(Photos: Jonathan Maus/BikePortland)

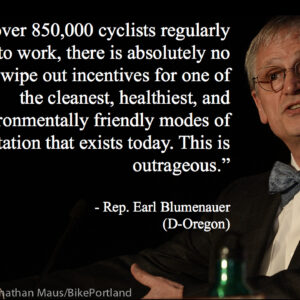

Hoping to incentivize cycling in America, Oregon Congressman (and former Portland City Commissioner) Earl Blumenauer has introduced the Bicycle Commuter Act of 2019.

The bill would re-instate a tax benefit for biking to work that was repealed in 2017 as part of the Republican-led Tax Cuts and Jobs Act.

Rep. Blumenauer, who has pushed for a version of this bill since at least 2006 and got it passed in 2008 as part of former President Barack Obama’s financial bailout bill, said in a statement released by his office today that, “The bicycle is the most efficient form of urban transportation ever devised,” and that despite the proliferation of bike share and cycling in general throughout the country, there remains no tax benefit for riding to work.

The IRS currently offers a “qualified transportation fringe benefit” of up to $265 per month for driving a car, parking a car, and taking transit. Shockingly, the most efficient and healthiest form of transportation — cycling — is ineligible.

The recent tax bill pushed through by President Donald Trump repealed the meager, $20 per month bike commuter benefit through 2025.

Now Rep. Blumenauer along with fellow representatives Vern Buchanan (R-FL) and Ayanna Pressley (D-MA) want to reinstate, modify, and expand the bike commute benefit.

The bill seeks to: Make the benefit a pre-tax benefit instead of a reimbursement; Allow employees to receive a bicycle benefit of up to 20% of the parking benefit (currently equals $53/month for bicycling, indexed to inflation); Allow the bicycle benefit to be used in concert with the transit and parking benefits (previous incarnation required people to choose one or the other); Adds bikeshare as eligible for the benefit and clarifies that electric bikes are eligible.

Advertisement

Below is the text of the bill:

[pdf-embedder url=”https://bikeportland.org/wp-content/uploads/2019/03/BLUMEN_002_xml.pdf”]

Blumenauer’s bill would help people who use a range of modes to get to work, such as someone who usually bikes, but opts for transit when it rains or who use bikeshare to get to a bus stop. “Present-law doesn’t provide a benefit for all of these scenarios, but it should,” reads a statement about the bill. “The Bicycle Commuter Act provides the flexibility that people need.”

The bill has been endorsed by The League of American Bicyclists, the New York City Department of Transportation, People for Bikes, and the Safe Routes to School National Partnership.

Portland Transportation Commissioner Chloe Eudaly said she “strongly supports” the Bicycle Commuter Act. “Biking is an undeniably positive form of transportation: it promotes physical, emotional, societal, and environmental health. By providing a financial incentive for biking to work we will not only encourage a better lifestyle, we will also reduce carbon emissions and further our collective climate goals.”

The bill comes out just days before cycling and transportation advocates will come together in Washington D.C. for the National Bike Summit.

— Jonathan Maus: (503) 706-8804, @jonathan_maus on Twitter and jonathan@bikeportland.org

Never miss a story. Sign-up for the daily BP Headlines email.

BikePortland needs your support.

Thanks for reading.

BikePortland has served this community with independent community journalism since 2005. We rely on subscriptions from readers like you to survive. Your financial support is vital in keeping this valuable resource alive and well.

Please subscribe today to strengthen and expand our work.

Thumbs up, but if we were really serious about saving the earth, our children and ourselves we would make full time bicycle commuters ( would have to be car-less also) exempt from Federal Income Tax. Would require income limits and strict tests for validity. Seems crazy right? but if we don’t do something as significant as this to change our ways, what is the point of tax revenues? To paraphrase a bumper sticker I used to have, ” there is no IRS on a dead planet.”

We have enough people not paying taxes as it is. Let’s remember many of us do not have safe infrastructure available to us that makes bike commuting a viable alternative.

Are you suggesting you should pay no Federal taxes simply because you ride a bike?

Carfree is not even close to the same thing as ‘simply riding a bike.’

Bikeninja mentioned full time bicycle commuters.

I telecommute. Should I pay federal taxes? Or just a portion?

No I am suggesting that you pay no federal taxes because you have given up a destructive and violent habit that threatens the existence of future generations and you can thus be held out as an example of how we can change our future for the better. This alone is worth more than all the taxes now collected from car-free bike commuters.

I don’t know about you, but I’m going to enjoy my proceeds from giving up a destructive and violent habit by enjoying an extra steak each week. Bring on the tax cut!

I’m with you Kitty but I think we’ll be reported to AOC! ; )

I am going to use my tax break to ride my bike to the airport and travel half way around the planet on a plane. Play stupid games, win stupid prizes.

