A new report presented to Oregon Governor John Kitzhaber yesterday outlines and prioritizes 16 new “non-roadway” transportation funding mechanisms. Among the ideas selected as a priority for “additional consideration for further implementation” and possible legislative action, is a “User fee for bikes.”

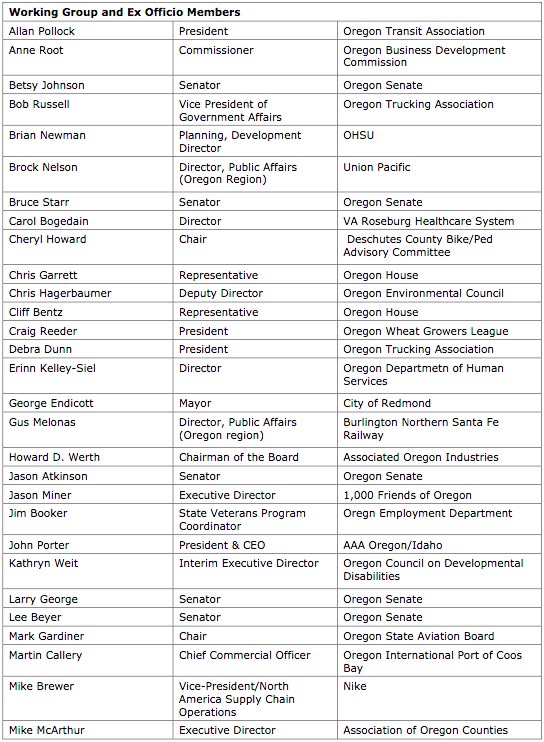

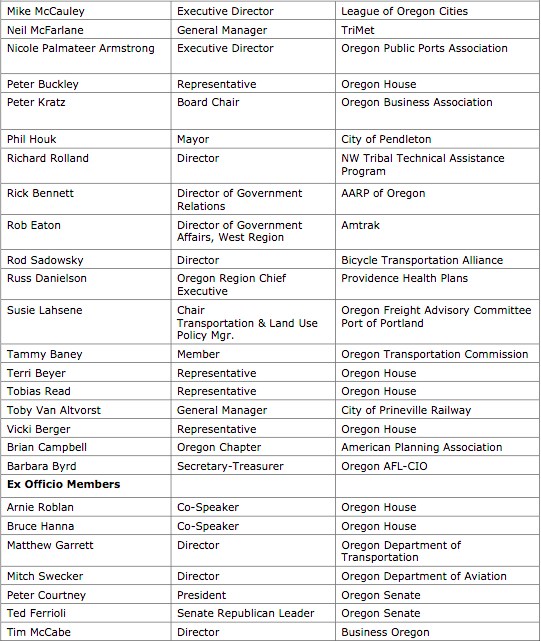

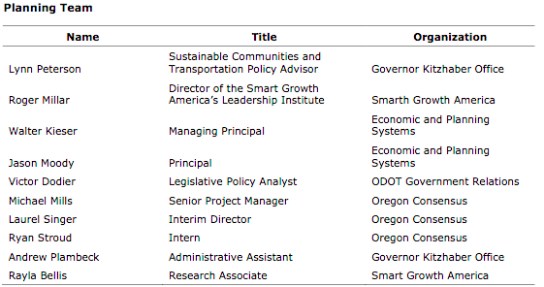

The 93 page report, Oregon Non-Roadway Transportation Funding Options: Report to the Governor, (PDF) is the result of a 64-person “Non-Roadway Working Group” that was convened by Kitzhaber back in November. The group included a large list of transportation stakeholders (including Bicycle Transportation Alliance Advocacy Director Gerik Kransky), many members of the Oregon legislature, and State staffers (see full list below).

The purpose of this project (which has been on the to-do list for the state since 2008) was to, “develop recommendations for sustainable funding of non-roadway transportation, including rail, marine, aviation, transit, and on and off-road bicycle and pedestrian paths.”

“We think it’s ridiculous for the state to consider putting a barrier between people and their bikes. We’re really upset. We argued strongly against it… It doesn’t belong on there. It doesn’t make sense.”

Gerik Kranksy, Bicycle Transportation Alliance Advocacy Director

In Oregon, there is an extreme lack of funding available for anything other than traditional, auto-centric highway and bridge projects. There are several reasons for this problem, with the largest being that our state constitution mandates that gas tax can only be used for projects within the highway right-of-way. Oregon also lacks a sales tax. Throw in a recession and better gas mileage in cars and you see how the money is scarce.

