(Photo: M.Andersen/BikePortland)

Can Portland’s proposed transportation income tax count to three?

In the political tea leaves of Portland’s five-member city council, three is the magic number. And the tenor of Monday’s hearing on the city’s proposed tax suggested that consensus is building. But the vote seems likely to hinge on who would pay how much.

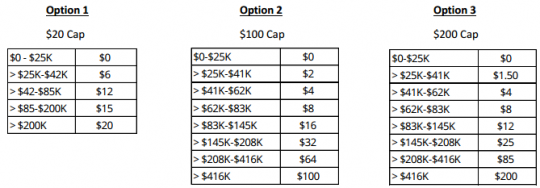

What Portlanders would pay

In their documents Monday, Portland Bureau of Transportation staff offered three scenarios for a fee structure based on a taxpayer’s adjusted gross income. (That’s your income minus student loan interest, self-employment tax and health savings accounts, but not deductions such as mortgage interest.). Here’s what the per-month payment might look like for single tax filers, with the flattest tax on the left and the most progressive one on the right:

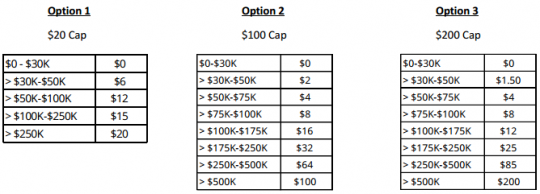

And here are the corresponding scenarios for joint tax filers:

As The Oregonian reported Monday morning, these exemptions for low-income workers would ensure that 41 percent of Portlanders would owe nothing.

Meanwhile, a different tax would also be charged to every licensed business in the City of Portland. For the smallest businesses, fees would range from $2.50 per month for a freelance photographer to $12.50 a month for a small coffee shop to $15 a month for a tiny medical office.

For the largest businesses, fees would range from $20 a month for a large bank to $60 a month for a major software firm to $120 a month for a hospital or large hotel.

You can read about the proposed business rates here.

Any of the scenarios above would be projected to raise $40 million a year — assuming that 90 percent of businesses and 83 to 85 percent of residents who are supposed to pay the tax actually would. (The city’s $35-a-year arts tax, which is collected annually by April 15 as this tax would be, currently has a 71 percent compliance rate.)

What the commissioners said

(Photo: J.Maus/BikePortland)

Commissioner Amanda Fritz, who had once been seen as the likelist to join Mayor Charlie Hales and Transportation Commissioner Steve Novick as a third vote for the plan, was the most vocally skeptical of the plan Monday, saying that couples who make more (but not a lot more) than $30,000 between them should be exempt from a tax.

“$30,000 doesn’t seem high enough to me” for the exemption for joint filers, Fritz said.

Fritz also questioned a $3 million line item that would help fund a biking-walking bridge across Interstate 405 at Flanders.

“We had an extensive conversation about this,” she said, referring to the abandoned 2008 proposal to relocate the Sauvie Island Bridge to this location and making clear that she continued to see it as a lower priority than safety improvements in more outlying neighborhoods.

Commissioner Nick Fish, for his part, asked if the city’s advisory committees had considered exempting businesses from the tax in their first year.

“We’ve seen a big jump in business licensees,” Fish said.

Willamette Week reported Monday that Fish has suggested splitting an upcoming council vote into two questions: first, whether a tax should be created; and second, whether it should be approved by voters.

“This change would allow him to back the reworked street fee without reneging on his promise not to bypass voters,” WW’s Aaron Mesh wrote.

Advertisement

One telling point in the work session came when Hales casually laid out a possible compromise over whether a tax or fee should go to voters.

“There seems to be consensus among the committees that a referral is not at this point necessary, but a sunset seems reasonable to me.”

— Mayor Charlie Hales on the need for voters to approve a transportation income tax.

