There is no more staunch defender of the Bicycle Commuter Tax Benefit, a current federal provision that allows people to exclude (a whopping) $20 a month from taxable income for “expenses related to regular bicycle commuting.”

So when emerged that the Senate GOP’s tax plan would kill it, while retaining a $255 monthly commute benefit for parking cars, we knew Oregon Congressman Earl Blumenauer would have something to say about it. After all, he authored the current benefit and championed its passage in 2008. To Blumenauer, it’s a simple matter of equity.

“Stop the discrimination against people who burn calories instead of fuel,” he shared with a room full of advocates on Capitol Hill at the 2007 National Bike Summit.

Now the Senate GOP wants to renew that discrimination.

Advertisement

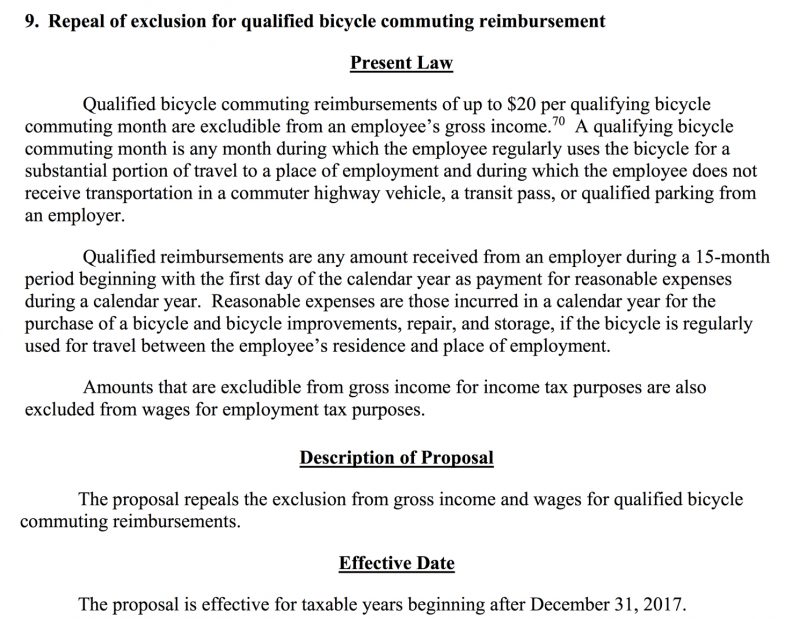

Here’s the section from page 34 of the “Tax Cut and Jobs Act” (PDF):

This morning Blumenauer said this is “outrageous”:

“This is reflective of the larger GOP tax plan—taking something away from working Americans to pay for massive tax breaks for the 1 percent and their kids. With over 850,000 cyclists regularly commuting to work, there is absolutely no reason to wipe out incentives for one of the cleanest, healthiest, and environmentally friendly modes of transportation that exists today. This is outrageous. The Senate should drop this misguided proposal and work to improve the bike benefit.”

10 years after he fought to pass the bike commuting tax benefit, now he’s fighting to save it.

Keep it up Earl. We’ve got your back.

UPDATE: The League of American Bicyclists has issued an action alert to save the Bike Commuter Benefit.

— Jonathan Maus: (503) 706-8804, @jonathan_maus on Twitter and jonathan@bikeportland.org

Never miss a story. Sign-up for the daily BP Headlines email.

BikePortland needs your support.

Thanks for reading.

BikePortland has served this community with independent community journalism since 2005. We rely on subscriptions from readers like you to survive. Your financial support is vital in keeping this valuable resource alive and well.

Please subscribe today to strengthen and expand our work.

Madness!

Do we know how many of those 855k bike commuters were actually able to take advantage of this? I’m going to guess: a tiny proportion. So to me this seems mostly like a symbolic fight.

I am one of the bike commuters who takes advantage of this.

I didn’t even know we could claim that tax deduction. That enough for a new set of tires.

It’s not really a personal tax deduction. It’s a tax-exempt transportation benefit your company can choose to offer you. So if your company subsidizes TriMet annual passes for you or your space in a parking garage, they could also elect to give bicycle commuters the tax-exempt commuter check (of 20/mth)

Yeah, it is frustrating, my work provides everyone a free parking space but won’t provide the transit benefit of allowing us to purchase transit passes with pre-tax dollars even though they would save money by doing it. I haven’t even tried bringing up the bike benefit, although we are small enough that I don’t think we’d have many takers since I think you still have to choose between either transit or bike and the transit benefit is worth more to most multimodal commuters. It would be nice if you could just do it yourself rather than having to get your work on board if they don’t feel like bothering.

It shouldn’t be a pre-tax deduction from your pay, as it is to be paid to you (not taken away from you).

It should be a reimbursement outside of tax (or add to your net if your employer doesn’t want to reimburse it separately), in addition to your pay, without being taxed.

That said, it cannot be combined with any other qualified transportation fringe benefit, so if your employer pays your parking or transit pass, they cannot also give you the bicycle commuter fringe benefit. But they can pay for your parking AND a transit pass– those two can be combined.

See IRS publication 15B for more information.

You are definitely correct there.

We should remove incentives for driving… I’ve always seen these issues as coupled. The Driving tax credit should be removed

I’m ambiguous on this.

First, let’s remember it’s a credit for parking, not driving. I know the former assumes the latter, but I hope the importance of the distinction becomes clear in a moment.

Second, and this is a serious question, what do you envision happening if the credit goes away? More people will bike or take transit? Prices on parking will drop for free-market reasons? My hunch is that neither of those is likely to happen in any large-scale way, at least not if there are alternatives, which brings me to…

My guess is that some businesses currently considering moving or staying downtown will put more effort into scouting suburban locations with abundant “free” parking. Unless the downtown location is business-crucial, employee pressure against out-of-pocket parking charges may prove a tipping point.