To help fill this funding gap — which they’ve pegged at about $550 million annually (or about 1/3 of the total annual gap) — the working group brainstormed 60 revenue-generating ideas. They then whittled that list down to just 16. Along with a the “user fee for bikes”, some of the other funding ideas they’ve chosen to prioritize include: expanded Lottery revenue, an expanded cigarette tax, expanded or new utility franchise fees, a new hotel/motel tax, use of the State Infrastructure Bank, and so on.

What didn’t make the prioritized list? A modification or expansion of the state gas tax, a congestion charge, weight mile fees, a VMT tax, and so on. (Keep in mind, this exercise only considered funding mechanisms to be used for “non-roadway” transportation modes.)

Just to be clear, here’s the expanded definition of “user fee for bikes” from the report:

Tax on bicycle operation or purchase dedicated to non-roadway transportation (e.g. bicycle license tax). Potentially voluntary with membership advantages

While finding new revenue streams to fund transportation in Oregon is crucial, this report raises a lot of questions. Who was on the Working Group? Why are “on-road bicycle facilities” (and not just dedicated “bicycle paths”) included in a discussion about “non-roadway” transportation modes? Why — despite its implementation challenges, failures in the past, and relatively low yield potential — is a fee on bikes and/or the people who ride them, still being seriously considered by Oregon leaders?

The make-up of the stakeholder group included only one representative to speak up for bicycle transportation. The BTA’s Gerik Kransky attended all the meetings. He said on the day the priority list was voted on, he “argued vociferously against” a bike users fee, but that in the end, he was simply outvoted.

“There were a lot of rail, port, freight, and marine advocates around the table… Then there was one bike advocate. There was no walking advocate. We were one vote out of 60.”

Kransky does not mince words in expressing his disappointment about this:

“We [the BTA] think it’s ridiculous for the state to consider putting a barrier between people and their bikes. The inclusion of a bike user fee on this list, flies in the face of the knowledge that we know bicycling provides benefits to our communities. We’re really upset. We argued strongly against it… It doesn’t belong on there. It doesn’t make sense.”

Kransky also correctly points out that various bicycle licensing and taxing schemes have never penciled out financially, once administrative costs are taken into account. The working group seemed to understand a bike user fee wouldn’t return much in the way of funds. The report itself states, “previous efforts have not even covered program administrative costs.” The report also noted the potential difficulty of enforcing a bike fee.

The few comments from working group members about a bike user fee that are shared in the report are also revealing:

Costs to run would be more than income generated.

Has been shown to not pay for itself. How about sales tax on bicycle equipment.

Oregon Legislative Fiscal Office analyzed this issue in the 2007 Legislature in HB 3008 and determined it would cost more to administer than it would return in revenue.

There is very little money here, we would require a great deal more information to move forward with this as a legitimate finance option.

Should do all we can to encourage carbon free transport options.

Tax on purchase is fine, on use is insignificant.

The costs to administer such a fee would outweigh the revenues.

This is long over due.

There is also concern that the annual funding gap for “Bicycle/Pedestrian Programs” has been significantly under-estimated. The report lists the total, statewide annual funding gap for bicycle and pedestrian investments as being a paltry $7.8 million. Expert sources I’ve heard from point out that this is a very misleading number. In the Portland region alone, one expert told me the annual bicycle and pedestrian project funding gap is $30 million per year.

Then there’s the “non-roadway” issue. I first heard this new term being used by ODOT Director Matt Garrett during our interview back in April. ODOT is using this term as a label for modes that do not rely on the public right-of-way — a.k.a. our roads and highways. “Bicycle facilities” can and should be built on public roads and ODOT should be very careful about attaching the term “non-roadway” to “bicycle facilities”. In a state where bicycles are considered vehicles with the full legal right to be on all public roads (minus most a few urban interstates), I feel this new term is a slippery slope to disrespect for a legitimate travel mode.

In the end, it’s clear that the idea of generating state revenue from the use or purchase of bicycles remains a potent one among Oregon politicians and policymakers. Kransky says the BTA will watch the upcoming legislative session closely to make sure any bike user fee bill does not move forward. Even so, my gut tells me we haven’t heard the last of it.