“There seems to be consensus among the committees that a referral is not at this point necessary, but a sunset seems reasonable to me,” he said. After six years, he suggested, the city council “can renew it, reject it or refer it [to voters], based on what the council at that time wants to do.”

No commissioners responded one way or the other to that.

Hales also said he favors a relatively flat tax, one that would charge the highest-earning Portlanders no more than $50 a month and would raise rates for middle-income earners.

Commissioner Dan Saltzman, for his part, said relatively little during the work session, at one point asking politely which projects would be scaled back if other projects ran over budget. (PBOT Director Leah Treat promised to work this out.)

And Novick, the politician who’s devoted most of the last year to the proposal, said he’s glad the city was persuaded to abandon an earlier version of the fee that, like the many similar per-household fees around the state, charged rich and poor about the same.

“In May and June we brought a proposal to council that was mostly what everybody else does,” he said. “We now have street revenue proposals before us that do not represent what everybody else has done. And I think we in Portland agree that that’s often a good thing.”

After the work session, city staffers who have been taking direction from Novick and Hales to gather consensus around the fee congratulated one another on a job well done.

A public council hearing is set for Nov. 12, with a likely vote Nov. 19. If approved, the first payments would be due April 15, 2016.

Correction 11 pm: An earlier version of this post misstated the size of the city’s annual arts tax. Also, Commissioner Fish says it misquoted his statement that there had been an increase in business licensees; an earlier version of this post had quoted him as saying there had been an increase in business license fees.

Thanks for reading.

BikePortland has served this community with independent community journalism since 2005. We rely on subscriptions from readers like you to survive. Your financial support is vital in keeping this valuable resource alive and well.

Please subscribe today to strengthen and expand our work.

Why would they use a different way to calculate your income than normal income tax. I just don’t understand why the city insists on creating new complicated bureacracy around this? Why not just have it be a part of filing your income tax that we all already do and base it on the same income federal and state taxes are based on? Also it seems that by doing this separately they are creating a fee that only residents of portland will pay even though commuters put much of the peak demand on our streets. Why not an income tax that is on people who live or work in portland much like oregon’s income tax is for people who live or work in oregon?

It’s not clear in this case, but adjusted gross income normally refers to adjusted gross income (AGI) for federal tax purposes. I think Michael’s way-to-brief description here is simply meant to remind people that AGI includes some adjustments compared to gross or total income, but not itemized deductions.

Or, maybe the city is indeed crazy, and they really would attempt to calculate this tax on something other than a federal income tax filing.

I can’t understand how Fritz, after recent events, would hesitate to block any funding for traffic safety which would prevent similar families from having to undergo the tragedy her’s is.

To be clear, she definitely wasn’t speaking against funding for traffic safety; she was speaking against a version of this that would (a) charge $18-$48 a year to couples filing jointly who make like $35,000 a year between them, and/or (b) spend $3 million on a bridge project that she and many East and Southwest Portlanders see as benefiting mostly a richer part of town.

As much as I would love to see a NW Flanders St bridge over I-405, I think we should be spending that $3 million east of 82nd Ave. There is a ton of work that’s needed out there to improve cycling conditions.

Interestingly, it looks in the median-income map in Michael’s article with the map of projects that both the Alphabet District has a lower median income than a large majority of Southwest and that only the Hillsdale/Multnomah Village area has a lower median income than the Pearl (the rest of Southwest having equal or greater income than the Pearl – and the areas with greater income than the Pearl are larger than areas with less income). Of course, this is all about averages, and the Alphabet District and the Pearl are already much better served for biking than Southwest.

Not to say that Southwest doesn’t deserve improvements. Just that an argument it should be prioritized because it’s poorer is contradicted by the facts. Certainly, I think the money for a Flanders bridge would be better spent elsewhere in the near-term.

I applaud Amanda for being concerned about taxation of people who earn less than median income. The exemption for the 1%ers is also an absolute outrage.

