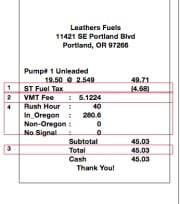

showing VMT charge.

(Graphic: ODOT)

At all levels of government, transportation officials are running scared due to a severe lack of funding available to maintain and improve our roads. The major reason for all this anxiety is the failure of the gas tax to evolve with the times. Truly a “dinosaur” of a funding mechanism, the gas tax hasn’t kept up with inflation, and it is dwindling as Americans drive fewer miles and cars become more fuel-efficient (and electrified in some cases).

While it’s widely accepted we must move beyond the gas tax; no one has figured out a way to do it. Until now.

It turns out the State of Oregon has been working on this for over a decade and they’re on the verge of some major breakthroughs that could lead to implementation of a mileage-based tax system by 2014.

Jim Whitty has managed Oregon’s Road User Fee Pilot Program since it was passed into law by the Oregon legislature in 2001. The project is independent of, but staffed and funded by ODOT, with a mission to figure out how to replace the gas tax. After 16 months of research, Whitty and his colleagues determined that a mileage-based fee, or vehicle-miles traveled (VMT) tax, was the direction to go.

Given all the recent headlines about funding, I recently called Whitty to learn more about what they’ve been up to.

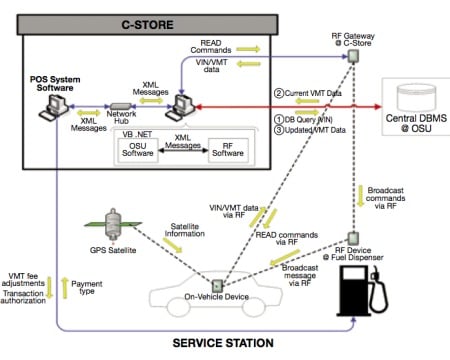

Whitty spoke excitedly about the project and with good reason. Since a pilot of the VMT tax concept in 2006 “didn’t work,” Whitty says they’ve now, “reconceptualized everything and have developed a whole new architecture” for the system.

While they learned a lot from the 2006 pilot, it was ultimately unsuccessful, Whitty says, because they took an “engineer’s approach,” which he characterized as “a bunch of smart people in a room working on something until it’s done.” It didn’t take into account the broader, public and political issues surrounding the project.

“The trouble is,” explains Whitty, “It’s a political issue, not just an engineering one. You have to get public acceptance and there were some policy flaws in that pilot.”

The VMT tax has been saddled from the start with privacy fears due to its reliance on a GPS tracking system attached to the car. Others opposed it due to concerns about government overreach and unresolved questions about how it would work.

With lessons learned, Whitty now says they’ve listened to the public and have designed the program accordingly.

A new pilot, set to begin in September of this year, has been developed around an entirely new paradigm. Here are some key elements (as relayed to me by Mr. Whitty):

— The new system is “open” so that it can evolve as technology evolves.

— The fee would be about $0.0156 (1.5 cents) per mile (which is based on 30 cents per gallon gas tax and a 21 mpg vehicle).

— People will be able to choose how they will meet requirements for paying the fee. “We’ll keep it as easy as possible. People can send in a check, use debit account, and so on,” says Whitty.

— If people don’t want to use GPS, they won’t have to. “There won’t be a push towards GPS,” says Whitty. Technology currently being used in cars like the Ford Sync and Nissan Leaf already send data to the Internet. “All those people would have to do is direct that data to the tax processor.” Whitty also mentioned a device currently used by Progressive Insurance that doesn’t include any location data at all. With a special dongle, users just plug into the car’s diagnostic port (the same one used by mechanics to ferret out engine trouble) and it reads a mileage number.

— A flat-fee option – estimated at about $500 per year – would allow people to purchase an unlimited mileage plan for a set price. Whitty says the maximum mileage would have to be set relatively high, like at 30,000 annual miles, so that people who drive a little don’t end up subsidizing high-mileage users.

— An online form for reporting mileage is also under consideration as an option. “It would be intelligent,” says Whitty, “We want to make sure everyone pays and that no one’s cheating the system.”

— Private sector fee collection. Whitty says they’d like to leave this option open. Not only would privatizing the collection allay fears of increased government bureaucracy, it would also help make the case for the program as a private sector job creator. “ODOT’s role could evolve to simply being the auditor and enforcer.”

“There won’t be a push towards GPS.”

Key to the new approach is that the public won’t be forced to use any single option. “It’s not a push from the state,” is how Whitty puts it. He feels if people have a choice, and can use technologies already available in the marketplace, the program will succeed.

One high-profile fan of the idea is U.S. Congressman Earl Blumenauer. Blumenauer picked up on Whitty’s work, and in 2009 he even introduced legislation around it, saying,

“… with the highway trust fund flirting with a dangerous deficit, we need innovative solutions that will create a steady source of revenue… it is time to expand and test the VMT program across the country… It is time to get creative and find smart ways to rebuild and renew America’s deteriorating infrastructure.”

Next week, Whitty and his team will begin a three-day workshop consisting of face-to-face meetings with companies developing, “leading edge technologies in mileage taxation systems.” 19 firms have already signed up and Whitty is confident that by the end of the week, “We’ll know what the marketplace can give us.”

Besides the technology itself, and convincing the public this isn’t just “Big Brother” creeping into their daily lives, Whitty has to contend with the automakers’ lobby. A bill in the Oregon legislature last year (HB 2328) attempted to implement a mileage-based tax on electric vehicles. Despite uneasiness by EV drivers and advocates, It did better than many thought it would, passing through two committees with bipartisan support.

In the end, Whitty recalls, the bill was killed by a lobbyist hired by a group representing auto makers. Whitty says they were concerned about how exactly the mileage tracking would work. “It was an early attempt and we didn’t have all the answers. We were saying, ‘Hey, trust us.'”

Whitty says they plan to introduce legislation to implement a mileage-based tax for electric vehicles (to start small and work out any kinks in the system) in 2013. By that time, he thinks they’ll have all the answers.

“You can never predict passage, but I can you that all nearly all the issues will be resolved by then and I think think it’s very likely that we can make this happen.”

— Learn more on ODOT’s website.

NOTE: I’ve made an edit to the story to clarify that the $500 fee I referenced is for the annual flat fee option.