Stay tuned for more reporting on these topics.

— Download the full report here.

UPDATE: I just spoke with Governor Kitzhaber’s transportation policy advisor (and former Chair of Clackamas County) Lynn Peterson. Peterson said that the user fee for bikes, as prioritized in this report, is merely “a placeholder to acknowledge that we need to find a way to pay for bicycle infrastructure.” “It was duly noted in the committee that this wasn’t the best way to fund bike infrastructure, but there really wasn’t anything else on the table… It’s just the beginning of the discussion,” she said.

Here is the full list of Working Group members and project planning staff (note: Kransky is not on the list, but I have confirmed that he, not Rob Sadowsky, was present and active in the process):

Thanks for reading.

BikePortland has served this community with independent community journalism since 2005. We rely on subscriptions from readers like you to survive. Your financial support is vital in keeping this valuable resource alive and well.

Please subscribe today to strengthen and expand our work.

If you ask people to pay a fee for their bikes, they’ll expect that money to be used on bike infrastructure…

Why — despite its implementation challenges, failures in the past, and relatively low yield potential — is a fee on bikes and/or the people who ride them, still being seriously considered by Oregon leaders?

good question.

to which I’d add one about the funding of the CRC…

While finding new revenue streams to fund transportation in Oregon is crucial…

While this is familiar thinking I’m not sure I agree with it. We could also look at this from the opposite end and ask how we could trim foolish things from our current budgets that don’t pencil out or are doomed for reasons other than finances but which should be phased out because continuing to pour money into them will lead to regrets and stranded assets.

9watts… I hear your thinking on that and I think that way too in some respects. However, regardless of how/what we are spending on, there is a lack of revenue for transportation. Bottom line is we need more money to maintain and build the system.

Yes, we can be smarter about what we spend on now, but that doesn’t discount the need to find new revenue streams.

You’re probably right, Jonathan. Certainly Germany’s infrastructure and it’s gas tax revenue are both ~ an order of magnitude better/higher than ours, so more money would not be hard to spend.

But when I try to take off my car-head and anticipate the demise of the vehicle which lends its name to that affliction I believe we’ll see that the transportation infrastructure costs we now take as given go poof. In a post-car world the CRC proposals would go poof, as would most of the other enormously expensive road building & expanding projects. We just won’t need to spend billions once we return to getting around by muscle power, whether human, equine, or asinine.

I stumbled over the non-roadway term as well and appreciate your calling attention to it. I assumed it referred to mountain bike trails and the like. Weird.

How about a user fee in direct proportion to the number of dedicated bicycle facilities in Oregon versus motor vehicle facilities? I don’t think the state actually counts that many decimal points on a cent, but I’ll gladly pay it 😉

Do we have to show them more examples of this kind of idea being tried, being shown to be infeasible, and being dropped? I’m sure glad we’re going to waste more legislative time on an idea that’s doomed to either fail or simply make things worse for everyone before it even starts. Seems to be the national trend these days, though.

Also, if I’m a non-roadway user, why is there any debate about whether I pay for the roads, and why are they thinking about charging me MORE to pay for the roads I’m apparently not using?

Hello, ODOT – welcome to the 21st Century, I know you’re about 50 years behind, but we’ll all really appreciate it if you jump ahead a little and start thinking in terms of the current realities instead of the dream of the 60’s.

Oh good grief. Again? I guess we’ll always have to keep swatting down these unworkable user-fee proposals every year or so … until we finally implement one, and prove that they don’t work.

That doesn’t mean someone won’t try again – never underestimate the ability of human beings to continue to run into brick walls however much it hurts. Look at our roads, that’s pretty much literally what we’re doing (though it’s more often concrete) 🙂

I would assume anyone who pays a bicycle user fee would receive an equal credit on their car registration fee. Fair is fair, right?

More seriously, maybe this was included for rhetorical/political purposes? It does provide cover for when the Oregonian Commenters Anti-Everything Society and their ilk squawk about “bikes paying their share”, politicians can truthfully respond, “we considered, examined and researched the idea and found it would waste more taxpayer funds than it brought in, so as fiscal conservatives, we rejected it.”

This is probably the most realistic explanation of why a bike fee was on the table in the first place. When it comes time to actually do a fiscal analysis on these various schemes, this idea will likely get jettisoned.