Aren’t the 1%ers in Portland the >500k group?

the cap creates a tax exemption for the wealthiest of the wealthy. imo, the 0.04% tax rate for someone who earns $500,000* should be extended to infinity.

I only say this to reduce outrage:

The tax above was listed as the monthly amount, not annual amount.

Tax rate for $500,000/year would be around 12 times the quoted .04% or .48%.

Will there be a guarantee that the income tax rate won’t increase and that revenue will be used exclusively for transportation maintenance/safety projects, and not art, homeless programs, and commissioner pet projects du jour?

Of course not Todd, come on now. What you can expect are more special taxes for the basic functions of government. Pretty soon the General Fund is going to be nothing more than the Police and Fire Retirement and Disability Fund.

This honor system tax payment system is insane (as is the honor system payments for the MAX).

“Hales also said he favors a relatively flat tax, one that would charge the highest-earning Portlanders no more than $50 a month and would raise rates for middle-income earners.”

Real shocker there!!!

I’d pay and I vehemently believe I *should* pay a heck of a lot more than someone earning median income.

It’s simple economics. Making the highest earners pay for everything is a good way to make sure that they all move out of town.

Actually, the economic studies that I’m aware of on this topic show that the ultra-rich are not very responsive to these types of progressive income taxes. For example, the sizeable “Millionaire’s Tax” in New Jersey had very low or no impact on out-migration by rich people.

http://web.stanford.edu/~cy10/public/Millionaire_Migration.pdf

And for an example of analysis you can do in your head, have the super-rich fled California and New York because they have high and progressive income taxes?

I don’t know how many people making over $500k/year I see making a huge stand (and going through the hassles of moving) over $2400.

“And Novick, the politician who’s devoted most of the last year to the proposal, said he’s glad the city was persuaded to abandon an earlier version of the fee that, like the many similar per-household fees around the state, charged rich and poor about the same.”

I really don’t trust anything Novick says. This was his baby, that he defended to the city when it was a flat, totally regressive fee.

That passage you quoted is frighteningly absurd.

Here’s the following paragraph:

“In May and June we brought a proposal to council that was mostly what everybody else does,” he said. “We now have street revenue proposals before us that do not represent what everybody else has done. And I think we in Portland agree that that’s often a good thing.”

What is the logic here?

I can think of several ways we could tackle/solve this with programs ‘that do not represent what everybody else has done,’ that have been scrupulously omitted from any conversation. The amount of lurching we’ve witnessed is frightening. If they propose next to tax cat ownership or use roof area as the basis for calculating the scale I won’t be surprised.

as somebody that doesn’t own a road-destroying motor vehicle I’m glad I have the option to not pay this tax designed mostly to repair damage from motor vehicles…

As another person who doesn’t own a motor vehicle I’ll be goddamned if I’m going to keep riding in the gutter with the broken beer bottles and the wet sewer grates if I have to pay the same fee as someone who does.

you already pay–and likely more than they do. I recommend Todd Litman’s Whose Roads.

Cheers.

Such a complex scheme…why not just enact a gas tax, or a citywide parking sticker fee? Or start charging for parking in congested districts? Parking lot tax? God forbid a congestion charge maybe! Connect it to road system usage instead of making me have to fill out yet another form at tax time.

Our city already has a collection system in place thanks to the Head Tax for the Arts.

Ahhh yes, and the ugly truth rears its two faced head!

when the “I want it my way and I want now” sayers are faced with a solution of “here you go, now pay for it!”

the excuses and dodging come flying!

if you’re talking about the street tax to fund roads then they haven’t proposed a solution yet… they’ve proposed a lot of things, a solution isn’t one of them…

Edwards,

can you explain? What you wrote sounds a lot like what some others have argued here in recent months, that some of us just object to paying for the infrastructure, that we’re trying to stick the costs to someone else, that we’re stingy or something.

