our work.

Because we all know how important it is to have skin in the game…

According to the graph you show above, the revenue raised is flattening out about 20%-25% less than $1.2 million/year. It looks a lot like our climate actions versus our goals graph.

I suspect that much of the bike buying in 2020 was a result of the same underlying motivations as the peloton mania. Bike sales stalled in 2021 and it will be interesting to see whether bike purchases deflate in the same manner as the peloton bubble.

https://www.singletracks.com/mtb-gear/the-bike-boom-is-over-but-shops-are-learning-to-ride-a-new-wave/

Please don’t call them “acoustic bikes”. It’s cutesy and just plain inaccurate.

They’re just bikes. If you have to give them a cutesy name, at least be accurate–some people are calling them “muscle bikes”.

What’s likely to happen, should this misuse of the word become popular, is that “acoustic” will completely lose its original meaning. The acoustics of a room will be an unfathomable concept.

I get the idea, but I find it obtuse to uniquely target cycling. It is possibly one of the most innocuous form of transportation. Cars by contrast actually ruin the environment (yes, even electric cars with their battery materials), cause deaths and injuries, and facilitate to terrible commuting culture. By the logic used to justify the excise tax, why not also tax shoes for sidewalk construction programs?

I think Oregon should literally do the opposite: Offer a one time tax rebate for buying a regular bicycle (not electric bicycles) to encourage cycling.

I agree, Daniel. It’s so crazy that Oregonians will NOT – I repeat, will NOT – countenance a sales tax – never, ever, EVER.

Except for bikes – we’ll tax the sales of bikes.

It’s insane, but at least cyclists can say we are paying more than our fair share.

We have a sales tax on cars of 0.5%. It is right in the article.

I wonder how much of the $900k raised is eaten up by administration costs?

The $200 exemption is too low. Or maybe it should just exempt all bikes with 18″ wheels or smaller. We shouldn’t be disincentivizing getting kids on bikes…