This is a simple way to defund non-motorized transportation. that’s really all that it is. They can hoard the entire pot for freeways, and just tell you to “use your own new dedicated funding source”. It’s a shell game, and we’re losing out big time. They honestly don’t care if it generates revenue, as now they’ll be entitled to all of the previous revenue entirely.

Second.

If I’m charged a road user fee, I’m riding on the interstate. Actually, I think bicycle users should get money back for all the money saved in infrastructure costs.

I’ve had an idea for some years now. Here is the actual list of line items from the 2011 Form 40 to which Oregon income tax return filers may elect to donate some of their tax refund:

Oregon Nongame Wildlife • 56

Prevent Child Abuse • 57

Alzheimer’s Disease Research • 58

Stop Dom. & Sexual Violence • 59

AIDS/HIV Education & Svcs. • 60

Habitat for Humanity • 61

OR Head Start Association • 62

OR Military Financial Assist. • 63

Oregon Historical Society • 64

Oregon Food Bank • 65

Albertina Kerr Centers • 66

American Red Cross • 67

I propose adding:

Oregon non-roadway transportation fund • 68

or better yet:

OR Non-Motorized Transportation Access fund • 68

Would that be so hard to do? What criteria does a fund/organization have to meet to be considered for getting their own line item here?

you gotta be a 501(c)(3) with gross revenue of at least a million, and you gotta collect ten thousand signatures to petition the commission for certification, and then to stay on the list you gotta snag at least 25k in checkoff contributions

Looks like the BTA meets the organizational qualifications. They would need the signatures and whatever approval is necessary to get on the form. Assuming that could happen, couldn’t the BTA then award “grants” to transportation departments for bike-specific infrastructure projects, on-road or off?

actually, BTA’s gross revenue in a fiscal year ending august 31, 2011 just barely crested a million, and that was up very, very substantially from the previous year.

http://dynamodata.fdncenter.org/990_pdf_archive/931/931057956/931057956_201108_990.pdf

fully half their revenue was government grants, and the largest share of their expenditures went to safe routes and similar programs. so it is not at all clear they could make the cut.

Sheesh. Fine. But the apparent substantial increase between 2010-2011 was due to a shift in fiscal year end, so the 700k or so reported for 2010 was only for an 8-month transitional “year”. I only looked at their online annual reports back to 2008, but each year they list revenue at >1M. I can see how having a lot of that come from government grants in the first place would be seen as a little sketchy, but don’t other N/Ps count that as a normal part of gross revenue?

you are right, i had forgotten about the fiscal year shift. they first started hitting a million a year in 2007.

and yes, having a big piece of that come from government grants is not uncommon. so yeah, they could try to get the 10k signatures and get on the form and then hope they hit 25k in contributions year after year. i don’t know if that is on their radar, but if so more power to them. presumably the money would go into their unrestricted account and might not be used for offroad whatever it is that people were suggesting here.

I seem to remember an idea someone posted a while back on user fees…something like a penny a pound per road vehicle per year. So I’d pay 25 cents a year for my 25 pound bike and 40 bucks for my two ton car. Seemed reasonable.

Road wear happens at about the fourth power of the heaviest axle of a vehicle (as mentioned here a short while ago, so if we were to pay $0.25 for a 20lb bike (+200lb rider), that’s 110lb on an axle. The average 3000lb car (and that’s on the low side these days) is going to have a 1500lb axle, so they’d owe (1500/110)^4 * 0.25, or $8644. I’d kick in my quarter if Mr Camry owner paid $8644 per year for the privilege to drive on our roads.

Also, what peejay said.

I like it, but I think you’d also need to incorporate mileage into that scale to be really fair.

I think something like 10k miles/year or more is considered typical for a car. But for a bike? Not sure. I like riding, but tend toward the shorter trips, so I’m probably in the low hundreds. Let’s be generous and say at most 500 miles/year on my bike. So then let’s propose a fee for all vehicles of a penny per pound per (pulling a number out of thin air) thousand miles.

Incorporating that into what you were saying:

…my forty pound bike would be forty cents/year, but twenty cents/year with mileage taken into account. And my 2300 lb car, assuming the typical 10k/year mileage, would be $230/year.

I remain interested in joining an Oregon “super fun bike club”. It would be a voluntary contribution to dedicated funds. Hopefully membership offers perks like free bike camping and/or discounted fees at state parks. I’m lost on any other ideas.