If you’re allying yourself with that line I will disagree strongly. I’ll only speak for myself, but I would happily pay for something that made sense, that was proportional to the deterioration my mode choice or travel behavior causes. As it is, this fee (all of the iterations we’ve seen so far) are not tied in any way to actual damage. The formulas they keep cooking up are wondrously complex but to what end? A hotel must pay 48 times what a freelance photographer does?! HAHAHA. This is so f*<&ing ridiculous.

http://en.wikipedia.org/wiki/Soviet-type_economic_planning

Just for clarification – “registered businesses” can be a totally virtual employee or small business.

So let’s take a freelance photographer (as the article mentions) with no actual physical office space. (S)he has a bike but no car, taking advantage of Car2Go or ZipCar for gigs where more space is necessary. The photographer would pay twice per month – as a business, and as a Portland resident.

Now, let’s take a suburban commuter – say, one with a pickup truck and studded tires. They would pay $0 per month.

I’m not saying that I totally oppose this fee – but Portland’s “licensed business” classification is already onerous on small businesses and freelancers (who pay double income tax), and adding on ADDITIONAL double taxes doesn’t make me feel great.

Michael – Are you citing exactly what the adjustments to income are for this tax or is your list just providing examples of adjustments? I am curious to know if the city plans to use the federal AGI adjustments or if they are picking and choosing what they will allow for adjsutments.

Examples. They’re expecting to use the federal AGI, as the state does.

This street fee thing is embarrassingly ridiculous. I’ve gone from paying way more than my fair share with the first proposed street fee. To paying nothing with the income tax street fee proposal. I feel I use the roads and should pay something, not nothing.

I guess I have to say it again: A GAS TAX PROVIDES ME AN OPPORTUNITY TO CONTRIBUTE CLOSER TO THE AMOUNT OF ROAD I USE BETTER THAN ANYTHING THEY’VE COME UP WITH YET. I’VE GOT GAS TAX FEVER!

Thank you Portland!! If I had to pay a gas tax when I buy gas in the city, you might have gotten some money from me!

the idea of a tax payed disproportionately by lower quintiles being used to build a fancy bridge in NW portland makes me see red. i’m all for a gas tax but i think it should be used to fund public/mass transport, not boost inner city real estate values.

As I have said before, I am opposed to a street fee or specific income tax directed to transportation infrastructure. I support a gas tax indexed to inflation that will produce fees from those machines that most impact safety of pedestrians and cyclists, and cause wear and tear on streets – private fossil fuel driven automobiles. Yes, I know it would be unpopular, but oh so fair and instructive for instituting a process that begins to reckon with the disaster of King Car culture.

I could not agree more.

Out of curiosity, this “gas tax” idea comes up every time in these threads. What do the members of City Council think about a gas tax? Have they made public statements on the idea?

I have the fever, too… Gas Tax Fever!

GAS TAX!

I doubt the City Commissioners will take a gas tax seriously because of its perceived unpopularity. I have not heard them discuss it up to this point. However, if enough people demanded a gas tax and that demand was expressed vigorously in many community venues they might likely entertain it. The tax they are now linking to income should rightly go directly before the population in a ballot provision.

They have scrupulously avoided the subject, for dubious ideological reasons. The whole thing is rigged.

(a) we must never utter the phrase gas tax.

(b) don’t forget, we must never utter the phrase gas tax.

(c) but we can cook up the most convoluted, cockamaimy formulas for charging our constituents the same amount of money, & so long as we never utter the words gas tax they won’t notice or object and everything should be o.k.

Yep, so perhaps the commenters here on BP should start brainstorming ways to move the gas tax conversation forward with City Council? I’m not sure how effective it is for those who feel passionate about this to continue to comment here that we need a gas tax. Politics requires active participation.

I showed up to a couple of meetings, I recommended a gas tax (and raising money from parking on the street, parking lots, vehicle registration, etc). I also emailed all of the City councilors and the mayor. These people have heard their ‘constituents’ request a gas tax, or at least consider it, and they have ignored the requests. Despite multiple suggestions for a gas tax at one public meeting I attended, and multiple suggestions sent via email, the gas tax was not included on their summary of ideas to consider.