In my mind, a vibrant central business district is very important to a metro area. Policies that support the downtown are, in my opinion, helpful to the whole region. Oddly, the parking credit encourages (or at least doesn’t discourage) a strong downtown, because parking costs are less of an obstacle.

I’m not completely sold on this line of thinking, but I can tell you from personal experience that my previous employer would have had a much harder time selling its move from the suburbs to downtown without that credit.

It’s small but I just cashed in a few months of benefits for a new pannier, and saved up a bunch to put toward a winter overhaul of my commuter bike last year. It’s sad that $20 was the biggest slice we could get in comparison to the parking tax credit, but that was a hard fought battle in itself. I think it would be easier to get the credit notched up in a potential future democrat-controlled congress than it would be to get the credit re-written back into law if it is totally stripped out of the tax code.

I’ve received over $2200 in incentives over the years. The bulk of my maintenance spending and bike upgrades have been covered by this incentive.

Ridiculous! Keep up the fight Earl! I get the $20 through my work at CH2M, it is small, but it is nice. I had no idea there was a parking write off, not a fan 🙁

WTF. If anything, this needs to be doubled down upon. This administration is straight up Dr. Evil level of cray-cray.

Of course the GOP is going to repeal it. Bicycling is a blue state thing. They will do anything they can to promote divisiveness. Besides climate change is fake news.

Please remember that the state of Oregon allows a $50 per person tax credit each year for political contributions. The tax credit means you can spend $50 and subtract that directly from taxes you would pay.

Agreed. Removing this benefit a part of a culture war, not a step toward Federal financial sanity.

Everything about the GOP tax plan is directly targeted at blue state citizens. Stuff like this is going to lead to the end of our democracy. It would be like the democrats introducing legislation that taxes pickup trucks and bullets, while cutting taxes for iPhones.

This reminds me of when Reagan took the solar collectors off the White House. Very small actual effect but tremendously symbolic, and not in a good way. I hope this does not portend 30+ more years of going towards the dark side on environmental and energy policy like the last time.

The amount saved is trivial (as noted) so you have to assume someone is happily reporting to the American Petroleum Institute that they did yet one more thing (actually I guess two – getting rid of the bike “subsidy” while keeping the parking one) to encourage car use and petroleum guzzling.

My commuter bike cost $200. Plus lots I put into afterwards. Still!

a simple and better idea: eliminate the parking tax break and give half of it to bicyclists…

you’ll save way more money directly, and then later save a ton of money in having healthier citizens that choose to bike to get the tax cut…

Wait a minute…I pay $75/month to park my bike and trailer in a locked room in a heated garage during the rainy months. Could I apply for a tax deduction? Does this need to happen through my employer? I’ve never done this for parking and have no idea how it works, can anyone educate me?

yes…it needs to be done by your employer.

Well said!

Sadly EBs bike commuter tax incentive really never was much on one (not his fault)…I would rather that Congress END ALL parking incentives (car and bike)…thus being the most fair, as the over indulgent car parking incentive greatly distorts the finances of commuter modal choice.

A pittance yes, but it adds up… the $240/yr from 2008 to 2015 underwrote a purchase of a new Brompton in PDX after I retired. All I had to do was let our accounting dept. at work know about the law after reading about it in BikePortland.

I am glad it worked out for a Brompton…we at Bikestation did not see too many commuters pay of their bike parking this way over the last decade nationwide (these commuters may have bought a bike with their funds like you or they may have worked for small firms without a CTR staffer…thus too much paperwork hassle).

This is what you get when Car head reigns.

This discussion is a perfect microcosm of what is wrong with our tax code, and how you all are missing the point. Everyone’s tax break (corporations, home owners, cyclists, etc etc) is crucial to their existence or so they say. The current attempt to simplify the tax code is a mild attempt to stop the legislators (e.g. Blumenauer) from using it for their own political (read: vote gathering) ends. It has to stop. I ride my bike about 8000 miles a year, purely recreationally, and drive my car about 5K. I almost never use my bike to commute or run errands, because I consider urban riding too dangerous. But, I do walk about 20 miles a week to run errands. Should I get a tax break for the 3 or 4 pairs of shoes that I got through every year? No. Do I want a financial pat on the back for walking so much? Heck NO.

“…how you all are missing the point”

Did you miss where several folks here in the comments suggested scrapping the credits for the car?

Well, I was a bit lazy…after reading the first 10 or 15 comments, all with the same theme, I made an assumption. When there is a long thread of comment, it is a real hassle to read every comment. So….Many of your are missing the point.

“When there is a long thread of comment, it is a real hassle to read every comment.”

But this is the best part of the comments here: the emergent insights, ideas that riff off what was said by others. We may have no idea where it will go, what we can learn.

meant to write all credits

https://bikeportland.org/2017/11/10/outrageous-to-repeal-tax-break-for-850000-u-s-bicycle-commuters-rep-blumenauer-says-253188#comment-6841318

I’d rather Blumenauer use the loss of the $20 bike commuter benefit as leverage for also eliminating for the $255 commuter parking benefit. That, in my mind, is the greater good.

I appreciate my employer facilitates this rather obscure benefit for me, but I doubt all of the estimated 850,000 bike commuters are able to take advantage of it. Because of its higher value, I’d guess the participation percentage is higher for those taking the parking benefit, than those taking the bike benefit. It’s a perfect illustration of why our take tax code is so misguided, unfair, and expensive to administer.

So Earl, please take the sword on the bike benefit you authored in 2008 costing us millions, and also slay the parking benefit costing us billions. It will be a more effective way to encourage bike commuting. Then, pedal on to the mortgage interest deduction….