Other sources (I have not been through the document) could be an income tax form checkoff to make a (nontax) contribution, and raising fees on Share the Road plates—are they really just ten bucks a year?

Tangential question: like bike registration, does the bottle bill pay for itself, either? There’s still broken glass in the shoulders, and even for many rural customers, the recycling is redundant. On a good day, feeding the stinky machines MIGHT pay minimum wage. It’s not worth my time, but leaving empties out on the curb usually means someone (legally) collects them before morning garbage collection, but does nothing to actually clean the streets. I’ve had to replace a lot of tires in the last year. Rant over.

Another idea–what would voters think about dedicating a portion of Oregon Lottery proceeds to non-roadway transportation development? Arguably, we could spend some of what has been allocated to “economic development” on no-mo transportation improvements and call it “tourism” development.

according to the story above, lottery proceeds was one of the suggestions made in the report. i myself am sorry we have a lottery, and i am especially sorry to see anything worthwhile made dependent on lottery revenue. the lottery is an extremely regressive and cynical tax.

Good point. I suppose if we are to ride the high road, lottery revenue would be a pretty dirty source of funds.

I’d gladly pay user fees to get a bicycle-only bridge over the Rose Quarter Transit Center.

It’s funny. The comments from working group members about a bike user fee that are shared in the report are quite revealing … of their attitudes.

“This is long over due.”

I don’t subscribe to a John Forester-esq intentional government conspiracy theory but “This is long over due.” in the context of the acknowledgement of the futility of taxing cyclists shows jealousy, spite and immature revenge fantasies still rule the in the minds of those that would be in charge.

Until they can separate what actually works from what is recommended by the play ground bully they shouldn’t be doing anything that affects the rest of us.

I’ve long believed that the motivation for most who recommend “user fees” for bikes is a desire to punish cyclists for their scofflaw ways rather than to actually raise any useful amount of money to be put toward “safety” or “infrastructure”.

As soon as we charge a toll for the use of HOV lanes on the freeway, I’ll consider paying a “user fee” to ride my bike to work. What is the HOV lane principle? I thought it was, “go to the extra trouble of keeping a car off the road by picking up passengers and enjoy privileged treatment on the road while still traveling in luxury.”

Yet when it comes to transportational bike users, we have many who would say, “go to the extra trouble of enduring the elements and the abuse of motorists, risking your life and using your own physical power to keep a car off the road and enjoy paying extra for it while still getting soaked and not enjoying any privileged treatment.”

The way that was written: “Tax on bicycle operation or purchase dedicated to non-roadway transportation (e.g. bicycle license tax). Potentially voluntary with membership advantages”

I would be OK with a 1-5% tax on bicycle-related purchases to go into a pot for more cycling infrastructure, provided that it was not reducing the amount of funding coming from other pots. Yes, I know that we’re already getting screwed, but moving on from this conversation would be good and a small percentage wouldn’t really hurt that much

Yeah, but it seems likely it would be used as an excuse to do exactly that.

The state can fund this “Non-Roadway” malarky with the rent it pays on the common areas where it puts up barriers to my mobility at the behest of the oil, automobile and freight industries.

The game is still fundamentally rigged, a point I have made to Gerick personally. Without a fundamental shift we’ll be getting table scraps until the carbon party gets a huge disruption ($6+/gallon gas) . . . then everything will change of its own accord.

Looking over that list of working group members, I half expected to see a few OregonLive comment section user names in there.

In what way is that funding gap deceptive? What’s the rationale behind the $7.8 million statewide, and the $30 million for PDX?

“In the Portland region alone, one expert told me the annual bicycle and pedestrian project funding gap is $30 million per year.”

See what I mean? How much of that is defensive spending – necessitated by the overwhelming presence and dangers of the automobile? How much would go away if/when those ubiquitous threats diminish?

The funding gap for bike/ped in this report only includes the annual funding spent by ODOT’s own bike/ped programs and only on state-run highways.

The $30 million annual gap, as it was told to me by an expert source, is based on a goal to complete the regional bike/ped system as laid out in the Regional Transportation Plan in 45 years.

For what it’s worth, in a follow up call a few minutes ago with Kitzhaber’s Transpo Advisor, I’ve learned that all the representatives from other modes in this working group feel like the gap for their respective mode is far lower than it should be.

Want more revenue? Charge for street-side parking.