I agree with you, Brian. But I’ve grown cynical on this one. As MaxD points out, this is an ideological tactic, unmoored from anything we might consider common sense.

A copout on my part?

Perhaps.

I hear ya. I feel the same about the last 20+ years and trying to find recreational opportunities for off-road riding in Portland. This is a bright group of people, though. I have to think there is a possibility of generating some ideas for pushing this idea, or at the very least, holding City Council accountable to an answer.

I would suggest getting involved at the neighborhood level. Neighborhood Associations, while still not the best lobbying groups in the city, do actually have more sway with city council (ie. they get more attention and a little more sway). For sure it’s a slow process, but that’s how our government works.

You can always run for office yourself (though that would require a lot more time commitment of course).

“I would suggest getting involved at the neighborhood level. Neighborhood Associations”

agreed. we are.

and notwithstanding, huffing and puffing on cool blogs fits well with having to work, too.

This rotten plan being pulled from the City’s collective 4th point of contact, seemingly as they go along, remains an exercise in throwing good money after bad. They’ve already admitted that it will still leave a huge funding gap. Where do they propose to get the rest of it?

I’ll say it again, the heart of our problem lies in our antiquated form of City government.We aren’t a quant little town anymore. Instead of representing Portland our councilors represent their bureaus (fiefdoms) first and foremost. This is how Parks, Rec, and Culture gets a bigger piece of the general fund pie than PBOT does. The City as it stands is pretty much operated like a taxpayer funded Ponzi scheme and it is unsustainable.

I know that a strong mayor system was shot down at the polls recently. Maybe a manager-council system would be more palatable to voters? If we stick with our current system I believe we are hosed. We need a more representative local government, period.

In any case, I’ll bet you dollars to donuts that if this stupid tax passes, active transportation will be lucky to get a sniff of the scraps.

Wow, $20 per month for a “large bank,” while my family ends up paying $8 to $12 per month depending on the plan. I can certainly see how my family’s transportation works out to have about half as much impact as a large bank.

After all, my house is kind of like a bank: All that activity at my driveway with dozens of autos parking for a brief time and driving out again, the armored car that makes a couple visits daily, long queues that occasionally back onto the street when my kids’ friends come to visit. Oh, and there’s that traffic signal right by my house.

BS!

But most of the people driving to that bank are already paying their $8-12 too, including most of the employees.

I don’t know that double taxation is the solution.

I don’t know about your employment history, but in my last job in downtown Portland fewer than half the employees were Portland residents. Not only would they avoid paying anything under the current Hales-Novick income tax plan, they were also most likely to be solo drivers. The Portland residents were the only ones who walked and biked and accounted for most transit riders, too.

I agree by far the worst part of this plan is that it inexplicably gives a subsidy to suburban SOV commuters.

But in a banks case, the employees would vastly be outnumbered by the customers, many (if not most of which) would be local (unless the bank was on the outskirts of town).

It would be great to get out of towners to pay, but besides a gas tax, how would you go about doing this?

Again drawing on when I worked in downtown with mostly suburbanites, they were regular customers of banks, restaurants and shops downtown. Because they were suburbanites, they would pay nothing.

Gotta side with Amanda Fritz on the bridge. $3 million is enough money to put diverters every 2-3 blocks on the entire Neighborhood Greenway network. This is required if we want to make Greenways into the type of place children can ride without needing a “bike train.”

Just curious as to when we reach the point to tell our politicions “enough is enough”. Raising taxes is fine if the money will be spent wisely but does the past allow us to trust them? No matter what form the tax(street fee, gas tax, income tax) I don’t think they are responsible enough to use the money for which it is intended.

For those curious Novick and Hales aren’t considering a gas tax, they have been explicit about their reasons. You can find it on their website here:

https://www.portlandoregon.gov/novick/article/493599?