It seems to me that if you are not purchasing gasoline, you are not directly paying Federal gas taxes – so problem solved 🙂

If you are advocating that you should not pay any Federal taxes of any kind simply because you choose to not drive (and already get the benefits of not doing so), then I’d ask you to present a case why you shouldn’t pay for any other services the Federal government provides that you benefit from. You know, like the goods that you purchase that arrive on infrastructure funded by the government.

This is absurd.

The superrich, corporations already pay no taxes, Amazon being just the most obvious case. If we actually offered a 100% income tax break to people who eschewed the automobile I think the fallout, the negative social or economic consequences, of this would be vanishingly small compared to the benefits. I’ve long felt that rendering visible the lives of the presently carfree: billboards, media exposure, comparable incentives that those who have been buying electric automobiles have enjoyed, would be salutary.

Related to your point, I actually think increasing the gas tax would be be the more direct approach, except expand it to include electricity as well… in short, an “energy tax.” Because the use and overuse of energy is what usually generates benefits for oneself at the expense of everybody else. So internal combustion vehicles would pay the most, followed closely by electric vehicles (which reap a slight benefit by virtue of the slight efficiency advantage of using centrally-generated energy), and bikes that use an order of magnitude less energy because they don’t haul 4,000 useless pounds around, would pay an order of magnitude less. That’s what it would be like if I were in charge. Vote for me I’ll set ya free. Rap on, brother, rap on.

No-one has said that at all on this thread. The intent of the bill is to include commuting by bike as part of the transit/commuting benefits that are already enjoyed by people who use those same benefits for parking their motor vehicle or take the bus or train or ferry to work.

Actually, bikeninja proposed, “we would make full time bicycle commuters ( would have to be car-less also) exempt from Federal Income Tax”–granted that’s more than “riding a bike” but it also goes far beyond the Blumenauer proposal.

Perhaps I misunderstood what exempt from Federal Income Tax means. Can you explain that for me?

Why is a bike only worth 2/10ths of a car?

Interesting that a Florida representative is backing this as FL is one of the deadliest states to ride in.

I don’t think the income tax should have anything to say about how a person commutes. But I also think if it is going to give a deduction for driving, it really has to do so for every mode. And they what you end up with is a deduction for commuters in general. Which really doesn’t make any policy sense.

So I might argue this bill solves the right problem (tax deduction for driving) in the wrong way.

Instead let’s commit to pulling even with Norway’s gas tax over a period of ten years. The share of income the Norwegians spend on their MUCH more expensive motor fuel is MUCH less than we do here in the US with our heavily subsidized fuel.

Much cheaper, and no admin costs.

They also export oil and natural gas…so they are profiting off of it.

perfect the enemy of the good? Are you unable to see anything of value in their domestic transportation priorities because the government still clings to fossil fuels? I could just as easily have picked another country that does not export fossil fuels: Italy, The Netherlands.

I’m not sure I would hold up Italy as an example of being particularly progressive in the motor vehicle realm. For best results, I’d recommend sticking to the small, tried-and-true north-western European countries, especially the urban areas of DK and NL.

Why? They all leave us in the dust.

In social indicators we’re dead last in every inter-country comparison of OECD countries. What is the point of splitting hairs here? If we adopted even ten percent of the suite of policies of any of those countries our collective jaws would drop at the improvements around us.

As usual… The solutions to all our problems are so easy and blindingly obvious that our leaders must be either stupid or evil (or both) for not implementing them. Europe (or at least the parts not falling under right wing rule) really does have everything figured out, and all we need to do is follow their lead.

There is no need for hyperbole. Why so allergic to criticism?

“… our leaders must be either stupid or evil (or both)”

You forgot out of whack, run by money, captive to the military industrial complex, etc.

“Europe (or at least the parts not falling under right wing rule) really does have everything figured out, and all we need to do is follow their lead.”

Instead of blowing smoke in our eyes why not speak to the identifiable, measurable, concrete, meaningful differences that many smart people have tallied between our system and the countries to which we normally compare ourselves? If you disagree that other countries already mentioned are no better, have solved nothing we haven’t, when it comes to transportation priorities, fiscal policy you should say so, name their shortcomings.

Interestingly enough, on Friday, Norway is voting whether or not to dump oil and gas stocks from their sovereign wealth fund. So, they may profit from the exportation, but they do have decent policies at home and maybe be willing to go so far as to have it impact the investment of the largest sovereign wealth fund in the world.

Right. And what about telecommuting? You could argue it’s even greener than bicycling to work, but it’s also left out.

We should also penalize people for having children 🙂

Why only $53 and not $265?

Which Portland-area employers offered the Bike Commuter Benefit* before its suspension?

If I recall, it was so complicated (and costly) to offer that many of even the bikiest Portland businesses and organizations didn’t offer it.

*the federal pre-tax benefit that got approved in ’08

EXACTLY! I found out about this and my fellow workplace bike commuters got all excited about it before we quickly got our hopes crushed that it was a non-starter because our employer wouldn’t touch it.

I understand the desire for accountability but I hope the new legislation doesn’t suffer from similar problems.