I think perhaps it’s time to send a message. Can Bikeportland arrange “A Day without a Bike”. Let’s pick one day, and leave the bikes at home, and drive cars. Let’s take every parking space, and clog up the arterials with traffic. Let’s show them that bicycles do benefit everyone.

I like the message, but let’s not forget that some (many?) of us don’t have a car.

We missed it for this year, but a good day to do the Drive To Work Day is right before Bike To Work Day. That way we can illustrate the contrast between how things are when as many people as possible drive, versus when as many people as possible ride their bicycles. I am not sure what to do about those of us who are carless.

I think this is a great idea, especially the day before Bike to Work Day. Non-car owners could take transit.

I love this. I’d rent a car for the day. I don’t work, but the kids and I would drive around and help clog the roads. This is a point worth making.

What? No tax on shoes to fund walking infrastructure? Oh, the Nike rep probably killed that one.

For those who drive and bike: Why don’t we create the People’s bike registration system. Easily done by writing your ODL (Oregon Drivers License) number on your bike. It will be unfunded, but mostly correct.

If we can make this work it will prove that all the state needs to do charge us an extra fee for not driving.

in regards to recording a bicycles serial number. Guns, computers, cameras, lawn mowers, etc., have serial numbers and we don’t record them with the state. Why does the state need to know my bikes serial number?

I’d be willing to pay the same amount as a driver’s licence: $40 for 8 years.

It’s simple: Base the fee on tire size.

This not accurate (from the article): “In a state where bicycles are considered vehicles with the full legal right to be on all public roads (minus most interstate freeways)”

We can legally ride on the majority of freeways in Oregon.

See:

http://www.stc-law.com/freewayright.html

If this is “non-roadway” why is the committee stacked with auto-centric organizations? What a surprise that a group of people with no expertise the subject, with built in economic incentives and pre-existing biases against a mode would come up with a less than zero solution. Now they can shuffle across the hall to their CRC committee and warm up next to the huge pile of cash they are burning with no results.

these people seriously need to step out of their capitalist brains and think about people instead of dollars…

and what do these same people suggest when we stop playing the lottery, smoking cigarettes, and staying in hotels? then they have to come up with more ideas…

sorry but you have to tax things that people need… things that will always be there… income tax and sales tax are the best sources of money… anything else you tax can be avoided, as they’re showing with the gas tax… they could hike up the gas tax, but then even fewer people would drive… then they’d have to hike it way up to compensate and then even less people would drive…

you can’t tax options, you have to tax necessity… sorry for all of you that think democracy is awesome, but the general population doesn’t know what’s best for people they don’t like… we need high taxes on basic services in order to pay for other basic services that can’t be taxed… we should all be paying a lot more out of our paychecks and on sales tax… I always vote for tax hikes to fund social benefits…

sorry but you have to tax things that people need… things that will always be there… income tax and sales tax are the best sources of money…

Spiffy,

you are entitled to your opinion about how taxes should/should not be raised, but please know that there are several approaches you are either unaware of or perhaps have misunderstood. Taxes can & do serve multiple purposes, only one of which is to maximize revenue for public projects over time.

Any discussion of taxes in the context of cost internalization should probably start with Arthur Pigou:

http://en.wikipedia.org/wiki/Pigovian_tax

A Pigovian tax (also spelled Pigouvian tax) is a tax levied on a market activity that generates negative externalities. The tax is intended to correct the market outcome. In the presence of negative externalities, the social cost of a market activity is not covered by the private cost of the activity. In such a case, the market outcome is not efficient and may lead to over-consumption of the product. A Pigovian tax equal to the negative externality is thought to correct the market outcome back to efficiency.

Here’s another, more specific example:

http://en.wikipedia.org/wiki/Ecotax

Here’s another link which provides a nice overview of this subject:

http://en.wikipedia.org/wiki/Tax_shift

Roads are a public resource and I don’t mind paying for their upkeep, even if payment were in a form other than income or property taxes. I don’t think bicyclists should pay as much as auto drivers, who use more of the resource (more space, more wear and tear, more demands on law enforcement and emergency response…)

As a auto driver, there is a certain appeal to the “everyone must pay” arguement. The “conservative” side of me is well aware that TANSTAFL.

In this case however it is heavily over shadowed by the ever increasing intrusiveness of the government into our lives. A fee on bicycle usage will require tracking, which will lead to licensing, which will lead to exams, etc. I may not support the same financial ends or infrastructure goals as many bicyclists but I also do not support yet more restrictions put in place by the government.