6. Why not just raise the gas tax, which could discourage people from driving?

Surveys show that gas taxes are extremely unpopular with the public, and this effort has been shaped by public input. A survey of Portland residents in March 2014 as part of the Our Streets PDX conversation showed that residents favored a street fee over a gas tax and other alternatives.

A gas tax would keep the transportation system financially dependent on the growth of driving and the associated pollution, climate change and negative health impacts. It would continue to diminish in purchasing power relative to inflation. It would also increase the perception that people who bike, walk or take public transit do not financially contribute to the transportation system. With a transportation fee, everyone pays and everyone benefits.

No. A gas tax provides an economic incentive to NOT DRIVE with the associated negative aspects such as pollution, climate change, etc. An INDEXED gas tax would not have a reduction in purchasing power. I don’t know about the current Hales-Novick income tax proposal, but their prior proposal WAS to be indexed to inflation.

Can we agree that having a job is good and driving is not-so-good? Which is a better one to discourage through taxes? A middle income worker ends up paying an income tax rate of something in excess of 24 percent (15 percent federal and 9 percent state), but the current gas tax is about 5 percent federal (18.4 cents/gallon) and about 10 percent Oregon (30 cents/gallon. Is it better to have a higher tax on something good (a job) or on something evil (consumption of gasoline that produces pollution and climate deterioration)?

There is no good reason to increase the income tax. Increase the GAS TAX!

That survey (that they kept touting at all the meetings) was pretty dubious. It really just seemed like finely crafted language to make exactly what they wanted to do sound exactly like what the survey chose.

I don’t doubt that a gas tax would likely be unpopular (even in Portland), but the reasoning given here is not very good.

Thanks Jonathan Gordon for finding that.

Ha!

This is so disingenuous and mealy-mouthed.

“Surveys show that gas taxes are extremely unpopular with the public, and this effort has been shaped by public input. A survey of Portland residents in March 2014 as part of the Our Streets PDX conversation showed that residents favored a street fee over a gas tax and other alternatives.”

Extremely unpopular? A pack of lies.

As far as I can tell the gas tax was never so much as mentioned in that survey. Here’s a review of the survey with a lot of the questions listed:

https://www.portlandoregon.gov/transportation/article/487227

And here is a discussion of the survey results:

https://www.portlandoregon.gov/transportation/article/487234

no mention of the gas tax anywhere. But there was this:

“Survey respondents supported a street fee more than other revenue options.

Respondents were asked about several funding options that some Portlanders suggested at community meetings in recent months. The options included a city sales tax, a city income tax, a tax proportional to what a person pays in state or federal income taxes, and city bond paid by property taxes. Just a one-quarter to one-third of the respondents said that any of these was more preferable to street maintenance and safety fee.”

So much for going with the majority.

“A gas tax would keep the transportation system financially dependent on the growth of driving and the associated pollution, climate change and negative health impacts. It would continue to diminish in purchasing power relative to inflation. It would also increase the perception that people who bike, walk or take public transit do not financially contribute to the transportation system. With a transportation fee, everyone pays and everyone benefits.”

J_R already dealt very ably with these whoppers.

“With a transportation fee, everyone pays and everyone benefits.”

Well, except for the 41% of Portlanders who won’t pay anything…

“With a transportation fee, everyone pays and everyone benefits.”

How can they say this with a straight face?

Every word in that sentence is mendacious, and what’s worse, they should know it.

If everyone here commenting in favor of a gas tax testified at the City Council meeting, it might make a difference to the conversation.

Constitutionally, they have to spend gas tax money on roads and bridges and not, alas, streetcars. And they have to get voters to change the city charter for a city gas tax.

http://www.portlandoregon.gov/transportation/article/370491 – page 11.

All this can be changed, reconsidered, done.

And then there’s the COUNTY gas tax. Not sure if those are subject to the same or different rules. But in any case, now’s a great time to start fixing this.