From my personal experience, the biggest incentives in getting people to bike commute are facilities for cyclists at their place of employment. Things like bike storage, personal lockers, showers and on site cafeteria or ability to prepare food. Lowering the barriers to bike commuting and making bike commuting visible in the place of employment are the two largest factors in getting others involved. Literally every employer I have worked for who had these amenities did so because of state or local tax incentives. There is zero interest in it unless the employer happens to have business within the bicycle industry and see it as a way to promote their business.

Another route towards this would be to amend building codes to simply require new construction intended for employment to have such things.

My work offered the benefit until it went away. We had about 15% of employees electing it. My previous employer did not offer the benefit, but there was only two of us that would have considered it. Since you couldn’t get the bike reimbursement and transit/parking, people that rode TriMet more than $20 a month elect for transit pass.

It was not complicated administratively (this is my job). You wouldn’t get a parking pass or transit pass if you elected the bike reimbursement. You’d turn in a receipt that would get scanned and tracked against the total you were eligible for. I’d say easier than parking or transit administration as those involve ordering passes from the parking garage or TriMet (and distributing passes before HOP). It was just a different reimbursement code in payroll verses expense reimbursement.

There was a silver lining at my job when the reimbursement went away. We decided to offer people that don’t elect transit or parking $100/month. It is taxable to the employee, but nice little bonus.

Same. We bumped up the reimbursement level once the benefit went away, too. The main downside was that we have to treat it as income and take taxes out. Many employers looked at it this way back when the benefit existed and didn’t bother to jump through the federal hoops.

The big detail that gets missed in articles and comment sections is that the bike benefit required employers to subsidize the $20/month benefit while the parking and transit benefits don’t require any employer subsidy. Employees can save money by redirecting THEIR PAY pre-tax towards parking (up to $265/month) and transit (up to $265/month). They never had a similar option, even with the bike benefit in place, to spend pre-tax pay on bike stuff. The employer had to foot the bill. That key detail makes the $20 bike benefit a tougher pill for employers to swallow than the $265 parking benefit and the $265 transit benefit.

Mine did. I (and others at my employer) chose this option for as long as it was available. It wasn’t a lot, but it covered bike maintenance costs for me. Sadly it went away.

The Netherlands outright pays people to commute by bike. About 22 cents/kilometer deposited directly into their bank account. No silly tax cut paperwork necessary.

While I’m all for tax breaks that incentivize transit, biking, and other active transportation (is there some reason folks who could walk should feel financial pressure to bike instead?), I think the first step is to stop incentivizing driving. Why not just pass a law that says if a business offers a parking subsidy to even a single employee, it must offer the full amount to all employees equally? The employees can use that money for parking, transit, biking, or buying a coffee on their walk to work.

I would imagine that many businesses would find the cost prohibitive and no longer subsidize parking at all (win) or only subsidize a portion, say the first $100/month, which would cover a transit pass or a nice bike, but only some of the cost of parking (also, win).

Agree, just don’t subsidize driving, make every mode cost what it really cost. Everyone is trying to play games with everything.

Exactly. Why reward biking over walking? For that matter, the most efficient form of commuting is not commuting at all–working at home.

I’d rather see driving-related tax breaks eliminated than more added. That’d be simpler and more direct.

This is a step in the wrong direction. Simply repeal any ‘qualified transportation fringe benefit’. All this meager and largely symbolic bike ‘benefit’ will achieve is allowing those who support parking subsidies to use a ‘fairness’ argument. The repeal of the bike benefit in 2017 gave those who want to see a meaningful way to dissuade commuting by car the upper hand, yet now this opportunity is being squandered by politicians more interested in signaling virtue than achieving results.

Really not following your logic here.

Simply put, if cars are going to be subsidized to the tune of $265 a month, then other commuting options should also.

“if cars are going to be subsidized to the tune of $265 a month, then other commuting options should also.”

Not sure what the goal here is. Incentivizing (all) commuting serves no purpose except to encourage movement. Why is this so hard? People cycling in other countries, other cities, are paid by their local governments to bike, per km. I could get behind that, but any holdover subsidy to driving (and there are hundreds of flavors of this) is obsolete, perverse, and should sunset post haste.

Asher’s logic was perfect. You say, if cars are going to be subsidized, then other commuting options should be, too. That makes some sense, but it has the drawbacks Asher mentioned, among others (subsidizing someone who bikes but not someone who walks or avoids commuting altogether, etc.).

He says, instead of leaving cars subsidized, and adding subsidies for bikes, remove the subsidies for cars. That makes sense, without triggering the drawbacks he mentioned.

You can argue pros and cons, but his logic is clear.

I think that all car subsidies should be repealed. The State government must do the same too. Too many state government offices provide cheap to free parking to their employees. So the State government (including Dems) can grandstand all they want about combatting climate change. But until they make it more expensive to drive, nothing will change. I have little faith in the federal government right now.