I am slightly more the paranoid-outraged-citizen then I am the foaming-at -the-mouth-republican on this one.

Everyone already pays into various highway funding pots, and people driving cars use proportionally more of those services than people on bikes, so the bike riders effectively pay more than their share.

http://www.grist.org/article/2010-09-27-why-an-additional-road-tax-for-bicyclists-would-be-unfair/

http://www.vtpi.org/whoserd.pdf

http://www.uspirg.org/home/reports/report-archives/transportation/transportation2/do-roads-pay-for-themselves-setting-the-record-straight-on-transportation-funding

As Jonathan commented above, “…all the representatives from other modes in this working group feel like the [funding] gap for their respective mode is far lower than it should be,” so apparently each group feels they are paying more than their share. That’s explainable in terms of human nature but I don’t understand where they’re getting their numbers, or whether their feelings are actually based on numbers? Wouldn’t a working group such as that have access to, and avail their study of, well-documented numbers audited by professional accountants and economists which show just how funds are obtained for the expenditures they’re talking about?

so apparently each group feels they are paying more than their share. That’s explainable in terms of human nature but I don’t understand where they’re getting their numbers, or whether their feelings are actually based on numbers?

Alan,

you make a damn good point. Haha.

These bikeportland conversations are just so much fun. I learn so much. Thanks.

Sure, and thank you for the sanity check…it’s not just me?! 🙂 I mean, following that same line of questions, if the working group actually had those numbers, how about they make them available for public review? Or, if they did not have them, then should their report not make it clear that those recommendations have no basis in actual budgetary reality?

The current state of this situation is that one set of users, automobile drives, pays yearly fees and licensing. The second set of users, bicyclists and pedestrians does not. I wasn’t making a financial statement about the costs versus road usage versus weight versus miles driven. I was making an statement of appearance. When everyone pays at the door to get on the bus but one person does not, for whatever the reason, people notice and their sense of “fair play” no matter how poorly thought out can kick in.

Myself, I don’t agree with your reasoning in general. For instance you say that bicyclists pay a portion toward highways. However, as far as I know, bicyclists aren’t taxed for highways. Taxpayers/Citizens are. And the suggestion that because taxpayers pay a portion towards highways but autos/trucks use the facilities that bikes are effectively paying more than their share already doesn’t really make a lot of sense. It’s a semi fact held in isolation that doesn’t tell a story. Here’s another one: A bike can use an auto lane but an auto can never use a bike lane. You could infer from that the bicycle should pay a portion of the road costs and that bicycles should cover 100% of the cost of the bike lane. It does reveal a fact, or a fact like piece of information, but doesn’t actually mean anything.

I appreciate your level-headed discussion of the perceptions of who is paying for what. Just a couple of counterpoints:

But what if one set of paying customers gets to sit in padded, sheltered, air-conditioned/heated comfort, while another group who “doesn’t pay” gets to cling to the bumpers or ride on the roof of the bus? Would the paying customers be envious then?

Regardless of the actual numbers involved, the notion behind this idea comes from the idea of extraction from the system. Simplified, it is this:

Suppose everyone (“taxpayers”) pays $10 toward construction and maintenance of a system (roads). Now suppose that one group chips in an extra $50 toward the system, but “uses up” $100 worth of value from the system, while another group doesn’t put any extra into the system, but only uses up $8 worth of value from the system. The first group gets $40 of value “for free”, while the second group “donates” $2 to the first.

Again, regardless of how the actual numbers might pencil out–it may be that nobody overpays–motorists, even with the extra gas taxes and reg fees they pay, likely underpay by more than any other user group. Cyclists who own a registered and insured car that they rarely use probably come closest to overpaying for the roads they use.

Hehe. You tell ’em. But how to get this point across to those who haven’t encountered it, who persist in feeling that bikers are freeloaders?

Yeah, I think that’s close to the heart of DerMorgen’s point about “appearance” or perception. There are many documents which convince me that the “funding gap” is overwhelmingly due to automotive use of highways (I’ve collected quite a few links to those in this thread) but most people don’t bother to read them. I do think an authoritative, mainstream publication like this “Transportation Funding Options: Report to the Governor” would be an important touchstone if it were to contain actual, audited data on transportation funding sources and how those funds are spent.

As far as I’m concerned, the only “user fees” for roads are tolls. Gas I can buy and put in my lawnmower or boat. My heavy truck I could mostly drive around the farm, on my own private property. Unless we create “smart roads” that detect a signal from my particular car and weigh it as I drive by so I can be charged a weight-mile tax (or just bill me for “tolls” charged on those certain roads), or use a (so far controversial) GPS-based system to charge weight-mile taxes, or create “congestion zones”, or literally set up toll booths everywhere, we are not charging anyone “user fees”.

Some things that strike me about this report and its priority of charging bike riders a “user fee”:

* Who considers or wants bike transportation to be “non-roadway”? Does that come from an assumption that bike use is mostly recreational? Is it a manifestation of a desire to get bikes off the road? Does it reflect resentment of bicyclists using the existing road and “causing” traffic delays to motorists? This classification of bike use as “non-roadway” doesn’t make sense to me as a daily commuter. If bike transpo is “non-roadway”, then what would bicyclists be paying a “user fee” to use?

* So extracting revenue specifically from cyclists is “long overdue”? Has the committee stopped to consider what the cost of supporting a single 4 or 5k-lb. passenger vehicle (let’s say traveling an extremely conservative 5k miles/year) is vis-a-vis road construction and maintenance (we can ignore environmental, health care, and emergency services costs for now)? If, on one hand, we consider this cost, and on the other consider the cost of supporting a bicycle on the roadway (let’s say traveling an extremely generous 5k miles/year), what is the difference in cost to the “system”? Certainly the savings realized by supporting a bike over supporting a car doesn’t warrant anything like a “user fee” for bike users, but does it create enough incentive (thinking rationally now, not with car-goggles on) for transportation departments to invest in encouraging more people to leave their cars at home by making roadways safer and more convenient for bicycle use?

* Speaking of incentives, does it make sense to create yet another disincentive (in addition to perceived safety issues, law and law enforcement bias, cultural superstitions about helmet use, etc.) for potential new transportation cyclists? Don’t we want to make bike use as attractive as possible with the aim of lightening the load on our crumbling roadways? Why then do we continually entertain the notion of coercing bike users to pay for the privilege of saving society money?

But y’all know this already.

The commercial trucking industry has most of this worked out.

When I fuel up I have to enter: truck ID, driver ID, mileage. And in the case of Oregon a fuel permit #.

The vehicle weight is tracked every time I go through a weight-in-motion scale or stop at a weight station (between Portland and Sacremento 5 total).

This is because of the disproportionate wear that heavy freight causes to our public roads in normal every day use. Similarly disproportionate in scale is the wear costs caused by personal automobiles versus bicycles.

My concern is this: we have a manifest economic need to move freight as quickly and efficiently as possible. Right now it is a trade off between rail (absolute energy efficiency) and trucking (time and cost efficiency; occasionally energy efficient). It should be noted that freight rail is NOT a public ROW but privately owned facility.

As such the inevitable (due to energy costs) improvements to our rail system to keep nationwide freight moving will effectively abandon roads as a viable system. As the pace of freight and everyday life accelerates there will be even less economic motivation to maintain a road system that no longer serves the chief customer of ALL roads throughout history: commercial interests.

Without commercial funding for roads and in conjunction with the recent privatization/libertarian efforts of our politicians we can expect that the next paradigm in public travel will be privately owned and thus not as freely accessible as our public roads are. So too will our entire road system become a crumbling ghetto; political lip service paid to the need for a free public Right Of Way.

‘Ere we go again. Thorough demolition job on cycle tax in http://www.toronto.ca/budget2005/pdf/wes_translicensingcyc.PDF

Plus

http://www.bikebiz.com/news/read/investment-in-cycling-pays-back-three-to-one

How in the world would they enforce?

Hmmm…

What’s wrong with a small sales tax on vehicle purchases to fund vehicle infrastructure?

Duh! Why didn’t I (or the committee) think of that? Folks sound perfectly willing to impose such a tax exclusively on bike purchases, but not motor vehicle purchases. I think it would be entirely “fair” if a 2% or so flat tax were imposed on all vehicle purchases–including recreational vehicles. So on my next, let’s say, $1200 bike purchase, I would pay…24 extra dollars, while the next time I bought a $15,000 car, I’d pay…300 tax dollars. We could even confine it to new, i.e., not used, vehicle purchases.